Premium financing using bank loans as a source of premiums has been around a long time; it was highly popular in the 1940s and 1950s due to the low interest rates. During that period, the 10-year US treasury bond rate ranged between 2% and 3%. The bank prime loan rate was in that same vicinity, and the loan interest was deductible in a 91+% top income tax bracket. Leveraging everything was in vogue for the wealthy -- particularly cash value life insurance. Imagine if today’s indexed universal life was available then.

The low interest rates created by the market turndown of 2000, the recession that began in 2008, and the recent quantitative easing by the Federal Reserve has also created a favorable loan interest rate environment. These factors, along with the presence of indexed universal life insurance (a product with serious growth potential coupled with downside protection), have resulted in a surge of sales activity featuring premium financing.

That said, many producers still harbor concerns about it relative to collateral requirements, interest rate risk, and loan repayment obligations. This Blog is intended to provide useful information to those who use premium financing as well as to those who are interested but not quite ready to make the leap to it.

One of the top markets for premium financing involves large face amounts of personally-owned life insurance purchased by wealthy clients and used as a non-qualified retirement plan.

Case Study

Insured: Robert Sullivan (age 46).

Primary Beneficiary: Lynne Sullivan (age 46).

Type of Policy: ?Indexed Universal Life illustrated at 7.50%.

Face Amount: $10.5 million increasing death benefit.

Premiums: $490,798 a year for 5 years.

Funding: Bank loans.

Bank Loan Interest: 5.50% paid each year until the loan is repaid.

Repayment of Bank Loan: Beginning of year 11 using a policy loan.

Policy Loans for After Tax Retirement Cash Flow: Starting at age 60.

Goal of the Case Study: Integrate the premium financing arrangement into the overall financial plan of the client.

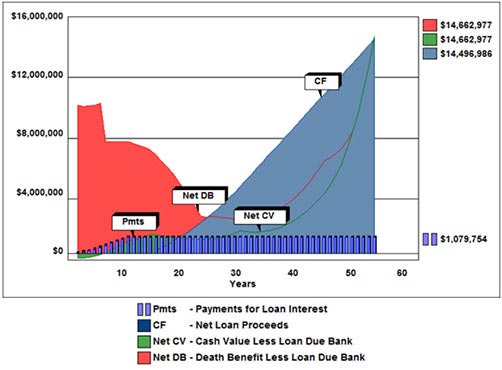

Let’s first look at the illustration that is generated from the InsMark Premium Financing System. Below is a graphic showing the results.

Over 10 years, the loan interest payments total almost $1.1 million. The long-range combination of after tax policy cash flow ($14,496,986) plus residual cash value ($14,662,977) totals slightly over $29 million. This results in a 20.88% pre-tax equivalent rate of return measured against the loan interest payments to the bank.

Click here to review the full premium financing illustration.

Conclusion

A well-designed premium financing arrangement can produce very dramatic results. Click here for a testimonial for our version of premium financing by one of our licensees.

Integration of Premium Financing Data Into Wealthy and Wise®

Through the lens of InsMark analytics, the premium financing illustration, impressive as it appears, is incomplete because it fails to provide the answer to this key question: Compared to what?

Let’s use InsMark’s Wealthy and Wise® to compare the overall effect on net worth and wealth to heirs of “doing vs. not doing” the premium financing strategy.

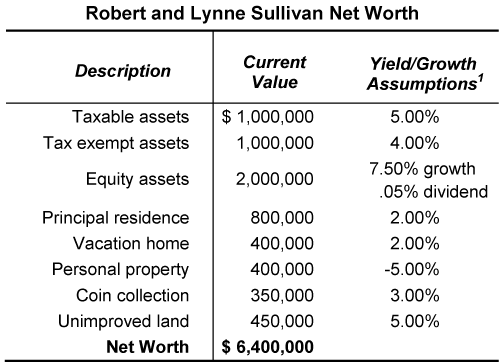

Below is a summary of Robert and Lynne’s net worth.

1 Click here for comments on Monte Carlo simulations.

The Sullivan’s retirement goal is $300,000 of after tax retirement cash flow starting in 14 years at age 60 -- indexed at 3.00% as an inflation offset.

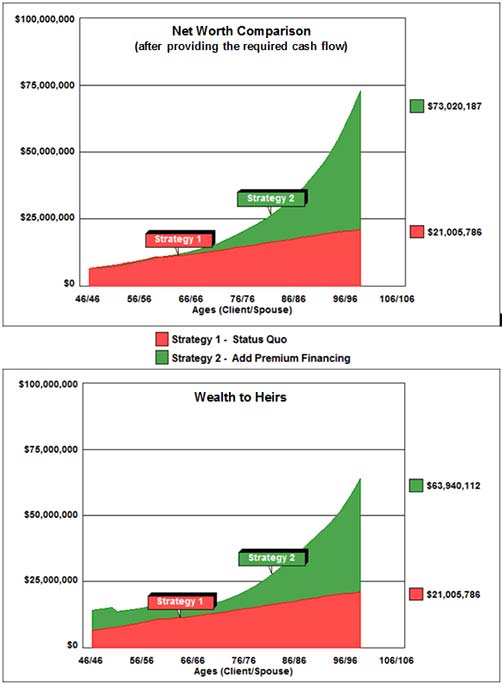

Strategy 1 illustrates a long-range projection of their net worth and wealth to heirs.

Strategy 2 uses identical data but imports the premium financing numbers as follows:

- The loan interest due the bank during the first 10 years is withdrawn from their liquid assets thus eliminating any out-of-pocket costs.

- The bank loans are repaid at the beginning of year 11 using a policy loan.

- The net cash value of the policy is added to their net worth.

- The policy’s net death benefit is added to their estate assets.

- Policy loans starting at age 60 provide part of their required retirement cash flow.

Both Strategies provide the Sullivan’s with tax retirement cash flow of $300,000 a year indexed at 3.00%.

Below is the comparative impact on their overall wealth. Long-range, the premium financing arrangement increases net worth by 348% and wealth to heirs by 304%.

Note: A 3:00% annual increase in the estate tax exemption is assumed.

As you can see, the financial analysis available from a combination of the Premium Financing System and Wealthy and Wise is light years ahead of the typical premium financing presentation by itself. Ask yourself this: Which graphics are more likely to impress the client -- the single graphic of the premium financing illustration or the double graphic from Wealthy and Wise showing the impact on net worth and wealth to heirs?

Click here to review the Wealthy and Wise report.

Special thanks to Robert Strauss, JD, Founder & President of DISCIPLINED ADVISOR NETWORK and the creator of the unique Self-Financed Insurance software for providing the data for the premium financing illustration. Bob’s organization is also an outstanding resource for the needed bank loans associated with premium financing. We believe that the combination of Bob/Bob software (Bob Strauss/Bob Ritter) presents an unbeatable combination.

For a license to use the InsMark Premium Financing System or Wealthy and Wise, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David A. Grant, Senior Vice President ? Sales at (925) 543-0513 or dag@insmark.com.

If you are licensed for the InsMark Premium Financing System (“PFS”) and would like to review the menu prompts we used for that part of the analysis, please email us at bob@www.robert-b-ritter-jr.com, and we will get the Case Data file (Workbook) right out to you. (Be sure to ask for the “PFS Workbook for Blog #18".) If you are licensed for Wealthy and Wise (“W&W”) and would like to review the menu prompts we used for that part of that analysis, be sure to ask for “W&W Workbook for Blog #18".)