(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark® Illustration System and the Leveraged Compensation System)

|

-look-alike-(part-1-of-2)-769x680.jpg)

|

Editor’s Note: If your practice includes executive benefits, this Blog should be useful for you. It is all about the mathematics of alternative funding of non-qualified benefit planning. It contains much of InsMark’s “Compared to What?” logic as we believe strongly that most clients welcome comparative analytics. If your practice does not include executive benefits, you should probably skip reading this Blog – unless you want to begin the learning process with an exceptional concept. |

A 401(k) Look-Alike is used by highly compensated executives who want to reduce current taxable compensation (or forego scheduled increases) in exchange for tax-free income in the future. Not only is this plan extraordinarily efficient for an executive, but the transaction can also produce a significant increase in net worth for the employer.

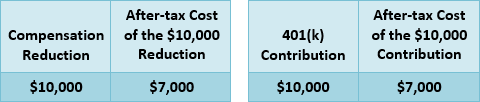

Consider this proposition: The after-tax cost of a $10,000 compensation reduction has the identical after-tax cost as a $10,000 contribution to a 401(k).

Example in a 30% income tax bracket:

Suppose the employer is willing to loan the executive the $10,000 realized from the compensation reduction and is also willing to accrue the loan interest. The executive uses the loaned funds to acquire an indexed universal life (IUL) policy.

Query: Will the $10,000 loan working in the IUL for retirement outearn the 401(k) – including repayment of the loan and accrued loan interest?

If it does, we have a superb arrangement that:

- Has the same after-tax cost as a 401(k);

- Produces better results;

- Has no contribution limitations.

Background

Designers of executive benefit plans for top earners are always in search of legitimate planning techniques that include tax leverage. One popular variation is called Deferred Compensation funded with corporate-owned life insurance in which an executive trades a portion of current compensation for the employer’s promise to make it up during retirement years when the executive will be — presumably — in a lower tax bracket.

There are three problems associated with this approach:

- Limited vesting is allowed;

- The employer may not be able to make good on its promise to pay;

- Income tax is still due when receiving the compensation later.

All three problems can be solved if the covered executive owns the deferred values. Typically, such ownership would trigger current taxation; however, InsMark’s 401(k) Look-Alike uses a split dollar technique in which the executive can own the plan’s values. Four factors are involved:

- The employer loans the executive the policy premiums using guidelines established in the final Split Dollar Regulations issued by the Treasury Department in 2003;

- Repayment of the loans and accrued loan interest occurs at a future date using policy cash values;

- The executive collaterally assigns the policy to the employer as security for the loans and accrued loan interest;

- The executive (or his/her family) is entitled to the balance of policy benefits, including significant after-tax retirement cash flow.

Plan Specifics for a 401(k) Look-Alike

The owner of the policy is usually the insured executive who either reduces current compensation or declines a planned increase. Using loan-regime split dollar, the employer makes annual loans to the executive equal to the compensation reductions.

Interest on the loans is set to the Applicable Federal Rate established under IRC Section 7872. The loan interest is typically accrued.

So long as the loan interest rate equals or exceeds the Applicable Federal Rate, no further loan interest is imputed by the IRS on the transaction. Generally, the loans are long-term loans (greater than 9 years), although mid-term loans (over 3 years but not over 9 years) or short-term loans (3 years or less) can be used.

The Plan’s Leverage for the Covered Executive

Through the voluntary compensation adjustment at the inception of the plan, the executive avoids the income tax that would otherwise be due on that income. So far, no income tax . . .

Assuming the plan is appropriately structured and designed, the executive-owned life insurance policy’s tax-deferred cash values are not taxed as they accrue. So far, no income tax . . .

The executive accesses policy cash values using policy loans which are not subject to income tax.

At death, the policy proceeds payable to the executive’s beneficiaries avoid income tax. So far, no income tax . . .

No income tax anywhere for the covered executive . . .

The Employer

If the employer is a profit-making organization, income tax is due on the compensation not paid to the executive. This tax is more-than-recovered when the executive’s policy cash values are used to repay the loans from the employer. If the employer is a tax-exempt organization, there is no income tax on the compensation not paid to the executive.

Click here to view a Flow Chart of the transaction for a profit-making organization.

