(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this Blog were created using the InsMark Loan-Based Split Dollar System)

|

Blog #157 will stress-test Loan-Based Split Dollar (LB-SD) as an alternative to the Controlled Executive Bonus Plan described in Blog #156.

Some Background

In Blog #156, we examined the use of a personally-owned Indexed Universal Life (“IUL”) policy funded with an executive bonus for Alan Westbrook, age 45, Senior Vice President, Sales, for Midland Oil Supply, Inc., an S corporation. Alan is a serious rainmaker for the firm, but he is not a stockholder. Midland’s President, Jennifer Hunt, wants to provide him with a significant retirement plan in addition to the company’s 401(k) plan in order to ensure he stays with the firm.

Jennifer is in a 40% income tax bracket counting the pass-through of the company's taxable income. Alan is in a 35% income tax bracket.

Blog #156 featured a Controlled Executive Bonus arrangement that was used to fund the IUL policy owned by Alan. The “Control” feature is a written agreement with Alan that he must repay a portion of the bonuses should he voluntarily leave the firm (or be terminated for cause) during a prescribed number of years. With Plan 1, the bonus repayment obligation terminates in five years. An alternate Plan 2 terminates the repayment obligation in ten years.

Click here to review the tax consequences of the executive repaying any of the bonuses and the employer receiving such repayment.

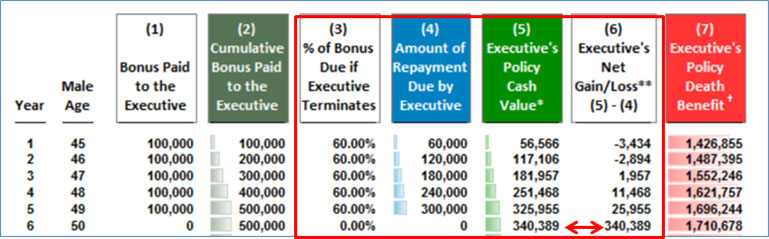

Alan’s IUL has five annual premiums of $65,000 that are funded with a yearly gross-up bonus of $100,000 which includes the tax on the bonus. The plan has a cumulative bonus repayment requirement of 60% during the five years (see Image 1 below). This eliminates any repayment by the beginning of year 6, at which point the retirement benefit is fully funded. Plan 1 is illustrated to produce annual, after tax, retirement cash flow of $75,000 a year starting at age 65 — all for no out-of-pocket cost for Alan assuming he remains employed for five years. After tax, retirement, cash flow benefits total $2.25 million for the years illustrated.

Below are the repayment requirements of Plan 1.

Controlled Executive Bonus Plan 1

Image #1

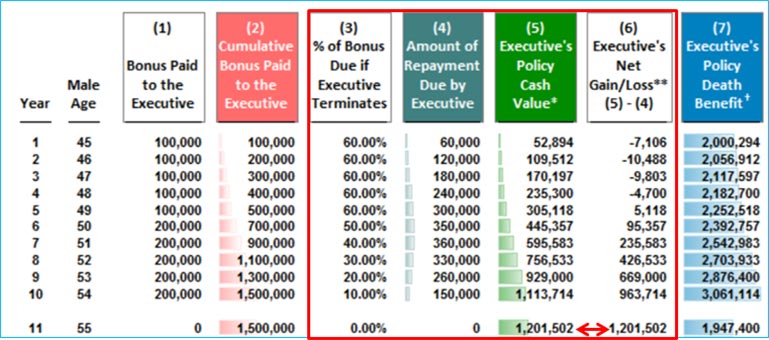

The ten-year premium for Plan 2 is $65,000 a year for five years increasing to $130,000 in years six through ten and is subject to a cumulative bonus repayment requirement of 60% during the first five years reducing by 10% a year in years six through ten (see Image 2 below). This eliminates any repayment by the beginning of year 11, at which point the increased retirement benefit is fully funded. Plan 2 is illustrated to produce annual, after tax, retirement cash flow of $235,000 a year starting at age 65 — all for no out-of-pocket cost for Alan assuming he remains employed for ten years. After tax, retirement, cash flow benefits total over $7 million for the years illustrated.

Below are the repayment requirements of Plan 2.

Controlled Executive Bonus Plan 2

Image #2

Click here to review the illustration for the Controlled Executive Bonus (Plan 2).

The repayment obligations of a Controlled Executive Bonus Plan may remind you of split dollar in many ways, but it is essentially quite different particularly in that the funding bonuses are tax deductible by the employer, and the premium loans in split dollar are not. Click here to review a report entitled “Controlled Bonus Plan vs. Split Dollar Plan”.

