(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark® Cloud-based Documents on A Disk™, InsMark’s Illustration System, Loan-Based Split Dollar System, Leveraged Compensation System, Premium Financing System and Wealthy and Wise®)

|

Note from Bob: We have seen almost nothing published on the impact of Tax Reform on presentations you make to clients for retirement or estate planning. While understanding the terms of Tax Reform is very important, it is only half of the map. The other half involves its impact on what you present to each client. This Blog is designed to address this issue.

1. Retirement Planning

We believe that the Tax Cuts and Jobs Act (“Tax Reform”) has made the purchase of cash value life insurance more attractive in the retirement planning sector. Specifically, (a) most companies will have more after-tax profits (and the resulting capital) given their lower tax rates thus aiding your COLI and ExOLI1 activity and (b) individuals are rightly concerned about higher personal tax rates in future years (especially in light of the universal condemnation of Tax Reform by Democratic Party members). These combine to provide an ideal environment to diversify a portion of the client’s overall portfolio into cash value, life insurance products.

1Executive-Owned Life Insurance (like Executive Bonus, Executive Trifecta, Dual Security, Loan-Based Split Dollar, 401(k) Look-Alike, and Leveraged Deferred Compensation Plans.

Accordingly, the following InsMark sales presentations are now even more compelling for your individual and business customers:

InsMark Illustration System

Personal Insurance Tab

| New | Various Financial Alternatives |

| New | Other Investments vs. Your Policy |

| New | Permanent vs. Term |

| New | Dollars of Benefits for Pennies of Cost |

| New | InsMark Compare |

Executive Benefits Tab

| New | Dual Security Plan (for pass-through organizations) |

| New | Click here for more details of this plan |

| New | (Note: The Dual Security Plan has the potential for an extensive impact on sales due to reduced taxation of pass-throughs like LLCs, LLPs, and Partnerships.) |

| New | Executive Trifecta |

| New | Executive Bonus Plan and Executive Security Plan (Controlled Bonus featured) |

Split Dollar Tab

| New | Endorsement Split Dollar with Optional Transfer |

| New | Endorsement Split Dollar with Salary Continuation at Retirement |

Personal Needs Analysis

| New | Retirement Needs Analysis |

Wealthy and Wise®

| New | Planning Funded by Smart Asset Allocation* |

| New | Cash Value Life Insurance Instead of a 401(k)* |

| New | Permanent vs. Term* |

| New | Roth Conversions with Income Tax Funded by Asset Allocation* |

| New | Retirement-oriented Bonus Plans Funded by Asset Allocation* |

| New | Retirement-oriented Leveraged Bonus Plans Funded by Asset Allocation* |

| New | Retirement-oriented Split Dollar Funded by Asset Allocation* |

| New | Retirement-oriented Premium Financing Funded by Asset Allocation* |

| New | Retirement-oriented Paycut Deferred Compensation Funded by Asset Allocation* |

| New | Estate-oriented Loan Regime Private Split Dollar Funded by Asset Allocation* |

| New | Estate-oriented Premium Financing Funded by Asset Allocation* |

| *no additional out-of-pocket cost to the client. |

Most of the Wealthy and Wise material referenced above was published prior to Tax Reform. During the eight years before the federal estate tax reverts to its 2017 indexed levels, there will be a reduction in the amount of federal estate taxes illustrated in the examples.

Tax Reform has not harmed any of the strategies referenced above. Many Individuals will see an increase in their take-home pay. C corporations will have significantly more after-tax revenue with which to extend benefits. Most pass-through organizations (S corporation, LLCs, LLPs, and Partnerships) will have more after-tax cash flow, and principals of the latter three have a terrific new benefit in the Dual Security Plan we just introduced (don't overlook it!).

2. Estate Planning

At first glance, it may seem that Tax Reform has damaged the estate planning market for cash value life insurance sales where customers may feel:

- They don’t need to purchase life insurance owned by ILITs; or

- They no longer need their existing trust-owned life insurance and can surrender those policies.

We believe both of these conclusions are false in the vast majority of client circumstances. Specifically, customers/advisors who carefully analyze the new law should continue to purchase/need policies in the same quantities and death benefit amounts as in recent years for the following reasons:

The increase in the tax exemption from $11 million to $22 million (per couple) is temporary. Starting in January of 2026, they go back to last year’s indexed amounts. Therefore, any client that can qualify for new life insurance today will have a life expectancy of significantly more than eight years. Moreover, if the client were to die unexpectedly before 2026, the death benefits compared with premiums paid would represent an extremely high tax-free return to the overall estate.

