(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this Blog were created using InsMark’s Wealthy and Wise® and the InsMark Illustration System.)

|

Participating policy loans on max-funded Indexed universal life (“IUL”) policies can provide serious supplements to retirement cash flow (see Blog #58). The same can be said for executive benefits funded with IUL.

A life insurance illustration needs to be intelligently integrated within an overall retirement plan in order to communicate its use effectively. It is not enough to have a comprehensive retirement plan where the life insurance illustration is shown separately and disconnected. Nor is it enough to just show the life insurance illustration and say, “Look at this great retirement cash flow. Isn’t this a wonderful addition to your retirement?”

If a client has a formal retirement plan, the life insurance needs to be a part of it – regardless of its funding. This means integration with full-pay policies, executive benefit policies, premium financed policies, trust-owned policies, etc. If a client doesn’t have a formal retirement evaluation, you are well-advised to get one underway as it will make your life insurance presentations significantly more dramatic as you will see below.

We designed Wealthy and Wise® to perform this evaluation where we typically compare “do it vs. don’t do it” and include the life insurance in one of a “do it” scenarios. We can also direct Wealthy and Wise to fund premium costs, income tax costs of bonus benefit plans, and loan interest costs of premium financing and split dollar arrangements via asset allocation rather than out-of-pocket expenditures. For an example, I’ll use one of the Controlled Executive Bonus Plans described in Blog #156 for Alan Westbrook, age 45, Senior Vice President, Sales, for Midland Oil Supply, Inc.

Alan is a serious rainmaker for the Midland Oil and a non-shareholder, and the company wants to keep him employed. As a result, he has been offered a bonus plan funding an IUL policy that, provided he remains employed for the next ten years, will reward him with annual, after tax, retirement cash flow of $235,000 a year starting at age 65 (totaling over $7 million for the years illustrated). Due to his employer paying him a deductible gross-up bonus to cover the policy premium and the tax on the bonus, Alan has no out-of-pocket cost for the plan if, again, he remains employed for at least ten years. During those first ten years, he risks some serious repayment of bonuses should he voluntarily resign or is terminated for cause. (In this example, the ten-year repayment obligation is waived if he dies during the first ten years.)

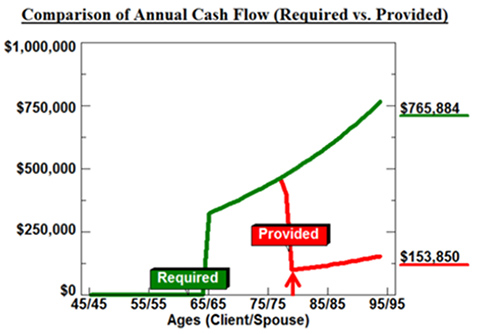

There were two Controlled Executive Bonus arrangements in Blog #156. Click here to review the second one — the main illustration for the plan is on Pages 2 and 3, and you can see the repayment obligations on Page 4.

Note: A Controlled Executive Bonus somewhat resembles a split dollar plan, but it is not governed by the new split dollar regulations issued in 2003. Click here to review the differences.

Retirement Case Study

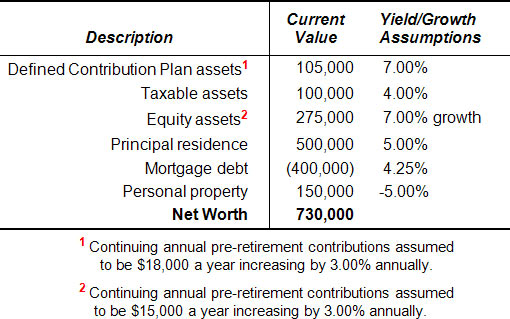

Alan and his wife, Jordan, are both age 45. Between them, their gross income is $450,000. Their state and federal marginal income tax bracket is 40%. After all taxes, their net income is $325,000. Their current net worth is $730,000, and below are the details:

| Net Worth |

| Alan and Jordan Westbrook |

Click here for comments regarding yields, sequence of returns, and Monte Carlo simulations.

