(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using Wealthy and Wise®.)

|

Strategy 1: Stretch IRA

Strategy 2: Charitable IRA

Strategy 3: Roth Conversion

|

Editor’s Note: The term “IRA” is used generically in this Blog as comments about an IRA also apply generally to similar techniques for 401(k)s, Keoghs, and Profit Sharing Plans. |

Harry and Angela Dorsey are ages 55 and 50, respectively, and plan to retire in 10 years. At retirement, they want $150,000 a year in after tax cash flow indexed at 3.00% as inflation offset.

Below is a summary of their current net worth:

| Net Worth |

| Harry and Angela Dorsey |

1Plans are to sell the primary residence at retirement and live year-round in their Florida Townhouse.

As you will see, of the three strategies discussed below (Stretch, Charitable, or Roth), there is no best choice for an IRA as each one has its own advantages. The worst choice is to make no selection at all as this guarantees the IRS an income tax windfall at the death of the second-to-die of Harry and Angela when income tax on the entire remaining value of the IRA is due.

Stretch IRA

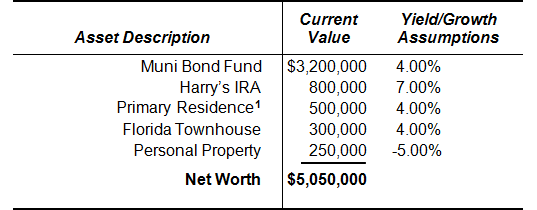

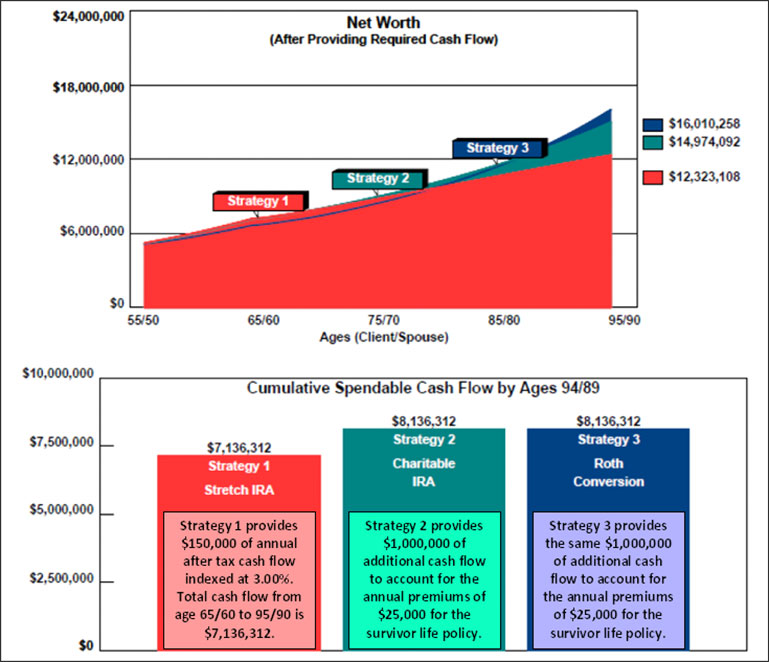

Below is a graphic of the Dorsey’s overall net worth using a Stretch IRA after accounting for their retirement cash flow needs:

| Image 1 |

| Stretch IRA |

Note: A Stretch IRA is accomplished by naming heirs as the final beneficiary of the IRA after the death of the second-to-die of Harry and Angela. The advantage of a Stretch IRA is that the tax deferred values of the IRA continue as tax deferred assets for heirs.

Charitable IRA

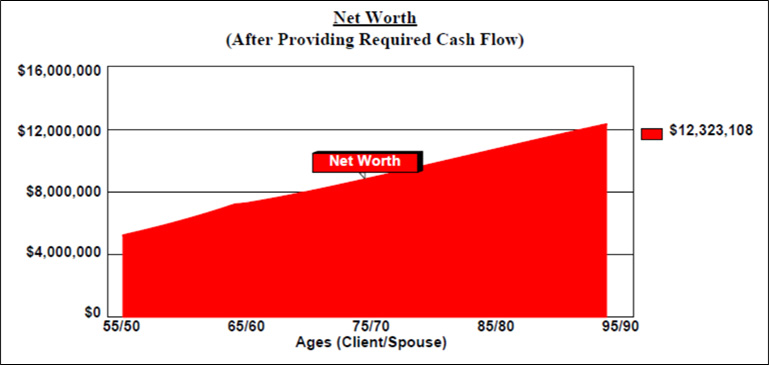

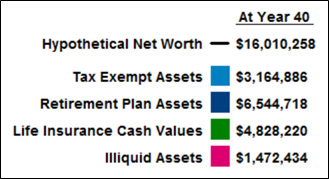

Below is a graphic of the Dorsey’s overall net worth using a Charitable IRA after accounting for their retirement cash flow needs:

| Image 2 |

| Charitable IRA |

A Charitable IRA is accomplished by naming a qualified charity as the final beneficiary of the IRA after the death of the second-to-die of Harry and Angela. Prior to that event, values in the IRA are freely available to the Dorseys without any interference by the charity.