Case Study #1 (Profit-Making Organization)

|

Tony Jamison, age 45, is President/CEO of Jamison Advertising, Inc., a successful, privately-owned, C corporation. He is personally maximizing his contribution to the company’s 401(k) plan and is intrigued by questions from his financial adviser: |

|

“If Congress increases the limit on 401(k) contributions by $100,000, would you take advantage of it?”

“Are they thinking of doing that?” asks Tony.

“No, but if they did, would you do it?”

“In a heartbeat,” Tony responds.

“I’ll put some numbers together assuming Congress passes that increase” replies his adviser, “I’ll show you seven years of deductible contributions as an example. I’ll compare that to an alternative called a 401(k) Look-Alike that is funded with the same after-tax cost as those 401(k) contributions.”

With the 401(k) Look-Alike, Tony reduces his compensation by $100,000 a year for the next seven years. Jamison Advertising agrees to loan Tony $100,000 a year for seven years funded by his compensation adjustment. Tony uses the loans for premiums for a personally-owned, 7-pay, $2.1 million UL policy. He collaterally assigns the policy to Jamison Advertising as security for the loans. Loan interest due the company is illustrated at a gradually-increasing long-term Applicable Federal Rate of 2.74% and accrued.

In his combined federal and state income tax bracket of 45%, the $100,000 annual compensation reduction has an after-tax cost to Tony of $55,000 a year for seven years, the same as $100,000 contributed to our pretend 401(k) for seven years.

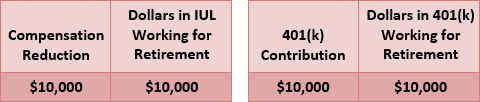

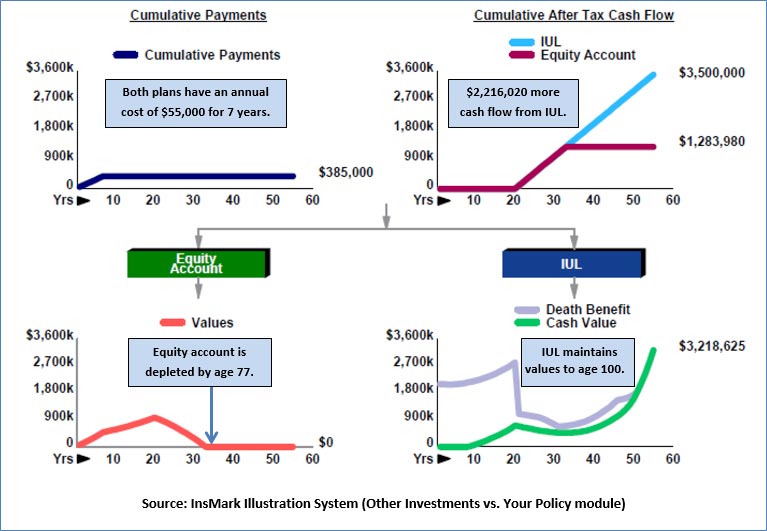

Below is a graphic of Tony’s costs and benefits:

| Image 1 |

| 401(k) Look-Alike |

| Executive’s Costs and Benefits |

The cumulative net payments of $385,000 consist of seven years of Tony’s after-tax funding cost of $55,000 a year. The $3,500,000 loan proceeds (for retirement), and the $3,218,625 of residual cash value are after repayment to Jamison Advertising of the premium loans and accrued loan interest at the beginning of year 21.

Click here to review all the reports for this 401(k) Look-Alike. Notice in Column (4) on Pages 7 and 8 that Jamison Advertising has a significant negative charge to earnings throughout the plan. (A negative charge to earnings produces a credit to earnings.) As you can see on Page 9, this transaction has produced a pre-tax equivalent rate of return for Tony of 14.70%.