The Westbrooks want to duplicate their current after tax income of $325,000 beginning at age 65 and index it by 3.00% a year for an inflation offset. This should be reevaluated yearly and adjusted accordingly as their after tax income increases (or decreases).

Note: This need for ongoing evaluation is why you should charge ongoing monitoring fees for Wealthy and Wise analyses (assuming you have no compliance prohibitions against it). See Blog #98 for an analysis that compares charging or not charging such fees.

The Westbrook’s projected net worth (including the additional contributions to their retirement plan and equity account) is not sufficient to support their desired retirement cash flow. As shown by the red arrow in graphic Image 1 below (from Wealthy and Wise), this begins at age 77, and all they are left with is their Social Security income and their home.

| Image #1 |

Click here to review the year-by-year bad news starting at age 76.

This inevitably leads them to this question: “What should we do?”

They have several options:

- Reduce their retirement cash flow goal considerably;

- Eliminate the indexing on retirement cash flow;

- Delay retirement;

- Manage liquid assets for more aggressive yield;

- Transfer a portion of conservatively invested liquid assets into more aggressive investments;

- Sell their home at retirement and downsize to a smaller home and transfer the freed-up funds to liquid assets.

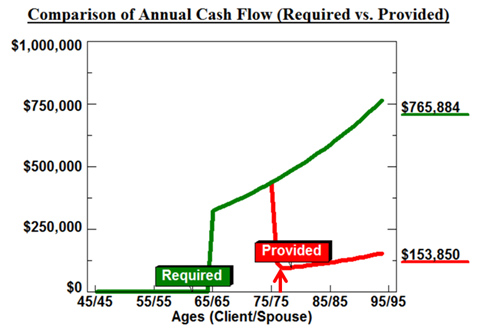

| Assuming their home has grown at 5.00% a year (their assumption) to a little over $1.3 million, downsizing to, say, a $600,000 replacement home helps by providing a little over $500,000 of additional cash to add to liquid assets. Click here to review that data. Unfortunately, it only adds four years to their desired cash flow. |

| Image 2 below (from Wealthy and Wise) reflects this reduction in cash flow. Image 2 may look exactly like Image 1, but a careful look shows the red arrow in Image 2 has moved slightly to the right to begin at age 79, and all they are left with is their Social Security income and their downsized home. |

| Image #2 |

|

Alan and Jordan are fortunate recipients of the Controlled Executive Bonus plan provided by Alan’s employer, Midland Oil Supply, Inc. To demonstrate this to them, I’ll integrate its $235,000 in annual, after tax, retirement cash flow along with its cash value and death benefit into their overall Wealthy and Wise analysis. |

|

The problem is solved — as you can see below in the Wealthy and Wise graphic comparing all three Strategies:

| Image #3 |

| Strategy 1 vs. Strategy 2 vs. Strategy 3 |

| Net Worth |

The results of the bonus plan provided to Alan by Midland Oil Supply, Inc. are extraordinary, and you don’t want a graphic like this shown to your clients by anyone other than you. When integrated within their retirement plan, the cash flow realized not only meets their goals, it is more than double what their current plan provides. In addition, it does so with long-range net worth exceeding $12.5 million – which again is more than double what their current plan provides.

Click here to view all the reports in the analysis. (We illustrated all three scenarios to age 95, five years past their joint life expectancy.)

There are 99 pages of reports from this InsMark Wealthy and Wise evaluation including 9 different graphics and 51 different numerical reports, many of which extend to two pages. That’s a lot of reports; however, with a Wealthy and Wise presentation, I recommend that you have all the reports for a given analysis with you when you are visiting with a client or client’s attorney or CPA. The system backs up every number shown, and you never know which report you’ll need to have handy to answer the inevitable question, “Where did this number come from?” That’s why I provided all of them to you in this Blog.