While providing a generous gift to a favored charitable cause (the Red Cross in the Dorsey’s case), their children are short-changed by the amount of the gift of the IRA. We offset this by providing for $1.5 million of indexed survivor universal life coverage bearing a $25,000 annual premium and paid for by withdrawals from their Muni Bond Fund. Since projected estate taxes should not be an issue with the Dorseys, we kept the policy inside the estate where its cash values add to net worth and the children are beneficiaries of its tax free proceeds. With larger estates, you will likely want to have the policy owned by an irrevocable life insurance trust formed on behalf of the children.

Roth Conversion

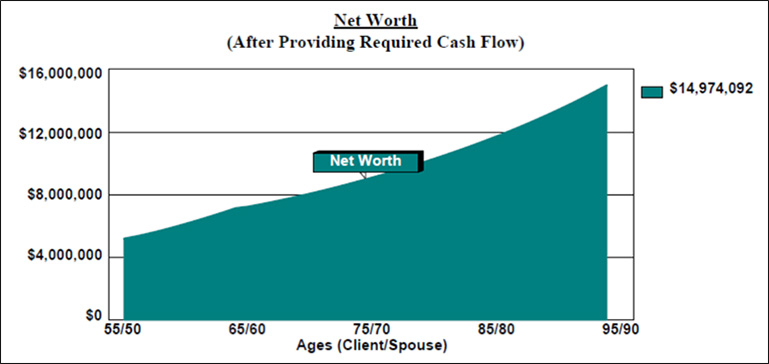

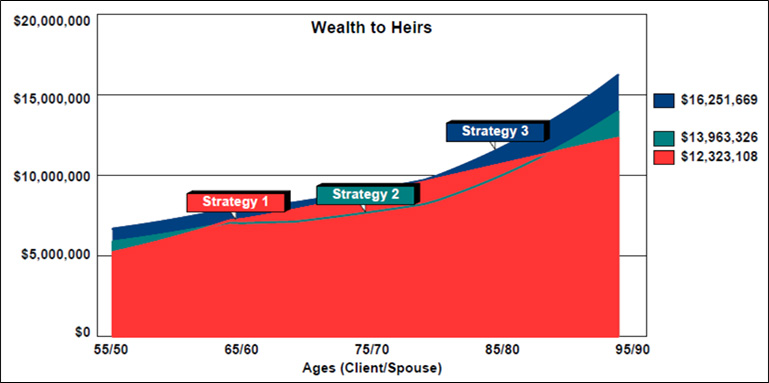

Below is a graphic of the Dorsey’s overall net worth using a Roth Conversion after accounting for all retirement cash flow needs including the income tax on the conversion:

| Image 3 |

| Roth Conversion |

To minimize the income tax on the conversion, we converted the IRA to a Roth IRA in $100,000 increments over 10 years and withdrew the income taxes caused by the conversion from their Muni Bond Fund. The net worth numbers include the cash values of the same survivor life policy included in the Charitable IRA analysis.

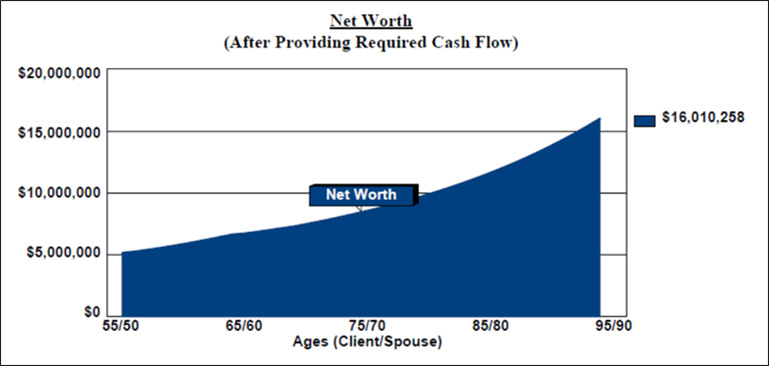

Below is a graphic of the net worth of all three strategies including a comparison of the after tax cash flow supported by each strategy:

| Image 4 |

| Net Worth Comparison |

As you can see from the breakdown of Strategy 3 net worth below, values in the Roth and the survivor life policy total $11,372,938 ($6,544,718 + $4,828,220) which is 71% of the total net worth of $16,010,258 – superb asset allocation considering the tax advantage of these two financial instruments. Serious amounts of additional cash flow are available to Harry and Angela throughout their retirement without tax using withdrawals from the Roth and loans on the survivor life.