Finally, Democrats are on record indicating their desire to change the estate tax as soon as possible to lower the exemption to $2 million and raise the estate tax rate from 40% to 65%. In short, most clients should not expect that the current, high exemption will last until their future mortality age; therefore, the increased exemption amount is a misguided justification for reduced life insurance purchases or cancellations. (That said, we do expect to see some increase in sales of trust-owned policies in the life settlement market if clients want to sell them now to take advantage of the current higher exemptions amounts before 2026.)

Life insurance policies can be designed to enhance family net worth before and after the death benefit is paid. Every client that purchases life insurance for estate planning purposes by definition has a large enough personal net worth that they can now focus on “family net worth”. If this weren’t true, they would not be considering trust-owned life insurance at all. Instead, they would focus on personal wealth accumulation (see the InsMark presentations on Pages 1 and 2). Therefore, if a policy owned by an ILIT can enhance “family net worth” both before and after the death of the client, this is an attractive planning solution even if the estate tax is zero.

To see an example of this, we have restated below some key portions of Blog #163: Family Net Worth™ (It’s Irresistible!) Part 1 of 2.

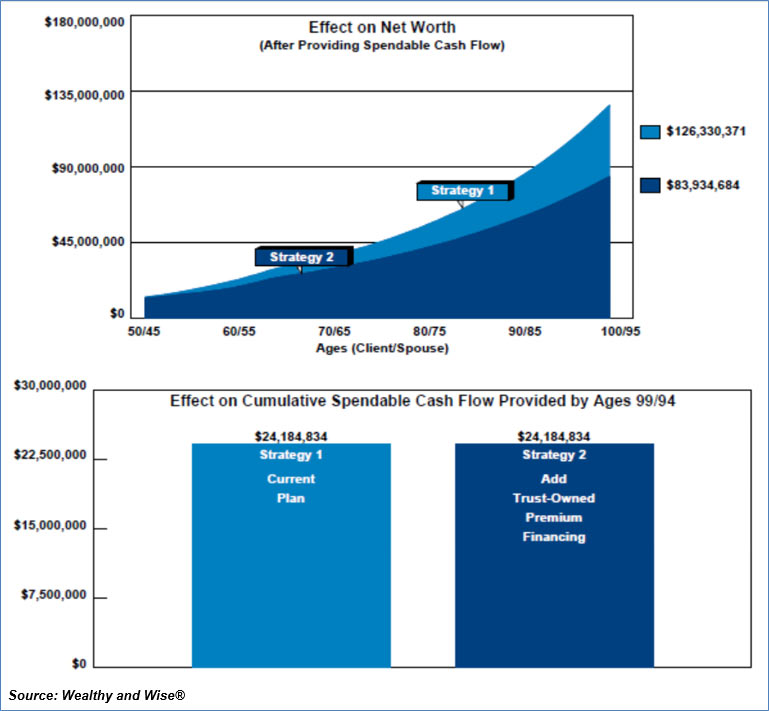

| Image 1 |

| Net Worth Comparison |

Strategy 2 produces a one-third decrease ($42+ million) in net worth caused by the increase in cash flow needed for the gifts to help fund the premium financing. That is a humongous net worth reduction, so let’s see what we can do to improve the impression of it.

Have we overlooked anything? What about the cash value of the policy in the trust (net of the outstanding loan to the bank during the first 15 years)? So far, the trust’s net cash value has not appeared as a component of net worth; however, it is a part of Family Net Worth before the death of the Baxters.