Note: If you missed reading Blog #156, you may want to review it for complete details of both Controlled Executive Bonus Plans.

Loan-Based Split Dollar

LB-SD automatically has a “Control” feature due to the premium loans made by the employer to fund the plan. Split dollar loans are due in full until repaid unlike the plans in Blog #156 described above in which the employer establishes the percent of the cumulative bonuses due for repayment if the executive terminates voluntarily or is let go for cause.

The IUL illustration used with the LB-SD benefit plan is also the same one I used with Plan 2 of the Controlled Executive Bonus plan, i.e., five annual premiums of $65,000 followed by five annual premiums of $130,000, all funded by loans from Midland Oil Supply to Alan.

Dealing with the outstanding loans at the beginning of year 11 can be accomplished in several ways, all of which can be illustrated in the InsMark Loan-Based Split Dollar System:

| 1. |

|

|||

| 2. |

|

|||

| 3. |

|

|||

| 4. |

|

|||

| 5. |

|

Today’s non-owner executives are seriously mobile. The more effective they are, the more mobile they become. This is the reason that Jennifer Hunt, Midland Oil’s President, wants to provide Alan with a “get-out-of-jail” card with no obligation to remain employed past 10 years (in the case of Plan 2). Is this thoughtless on her part? Shouldn’t she want to retain Alan longer than 10 years? If he is still a rainmaker, assuredly yes, and Jennifer is certainly free to include him in a new Controlled Executive Bonus Plan plan starting in year 11 in order to induce him to stay on board (likely with higher funding than Plan 2).

Each of the five exit strategies noted above is not particularly effective in this case which leads to the conclusion that LB-SD is not an appropriate executive benefit for a non-owner like Alan. The Controlled Executive Bonus Plan is clearly the new split dollar alternative for those companies with important non-owner executives that want a powerful benefit plan for key executives, current tax deduction for funding, design flexibility, and serious financial penalties for top executives who depart early.

If I had to pick one of the split dollar exit options for Alan, I would select the one that schedules equal bonuses in years 11 - 20 that gradually repays all the premium loans over the remaining pre-retirement years. (This is an easy option in the software.)

Click here to view this particular split dollar variation prepared in the InsMark Loan-Based Split Dollar System. Due to its extended years of premium loans, the illustration reflects use of the long-term Applicable Federal Rate (“AFR”) to establish the loan interest rate for the premium loans.

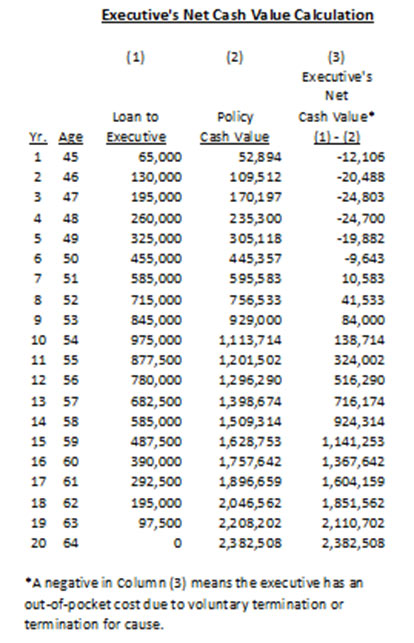

Below in Column (1) is the “Control” feature of LB-SD in pre-retirement years. By the beginning of year 11, $877,500 of the policy cash value is tied up with premium loans. In the case of the Controlled Executive Bonus, all policy values are free and clear at this same point.

For comparison purposes, Click here to review the illustration for the Controlled Executive Bonus (Plan 2) in Blog #156 which far better suits Alan’s situation as well as the company’s.

Conclusion

So, is there a general rule when to use Controlled Bonus and LB-SD?

It depends on whether the covered executive is an owner or non-owner of the business. My personal preference used to be LB-SD for either group, but with the development of the Controlled Executive Bonus, that arrangement has become my recommended plan for non-owner executives employed by any business entity (including C or S corporation, LLC, Partnership, Sole Proprietorship, and Tax Exempt Organization).

I think the decision as to Controlled Bonus or LB-SD for owner-executives depends on the relative tax brackets of the company and the owner-executive and the format of the business. First, owners of companies that are not corporations can’t make much use of either personally-owned bonus or split dollar plans. Even with a C corporation, a bonus paid to an owner who is in a higher tax bracket than the company may not make much sense either; LB-SD would likely be better. When the owner of a C corporation is in a lower tax bracket than the company (you won’t find many such prospects), a bonus plan without the “Control” feature could be appropriate.