| Strategy 3 Net Worth |

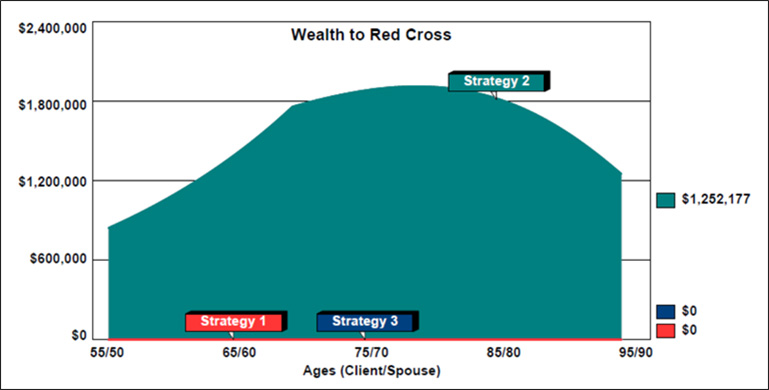

Below is a graphic of the wealth to heirs from all three strategies:

| Image 5 |

| Wealth to Heirs Comparison |

Below is a graphic of the charitable component Strategy 2, the Charitable IRA:

| Image 6 |

| Charity Comparison |

If the Dorsey’s charitable interests are significant, Charitable IRA may be hard for them to resist since, in addition to the generous gift to the Red Cross, both the long-range net worth and wealth to heirs results of Strategy 2 are substantial (see Image 4 and Image 5).

Reminder: In all three strategies, the net worth and wealth to heirs is accomplished after accounting for all the cash flow requirements, including retirement cash flow, life insurance premiums, and income taxes.

Click here to review 69 pages of reports from this InsMark Wealthy and Wise evaluation. It is a large number of reports; however, with a Wealthy and Wise presentation, I recommend that you have all the reports for a given analysis with you when you are visiting with a client or client’s attorney or CPA. The system backs up every number shown, and you never know which report you’ll need to have handy to answer the inevitable question, “Where did this number come from?” That’s why I provided all of them to you in this Blog.

Most Wealthy and Wise users select a few key illustrations for the main report and put the balance in supplemental sections or an Appendix. More elaborate report organization can be accomplished (Table of Contents and Section pages) through use of the following prompt -- which I used for this Blog -- located on the bottom right of the Main Workbook Window:

Coming Attraction

Next week in Part 2, I’ll provide you with an irresistible additional reason that will make virtually all clients want the Roth conversion.

Licensing InsMark Systems

To license Wealthy and Wise, visit us online or contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Testimonials

“Major cases we are developing have all moved along successfully because of the sublime simplicity and communication capability of Wealthy and Wise. I guarantee that the proper use of this tool will dramatically raise the professional and personal self-image of any associate who dares to take the time to understand it . . .”

Phillip Barnhill, CLU, InsMark Gold Power Producer, Minneapolis, MN

“InsMark helps us help our clients understand their money and their choices. I always learn something new that changes what we do and how we can do it more efficiently. That translates to a better bottom line for us and for our clients. It’s making more money for everyone -- just by pushing InsMark buttons on the computer.”

Kay Corbin, CLU, ChFC, InsMark Platinum Power Producer, Phoenix, AZ

“I am writing to give you a ringing endorsement for the Wealthy and Wise System. As you know, I am a LEAP practitioner. The Wealthy and Wise software has helped me supplement my LEAP skills in the over age 60 client base. I have been paid for many cases using Wealthy and Wise as support, the smallest of which was $27,000, the largest was $363,000. With those type of commissions, you would have to be nuts not to buy it.”

Vincent M. D’Addona, CLU, ChFC, MSFS, AEP, InsMark Platinum Power Producer?, New York City, NY

Important Note #1: The hypothetical life insurance illustrations associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.