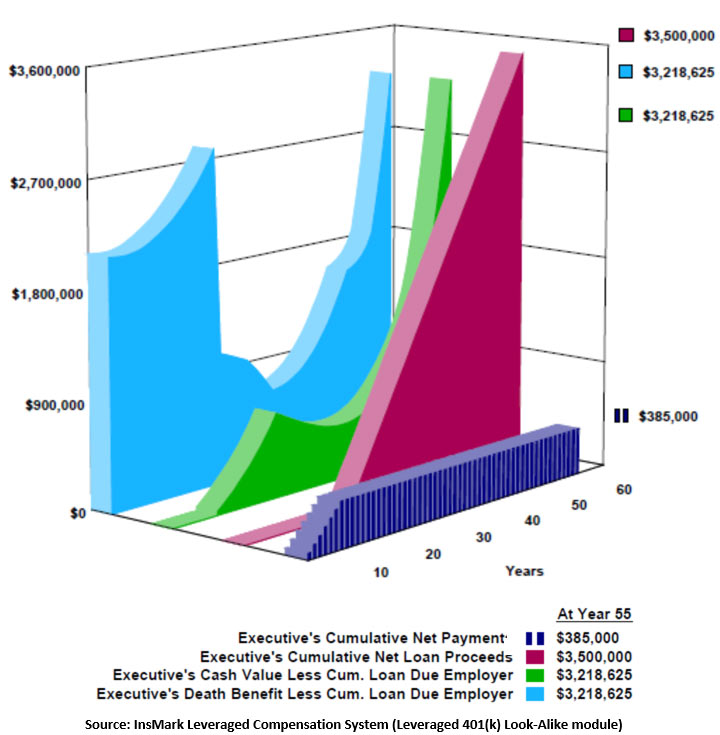

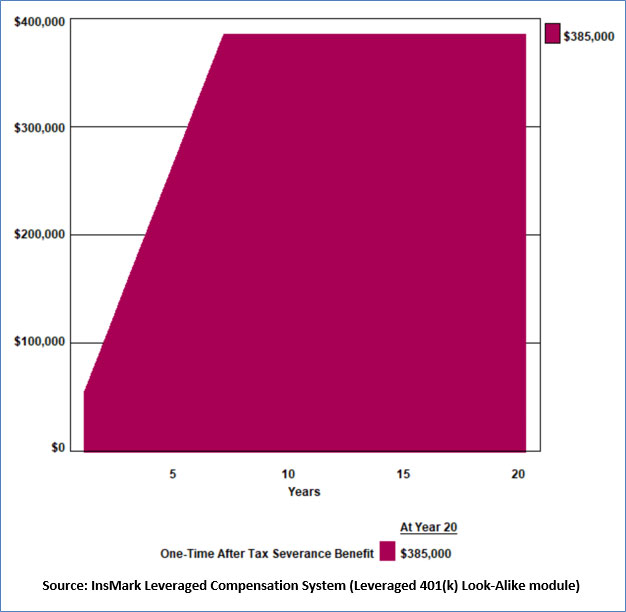

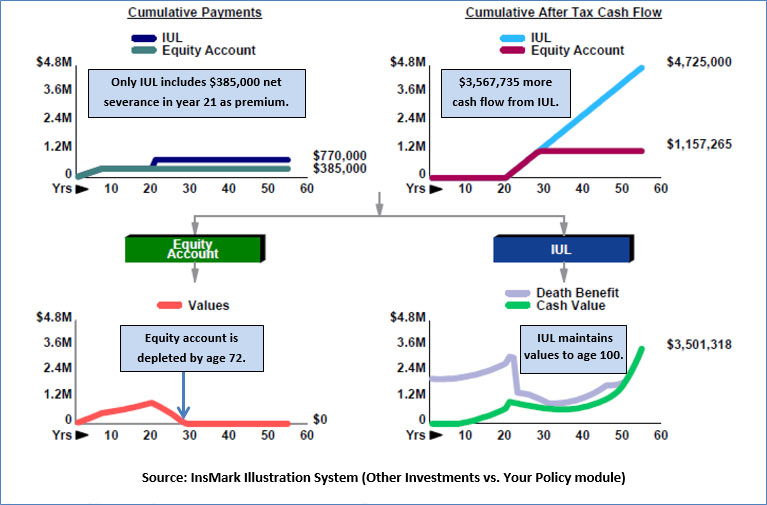

Next comes a comparison of these results to a $100,000 contribution by Tony for seven years to the pretend 401(k). If the 401(k) Look-Alike is a valid economic concept, the IUL funding it should outearn the pretend 401(k). Below is a graphic of this comparison using the Other Investments vs. Your Policy module in the InsMark Illustration System.

It’s not even close!

| Image 2 |

| IUL vs. Pretend 401(k) |

Click here to review the reports for the Image 2 comparison.

As you can see on Pages 5 and 6, I included a Comparison of Plan Costs for the IUL and the pretend 401(k) Look-Alike. This is an optional report favoring life insurance that I include in most of my comparisons.