Most Wealthy and Wise users select a few key illustrations for the main report and put the balance in supplemental sections or an Appendix. More elaborate report organization can be accomplished (Table of Contents and Section pages) through use of the following prompt which I used for this Blog — located on the bottom right of the Main Workbook Window:

Conclusion

At this point, there has been sufficient analysis that likely causes Alan and Jordan to 1) value their Controlled Executive Bonus Plan as a very generous retirement supplement and 2) welcome the golden handcuffs that go with it. If Alan declines to participate, it provides a valuable warning to Midland Oil Supply that he is likely thinking of other employment opportunities — an unfortunate discovery, perhaps, but certainly a valuable one, and a collateral benefit for an employer not normally associated with executive fringe benefits.

Almost all non-shareholder executives are concerned about their retirement. I believe exporting values of an executive benefit like a Controlled Executive Bonus to Wealthy and Wise makes that benefit virtually irresistible to the covered executive. I also believe employers will be much more inclined to reward such plans to top, non-shareholder executives due to this enhanced perception of the benefits. That means both the benefit plan and its impact on retirement planning should be emphasized to employers. You might start prospecting by asking key owners to read this Blog (assuming they have key non-shareholders they would like to pin closer to the firm.)

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

If you obtain the digital workbook for Blog #158, Click here for a guide to its content.

Note: You can retrieve the digital workbook for the InsMark Illustration System containing the Controlled Executive Bonus illustration and the guide to its content from this same location in Blog #156.

Note: Special plan documentation is required to support a Controlled Executive Bonus Plan. InsMark’s Cloud-Based Documents On A Disk™ (“DOD”) contains comprehensive sets of specimen documents for the Controlled Executive Bonus Plan in the Key Employee Benefit Plans section of documents. If you are not licensed for DOD and would like more information, go to https://insmark.com/products/cloud-based-documents-disk. If you are licensed for DOD, you can access the document sets by signing in at www.insmark.com.

Licensing InsMark Systems

To license any of the InsMark software products, visit our Product Center online or contact Julie Nayeri at Julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President — Sales, at dag@insmark.com or (925) 543-0513.

For help on how to use InsMark software, go to The Quickest Way To Learn InsMark.

Testimonials

“InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP®, CAP®, RFC®, Past President International Forum, InsMark Platinum Power Producer®, Encino, CA

“If you don’t get the client to distinguish cash flow from net worth, you won’t make the case sale. In my experience, Wealthy and Wise is the only system that recognizes this important estate planning component.”

Stephen Rothschild, CLU, ChFC, CRC, RFC, International Forum Member, Saint Louis, MO

“I am writing to give you a ringing endorsement for the Wealthy and Wise System. As you know, I am a LEAP practitioner. The Wealthy and Wise software has helped me supplement my LEAP skills in the over age 60 client base. I have been paid for many cases using Wealthy and Wise as support, the smallest of which was $27,000, the largest was $363,000. With those type of commissions, you would have to be nuts not to buy it.”

Vincent M. D’Addona, CLU, ChFC, MSFS, AEP, InsMark Platinum Power Producer®, New York City, NY

“InsMark helps us help our clients understand their money and their choices. I always learn something new that changes what we do and how we can do it more efficiently. That translates to a better bottom line for us and for our clients. It’s making more money for everyone — just by pushing InsMark buttons on the computer.”

Kay Corbin, CLU, ChFC, InsMark Platinum Power Producer®, Phoenix, AZ

“Major cases we are developing have all moved along successfully because of the sublime simplicity and communication capability of Wealthy and Wise. I guarantee that the proper use of this tool will dramatically raise the professional and personal self-image of any associate who dares to take the time to understand it . . .”

Phillip Barnhill, CLU, InsMark Gold Power Producer®, Minneapolis, MN

Important Note #1: The hypothetical life insurance illustrations associated with this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

“InsMark” and “Wealthy and Wise” are registered trademarks of InsMark, Inc.

“Documents On A Disk” is a trademark of InsMark, Inc.