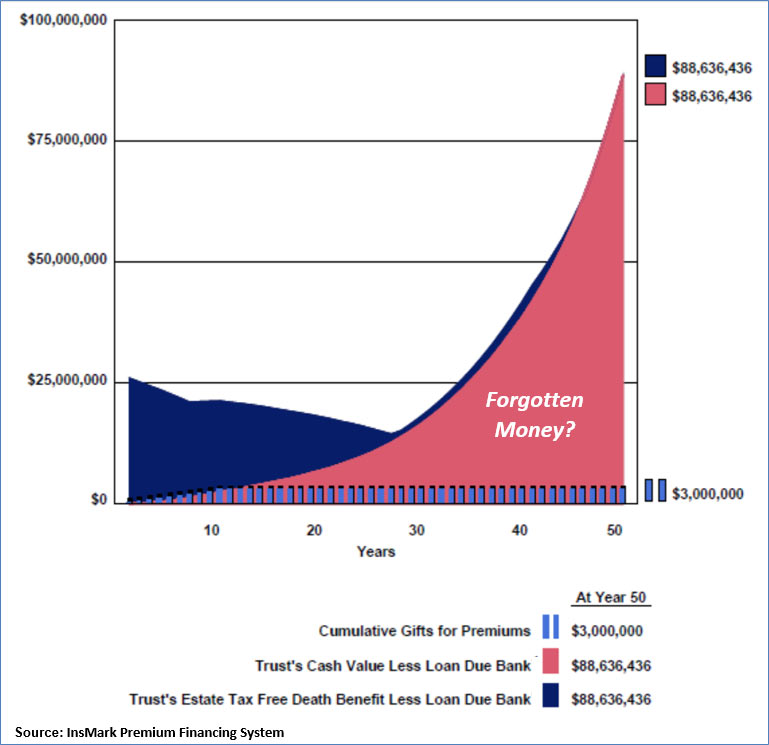

| Image 2 |

| Trust’s 50 Year Analysis |

Below is a graphic of the Baxters’ net worth in which assets outside of the estate (the cash value of the trust’s policy) are part of a new category called “Family Net Worth”.

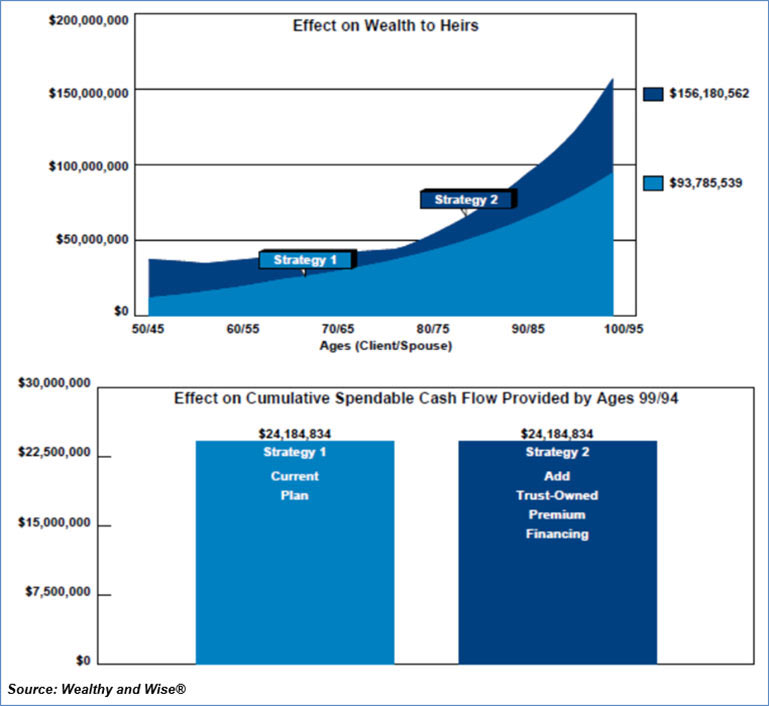

| Image 3 |

| Family Net Worth Comparison |

Family Net Worth of Strategy 1 adds no additional value as there are no assets outside of the estate. Family Net Worth for Strategy 2 is $46 million+ greater than Strategy 1 due to the presence of substantial life insurance cash values held in trust outside the estate.

As you can see in Image 4 below, Strategy 2 reflects a long-range increase of more than $62 million in Wealth to Heirs over Strategy 1 due to the death benefit of the life insurance owned by the trust.

| Image 4 |

| Wealth to Heirs Comparison |

These results require no additional out-of-pocket cost for the Baxters (a cash flow neutral evaluation) since asset allocation has funded all the requirements for retirement cash flow and gifts to the trust.

For full details regarding Images 1, 2, 3, & 4, see Blog #163: Family Net Worth™ (It’s Irresistible!) Part 1 of 2 where you will also have access to all the illustrations and digital Workbook files.

