(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System)

|

In Blog #154, we examined the use of a personally-owned Indexed Universal Life (“IUL”) policy as an alternative to a deferred Profit Sharing Plan (“PSP”) for Jennifer Hunt, president of Midland Oil Supply, Inc., an S corporation family business. Jennifer is in a 40% income tax bracket counting the pass-through of the company’s taxable income.

Alan Westbrook, age 45, is Senior Vice President, Sales, and is a serious rainmaker. He is not a stockholder, and Jennifer wants to provide him a significant retirement plan in order to ensure he stays with the firm.

Let’s examine “old reliable”, the Executive Bonus Plan — with a couple of new twists.

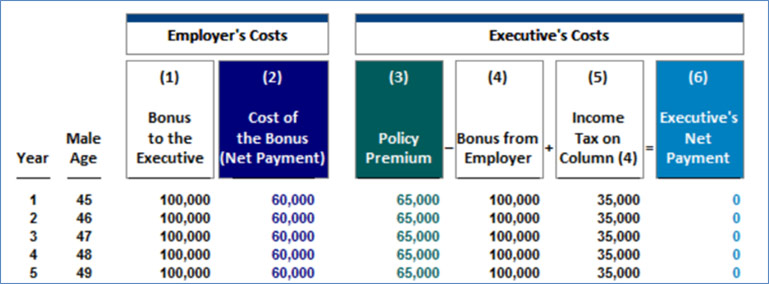

Bonuses

| $100,000 | — Company’s Annual Bonus to Alan in Years 1 - 5 |

| $ 60,000 | — Company’s After Tax Cost of Annual Bonus1 |

| $ 65,000 | — Alan’s After Tax Bonus in Years 1 - 52 |

| $ 65,000 | — Alan’s IUL premium in Years 1 - 5 |

| $ 0 | — Alan’s Out-of-Pocket Cost in Years 1 - 5 |

1Jennifer’s 40% bracket 2Alan’s 35% bracket

Image #1

This plan also includes a “claw-back” provision if Alan voluntarily terminates employment during the first five years or if he is terminated for cause during that period. If Alan dies during the term of the claw-back, the repayment obligation is waived.

Note: Specimen implementation documents for this plan are available below.

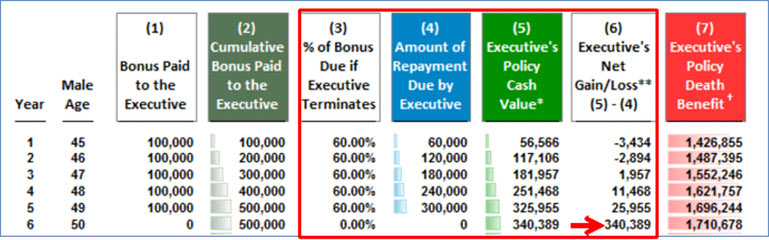

The repayment obligation looks like this:

Image #2

The percentage claw-back shown in Column (3) is arbitrary, and it can be any percentage desired by the business owner. I illustrated 60% in this example, and the first five years in Column (6) illustrate pretty severe “bad news”, but the relief in the beginning of year 6 is surely “good news” when the claw-back is eliminated. Alan is then fully vested in the policy’s growing cash value which is scheduled to produce annual, after tax, retirement cash flow of $75,000 a year starting at age 65 — all with no out-of-pocket cost for Alan if he remains employed for at least five years.

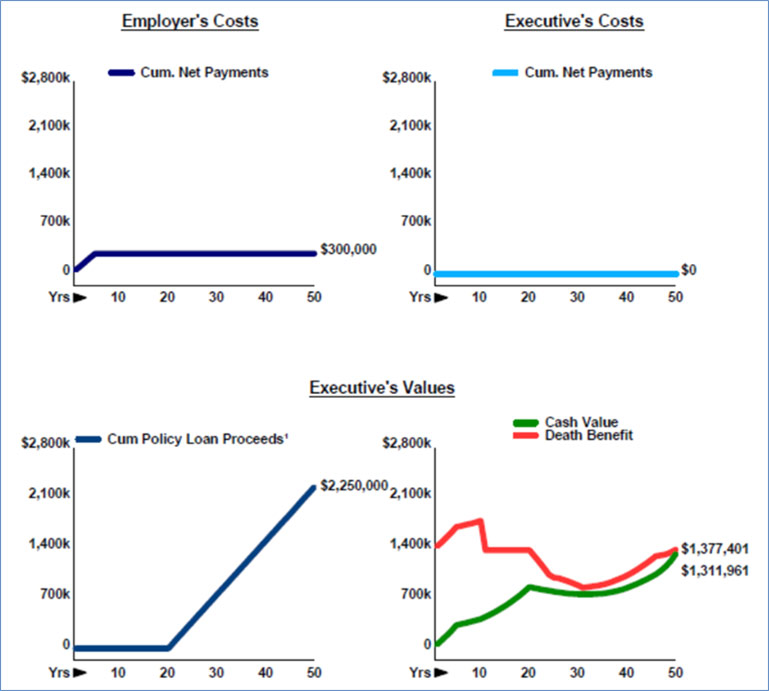

Below is a graphic of the overall plan:

Good News / Bad News Executive Bonus Plan

(Five Years of Funding)

Image #3

Click here to see the full illustration from the Executive Security Plan module in the InsMark Illustration System.