Results for Jamison Advertising

Recovering the premium loans and the accrued loan interest is a remarkable result for Jamison Advertising considering that it was Tony’s compensation adjustment that provided the money for the loans. Overall, the company has a 14.39% pre-tax (11.37% after-tax) equivalent rate of return on its after-tax funding costs. Click here to see the proof of that calculation.

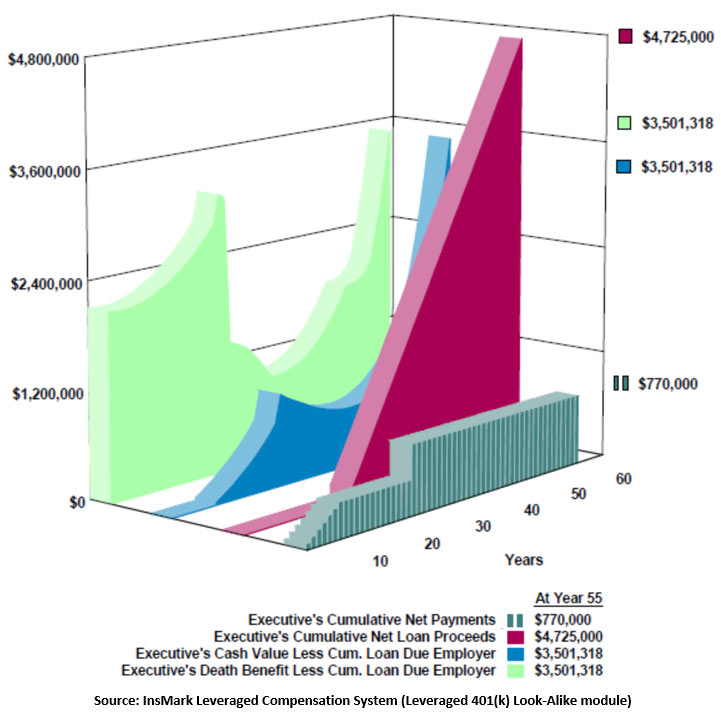

Tony’s Alternative Investment

To participate in a 401(k) Look-Alike, Tony must consider the following question. “If I keep the $100,000 compensation, I will have $55,000 after taxes. Should I invest this amount in the IUL – or is there a better use for it? If I invest it elsewhere, will I do better or worse?”

|

To help with the answers to Tony’s questions, what if he invests the $55,000 in an equity account? Would that out-perform the IUL funding the 401(k) Look-Alike? |

|

| Image 3 |

| IUL vs. Equity Account |

Click here to review all the reports for the Image 3 comparison. Note on Page 4 that the equity account would need growth of 10.55% plus the 2.00% dividend to match the results of the IUL – a total of 12.55%. That’s 565 basis points more than the 6.90% illustrated rate of the IUL.

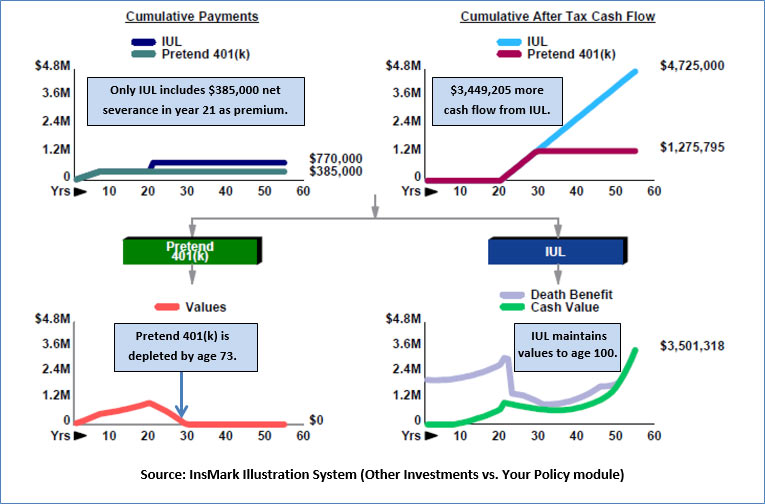

Adding a Severance Benefit

Good as the arrangement is for Tony, it doesn’t seem fair for Jamison Advertising to show a profit from Tony’s compensation reduction – so let’s include a separate severance benefit for Tony equal to his cumulative compensation reduction.

| Image 4 |

| Tony’s Severance Benefit |

Click here for details of the graphic. Page 1 shows the effect of the severance on Jamison Advertising. Note in Column (6) that the after-tax cost of the severance reduces the company’s charge to earnings. Page 2 shows the effect of the after-tax severance on Tony.