Note: We released Blog #163 on June 5, 2017. The level of estate taxes in Image 4 does not reflect their reduced impact during the eight-year life of Tax Reform that became effective on January 1, 2018. After eight years, estate taxes are accurate. This exception also applies to the two Additional Resources listed below.

Additional Wealthy and Wise® Resources

| New | Estate-oriented Loan Regime Private Split Dollar Funded by Asset Allocation* |

| New | Estate-oriented Premium Financing Funded by Asset Allocation* |

| *no additional out-of-pocket cost to the client. |

Conclusion

So relax. Tax Reform has only added to your potential sales opportunities.

Note to Wealthy and Wise licensees: Wealthy and Wise has been updated to include the increased exemptions in effect for 2018 through 2025. It also includes an option to illustrate the continuance of those numbers after 2025. If you import a digital Workbook file into your System (either one of yours or one of the Workbook files available from my Blogs), it will automatically update the Workbook with the increased exemptions in effect for 2018 through 2025. (If you do not see these changes in your System, you need to do a Live Update that is available under Help on the main menu bar.) Before March 1, 2018, there will be another Live Update for Wealthy and Wise that provides you with the additional option to “design-your-own” schedule of exemptions – perhaps to reflect what a client believes the Democrats might do to the numbers should they take control of Congress and the Presidency.

Licensing InsMark Systems

To license any of the InsMark software products, visit our Product Center online or contact Julie Nayeri at Julien@insmark.com or 1-888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or (925) 543-0513.

For help on how to use InsMark software, go to The Quickest Way To Learn InsMark.

Testimonials

“InsMark helps us help our clients understand their money and their choices. I always learn something new that changes what we do and how we can do it more efficiently. That translates to a better bottom line for us and for our clients. It’s making more money for everyone -- just by pushing InsMark buttons on the computer.”

Kay Corbin, CLU, ChFC, InsMark Platinum Power Producer®, Phoenix, AZ

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer®, Grafton, WI

“InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP®, CAP®, RFC®, Past President International Forum, InsMark Platinum Power Producer®, Encino, CA

“InsMark is the Picasso of the financial services world — their marketing savvy never fails to amaze me.”

Doug Peete, Past President, Top of the Table, InsMark Silver Power Producer®, Overland Park, KS

“InsMark”, “Wealthy and Wise” & “Executive Trifecta” are registered trademarks of InsMark, Inc.

“Family Net Worth” & “Documents On A Disk” are trademarks of InsMark, Inc.

Important Note #1: The hypothetical values associated with this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Life insurance illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

Important Note #3: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner when policy loans are present and net cash values are so low that the income tax on the gain on surrender (calculated using gross cash values less basis) is more – often significantly more – than the net cash surrender value.

This lurking tax bomb can be present in all forms of whole life and universal life where policy loans of any type are utilized. It can be avoided, and you, the producer, are key to making sure your clients are aware of how to sidestep it.

A tax bomb can be avoided if the policy is neither surrendered nor allowed to lapse, since the policy death benefit wipes away the income tax liability. The foundation of this special treatment is IRC Section 101. This statute provides that the proceeds of life insurance maturing as a death claim are exempt from federal income tax. This applies to the full death benefit, including any cash value component whether loans exist or not.

Note: It is best if you design the policy with no premiums scheduled after retirement if loans are anticipated in retirement years. This may require higher premiums during pre-retirement years, but a policy with no premiums scheduled is much more tolerable at advanced ages than one with continuous premiums.

Can your clients remember these facts years into the future? If they are incapacitated, will family members understand the issues? It is probably best to file a short note with the policy – something like this (although your compliance officer will likely have preferred language):

If/when you take policy loans on this policy, be sure to talk to your financial adviser before surrendering or lapsing the policy in order to anticipate unexpected tax consequences that may otherwise be avoided.

Does this note make it harder or easier to deliver the policy? It’s harder if you haven’t discussed it with your client; easier if you have. And that’s the point – you should discuss it.

Some life insurance companies have concierge units that monitor loan status at the point of lapse or surrender, and you would be well-advised to select an insurance company with this capacity. To be effective regarding the tax bomb, such carriers need to be proactive in their client relationships, not merely reactive to client inquiries. I hope that ultimately the policyholder service division of all life insurance companies will bring this potential liability to the attention of those surrendering or lapsing policies, particularly those policies with 50% or more of the gross cash value subject to outstanding loans.