Click here to review the tax consequences of the executive repaying any of the bonuses and the employer receiving such repayment. (This report is also available in the illustration module.)

Would Alan accept such a plan, and what would it indicate to his employer if he refused it? Probably that Alan is likely thinking of seeking other employment. What a terrific management tool this turns out to be — either way:

- It offers a benefit to a key non-shareholder executive that provides an important incentive to stay with the firm for at least five years;

- If the executive declines to participate, it can also uncover someone who is likely considering different employment.

In some ways, this bonus plan performs like a loan-based split dollar plan except, unlike loan-based split dollar, the bonus plan is deductible by the employer. The fact that it is not a loan-based plan means that provisions of Sarbanes Oxley do not prohibit its use for senior executives of public corporations. Click here to review a report entitled “Controlled Bonus Plan vs. Split Dollar Plan”.

Note: We will analyze a loan-based split dollar alternative for Alan in Blog #157.

Why Only Five Years of Funding for the Bonus Plan?

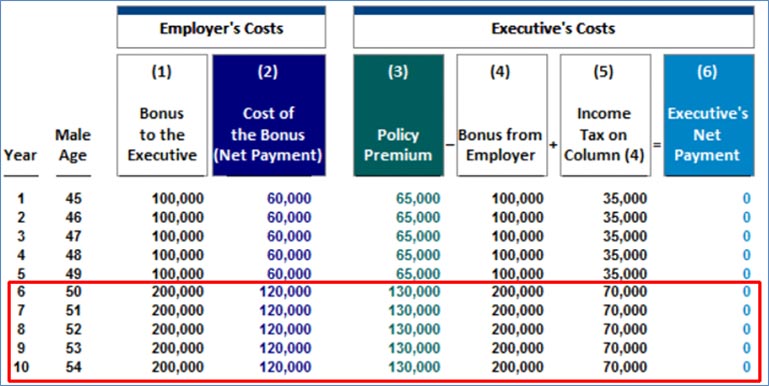

Let’s assume that Alan is so valuable to the company that there is a serious incentive to retain him for longer than five years. Below are details of a change in plan design that doubles the bonus in years 6 through 10.

Extended Bonuses

| $200,000 | — Additional Bonus to Alan in Years 6 - 10 |

| $120,000 | — After Tax Cost of Additional Bonus (40% bracket) |

| $130,000 | — After Tax Extended Bonus to Alan (35% bracket) |

| $130,000 | — Alan’s IUL premium in Years 6 - 10 |

| $ 0 | — Alan’s Out-of-Pocket Cost |

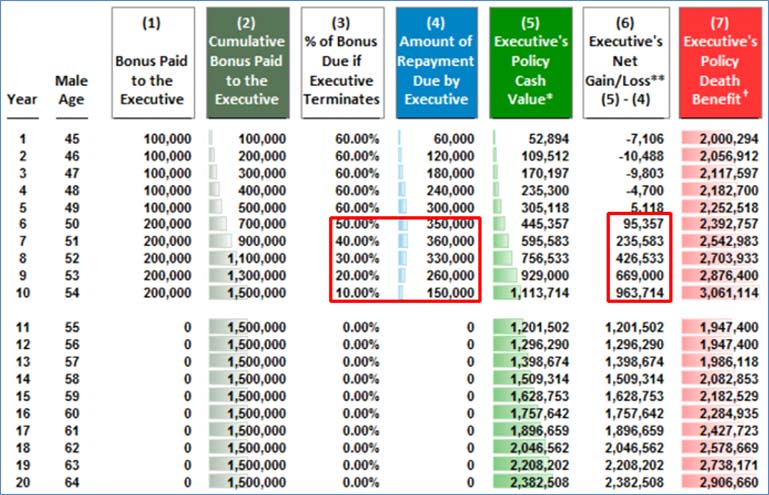

Image #4

This revised plan also includes a “claw-back” provision if Alan voluntarily terminates employment during the first ten years. See below for the new claw-back — note the reduced schedule in years 6 - 10 in Column (3).

Image #5

At the beginning of year 11, Alan has full vesting of some serious seven-figure cash values which are scheduled to produce annual, after tax, retirement benefits of $235,000 a year starting at age 65 totaling over $7 million for the years illustrated — all with no out-of-pocket cost for Alan if he remains employed for at least ten years.