Revised 401(k) Look-Alike (including Severance)

How should we account for the after-tax severance benefit of $385,000 that Tony receives in year 20? Let’s include it as an additional, one-time premium for the IUL in year 21. This changes the results of the 401(k) Look-Alike considerably by increasing Tony’s annual, after-tax, retirement cash flow increases from $100,000 a year to $135,000 a year, an improvement of $1,225,000 for total cash flow of $4,725,000.

Below are the results:

| Image 5 |

| Revised 401(k) Look-Alike with Severance |

| Executive’s Costs and Benefits |

Click here to review all the reports for this revised 401(k) Look-Alike. You can see the additional, one-time premium for the IUL in year 21 in Column (5) on Pages 5 and 7.

Next, we will compare the Revised IUL with Severance vs. the Pretend 401(k).

| Image 6 |

| Revised IUL vs. Pretend 401(k) |

Click here to review the reports for the Image 6 analysis. Note on Page 2 that Column (7) shows the after-tax severance of $385,000 as an additional premium for the IUL at the beginning of year 21. This additional premium increases the annual, after-tax, retirement cash flow to $135,000 which, when matched by the pretend 401(k), runs the 401(k) out of money by age 73, five years sooner.

Note: Normally, these calculations show the additional premium of $385,000 on both sides of the evaluation. In this case, that is inaccurate since the source of the $385,000 is the after-tax severance related only to the 401(k) Look-Alike. You can reflect this type of comparison only in the Other Investment vs. Your Policy module in the InsMark Illustration System by selecting this option from the Investment Details tab and canceling out the $385,000 (in this case) from the array:

Finally, let’s compare the revised IUL funding the Revised 401(k) Look-Alike with the equity account (including the extra premium for the IUL of $385,000 in year 21). The equity account does not get the additional $385,000 in year 21 since that is only available with the severance aspect of the 401(k) Look-Alike.

| Image 7 |

| Revised IUL vs. Equity Account |

Click here to review the reports for the Image 7 analysis. Note on Page 3 that Column (4) shows the after-tax severance of $385,000 as an additional premium for the IUL at the beginning of year 21. This additional premium increases the annual, after-tax, retirement cash flow from $100,000 to $135,000 which, when matched by the equity account, runs the equity account out of money by age 73, five years sooner than before.

Below are additional unique advantages when life insurance is used:

- There is no regulatory limit of the amount paid into a 401(k) Look-Alike;

- A waiver of premium can be attached to life insurance in the event of disability;

- Tax free cash flow from the life insurance (withdrawals to basis and/or loans) can be accessed prior to age 59 1/2 with no premature distribution tax;

- Life insurance also provides a significant death benefit;

- Many policies allow for advance of death benefits to fund long term care costs.

All this material has been constructed to address “Yes” answers to this question: “If Congress increases the limit on 401(k) contributions by $100,000, would you take advantage of it?”

Congress is not about to do this, but you now have the means for clients to do it on their own with a 401(k) Look-Alike that outperforms a traditional 401(k) and alternative investments by a considerable margin. I believe if you prospect using this concept with suitable clients that five- and six-figure premiums – and higher – will be available to you.

Case Study #2 (Tax-Exempt Organization)

If the employer is a tax-exempt organization (TEO), when the executive makes the compensation adjustment, the TEO pays no tax on the funds recovered and has 100% of the funds to loan to the executive. The executive’s numbers are identical to those shown above assuming age 45 and the same 45.00% federal and state income tax bracket.

Arthur Johnson, age 45, is President/CEO of the Lung Cancer Fund, a TEO headquartered in San Francisco, CA. Arthur is personally intrigued by the question about the pretend 401(k) posed by his financial adviser:

“If Congress increases the limit on 401(k) contributions by $100,000, would you take advantage of it?”

Click here to review several key reports from a 401(k) Look-Alike for Arthur. They are:

- The benefits for Arthur on the right side of the Summary on Pages 1 and 2 are the same as those for Tony Jamison discussed above.

- The TEO numbers on the left side of the Summary are different. There is no cost to the TEO, and it also has a sizable asset caused by the loans due from Arthur plus the accrued loan interest.

- The Employer’s Net Payment Analysis on Page 3 confirms the no-cost feature to the TEO.