The company’s perspective is critical in the selection of which plan to use as they both offer a superb benefit for a non-owner executive. If you are the CEO making the decision, which would you rather have: Controlled Executive Bonus with a funding tax deduction each year for ten years or LB-SD with non-deductible premium loans each year for the first ten years followed by ten years of tax deductions as the exit strategy of bonus rollouts occur? I believe the Controlled Executive Bonus would be selected in most cases.

Note: One concept that works well for owners and non-owners of any entity (C or S corporation, LLC, Partnership, Sole Proprietorship, and Tax Exempt Organization1) is Executive Trifecta®, an InsMark-developed concept.

1There are no individual “owners” of a Tax Exempt Organization, so this comment applies only to executives of such organizations.

If you would like to review how Executive Trifecta works, go to Blog #136: Taking Care of a Rainmaker or, for an advanced version that uses data from our Key Executive Calculator to mathematically determine the loss of a key executive’s services, go to Blog #44: Alternate Golden Handcuffs for Tom Hamilton (Part 4 of “Valuing the Business”). Blog #44 is the concluding episode of a 4-part series involving strategies for deciding to sell a closely held business. If this overall analysis is of interest to you, go to my Blog Archives and review Blogs #41, #42, #43, and #44.

Prospecting

One sure way to ramp up activity regarding executive benefits is to ask business owners this question:

“Do you have any non-owner executives who are so valuable to your business that you want to do whatever is economically feasible to induce them to stay with you?”

If the answer is “Yes,” say:

“Retirement planning concerns are on the minds of most -- maybe all -- of your executives. I’d like to show you a selective, cost-efficient way your company can provide a serious retirement enhancement to important executives. Would you like to see how it works?”

If you do this, you should get many favorable responses.

Plan Documentation

Variations of Loan-Based Split Dollar and Controlled Executive Bonus are available in InsMark’s Cloud-Based Documents On A Disk™ (“DOD”) in the Key Employee Benefit Plans section of documents. If you are not licensed for DOD and would like more information, go to https://insmark.com/products/cloud-based-documents-disk. Those licensed for DOD can access DOD and those document sets by signing in at www.insmark.com. (Specimen documents for Executive Trifecta are also available in this same location.)

Variations of Loan-Based Split Dollar and Controlled Executive Bonus are available in InsMark’s Cloud-Based Documents On A Disk™ (“DOD”) in the Key Employee Benefit Plans section of documents. If you are not licensed for DOD and would like more information, go to https://insmark.com/products/cloud-based-documents-disk. Those licensed for DOD can access DOD and those document sets by signing in at www.insmark.com. (Specimen documents for Executive Trifecta are also available in this same location.)

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Click here for the Guide to Digital Workbook File for Blog #157 that summarizes its contents of the Workbook.

Licensing InsMark Systems

To license any of the InsMark software products, visit our Product Center online or contact Julie Nayeri at Julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President — Sales, at dag@insmark.com or (925) 543-0513.

For help on how to use InsMark software, go to The Quickest Way To Learn InsMark.

Testimonials

“InsMark has increased my production by 10 fold. It clearly communicates to the client the best financial scenario to take.”

Gary Sipos, M.B.A., A.I.F.® InsMark Platinum Power Producer®, Sipos Insurance Services, Freehold, NJ

“The reason I use InsMark products is because they are so good at explaining financial concepts to all three parties: 1) the producer trying to explain the idea; 2) the computer technician trying to illustrate it; 3) the customer trying to understand it.”

Rich Linsday, CLU, AEP, ChFC, InsMark Power Producer®, Top of the Table, International Forum, Pasadena, CA

“My experience with InsMark’s Executive Trifecta is career changing. Showing this idea to a business owner is a win-win-win! The business owner wins by protecting and retaining one of his most valuable assets (a key executive). The executive wins by being recognized and rewarded for efforts, results, and loyalty. The financial professional wins by gaining the confidence and business of a new client. This concept can revolutionize a financial services career.”

Kerry L. Walker CLU, ChFC, InsMark Platinum Power Producer®, The Walker Firm, Inc., Aurora, CO

Important Note #1: The hypothetical life insurance illustrations associated with this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

“InsMark” is a registered trademark of InsMark, Inc.

“Executive Trifecta” is a registered trademark of InsMark, Inc.

“Documents On A Disk” is a trademark of InsMark, Inc.

“Good News / Bad News Benefit Plan” is a trademark of InsMark, Inc.