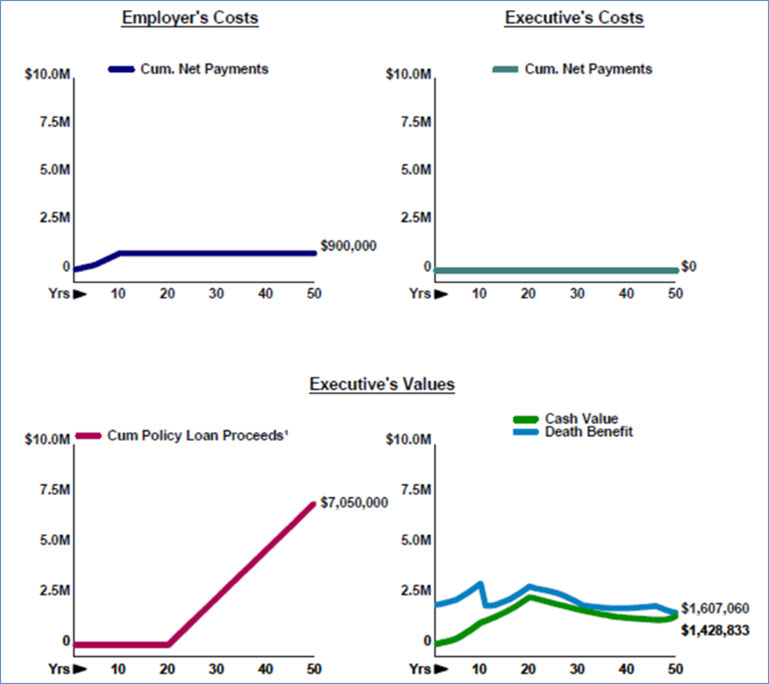

Below is a graphic of the revised plan:

Good News / Bad News Executive Bonus Plan

(Ten Years of Funding)

Image #6

Click here to review this revised Executive Bonus Plan.

Note: Controlled Bonus Plans typically include an Endorsement of Policy Ownership Rights (“Endorsement”) which restricts the executive from accessing policy values prior to retirement. The Endorsement takes the form of an Agreement between the business and the executive in which the executive agrees to this condition. The Endorsements are registered with the issuing insurance company and, as a result, the executive is unable to take any action on the policy other than that allowed by the Endorsement.

In the event of an Executive's death prior to retirement, the Endorsement allows the immediate payment of the death proceeds to the Executive's family.

Owner-executives frequently use a bonus approach for their own plans; however, they never use a claw-back or Endorsement technique. This is because owners do not want to impose voluntary restrictions on the funds in their own plans. While owners may well be willing to provide bonus funding for valuable non-owner executives, they do not want to see cash values easily squandered by such executives in pre-retirement years or, worse, used for competitive ventures, thus the Endorsement.

Conclusion

One sure way to ramp up activity regarding executive benefits is to ask business owners this question:

“Do you have any non-owner executives who are so valuable to your business that you want to do whatever is economically feasible to induce them to stay with you?”

If the answer is “Yes,” say:

“Retirement planning concerns are on the minds of most -- maybe all -- of your executives. I’d like to show you a selective, cost-efficient way your company can provide a serious retirement enhancement to important executives. Would you like to see how it works?”

If you do this, you should get many favorable responses.

Plan Documentation

Special plan documentation is required to support this benefit plan. InsMark’s Cloud-Based Documents On A Disk™ (“DOD”) has a comprehensive set of specimen documents for the Controlled Executive Bonus Plan in the Key Employee Benefit Plan section of documents. If you are not licensed for DOD and would like more information, go to https://insmark.com/products/cloud-based-documents-disk. Those licensed for DOD can access DOD and that document set by signing in at www.insmark.com.

Special plan documentation is required to support this benefit plan. InsMark’s Cloud-Based Documents On A Disk™ (“DOD”) has a comprehensive set of specimen documents for the Controlled Executive Bonus Plan in the Key Employee Benefit Plan section of documents. If you are not licensed for DOD and would like more information, go to https://insmark.com/products/cloud-based-documents-disk. Those licensed for DOD can access DOD and that document set by signing in at www.insmark.com.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

If you obtain the digital workbook for Blog #156, Click here for a guide to its content.

Licensing InsMark Systems

To license any of the InsMark software products, visit our Product Center online or contact Julie Nayeri at Julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President — Sales, at dag@insmark.com or (925) 543-0513.

For help on how to use InsMark software, go to The Quickest Way To Learn InsMark.

Testimonials

“InsMark has increased my production by 10 fold. It clearly communicates to the client the best financial scenario to take.”

Gary Sipos, M.B.A., A.I.F.® InsMark Platinum Power Producer®, Sipos Insurance Services, Freehold, NJ

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can't afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer®, Grafton, WI

“The reason I use InsMark products is because they are so good at explaining financial concepts to all three parties: 1) the producer trying to explain the idea; 2) the computer technician trying to illustrate it; 3) the customer trying to understand it.”

Rich Linsday, CLU, AEP, ChFC, InsMark Power Producer®, Top of the Table, International Forum, Pasadena, CA

Important Note #1: The hypothetical life insurance illustrations associated with this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

“InsMark” is a registered trademark of InsMark, Inc.

“Documents On A Disk” is a trademark of InsMark, Inc.

“Good News / Bad News Benefit Plan” is a trademark of InsMark, Inc.