- The Promissory Note Analysis on Page 5 confirms the growth and repayment of the loan to the TEO that is due from Arthur.

The severance feature for payment to Arthur works the same as it does for Tony Jamison. Since Arthur’s loans from the TEO are solely funded by Arthur’s compensation reduction, it seems fair that a separate severance agreement should be included in the plan’s arrangement.

Click here for a quick review of the details of TEO severance.

Click here to review the complete presentation for a TEO (including severance).

The results for Tony Jamison reflected in Images 6 and 7 apply specifically to Arthur Johnson as well.

Section 4960 Excise Tax

Section 4960 (part of the Tax Cuts and Jobs Act that passed in December 2017) provides that a TEO or a related organization that pays remuneration above $1 million to a covered employee, like Arthur Johnson, is subject to a 21% excise tax on the excess amount.

Click here for an excellent article on Section 4960 that discusses the issues using football coaches’ compensation (think Jim Harbaugh); however, the article applies to all TEOs with highly-paid executives earning more than $1,000,000.

A covered employee for purposes of Section 4960 is any employee of a TEO if the employee (1) is one of the five highest-compensated employees of the organization for a particular taxable year of the TEO, or (2) was a covered employee of the TEO in a prior taxable year.

Example: Arthur’s annual compensation is $1,100,000. If he continues at this level the Lung Cancer Fund will owe $21,000 in excise taxes ($100,000 x 21%) each year.

If Arthur enters into a 401(k) Look-Alike for the $100,000, he not only has a fabulous new benefit, he saves the Lung Cancer Fund this excise tax, a further incentive for the TEO to participate. What if Arthur were earning $1,500,000? Would he contribute the entire excess of $500,000? So long as Arthur can afford the cash flow impact of the compensation reduction, the sky is the limit on funding costs.

Moreover, with a properly drawn agreement, Arthur can access cash values in his 401(k) Look-Alike before retirement so long as he does not invade cash values designated for repayment of the employer’s loans.

Tax Authority for a 401(k) Look-Alike

The funding mechanism of 401(k) Look-Alike is Loan Regime Split Dollar which is authorized by the 2003 Final Split Dollar Regulations (Treas. Reg. §§1.61-22, 1.83(e), 1.83-6(a)(5) and 1.7872-15). The fact that funding of a 401(k) Look-Alike is assisted by an executive’s compensation reduction that is (optionally) recovered by way of a separate valid severance agreement should be irrelevant.

Caution: Due to provisions of Sarbanes-Oxley (SOX) which restrict corporate loans to executives, the 401(k) Look-Alike cannot be provided to top executives of publicly-owned companies. That still leaves a sizable market of private companies and tax-exempt organizations as potential clients.

Perfect Clients for 401(k) Look-Alike

- Owner/employees/directors of successful, private C corporations (there are many more of these available due to the recent 21% top C corporate tax bracket);

- Highly paid non-owner executives of any successful business entity (C or S corporation, LLC, Partnership);

- Highly paid executives of successful Tax-Exempt Organizations (think college presidents, coaches, and senior officers of large charitable organizations).

Conclusion

The 401(k) Look-Alike provides a supplemental retirement plan for covered executives that would be impossible to duplicate on their own. This strategy also produces very favorable results for any employer as it receives loan repayments initially funded by the executive’s compensation adjustment.

The 401(k) Look-Alike is closer to a slam-dunk than any of the other executive benefit plans as both employer and executive have such positive results. The same logic can produce a Keogh Look-Alike, 403(b) Look-Alike, and Section 457 Look-Alike. For those licensed for the InsMark Leveraged Compensation System, the 401(k) Look-Alike module can reflect any of these alternatives merely by customizing the Proposal Heading on the Basic Data tab.

Go forth and prosper!

Specimen Documents

Specimen installation documentation for 401(k) Look-Alike is available in InsMark’s Cloud-Based Documents On A Disk (DOD) in both the Business Owner Benefit Plans and the Key Employee Benefit Plans section of documents. These specimen documents don’t exist anywhere else, so if you use this concept, you will need them – particularly those relating to severance. If you are licensed for both the InsMark Leveraged Compensation System and DOD, you can access these documents from within the 401(k) Look-Alike module (part of the Leveraged Compensation System) by clicking on this section on the lower right of the Basic Data tab:

Specimen installation documentation for 401(k) Look-Alike is available in InsMark’s Cloud-Based Documents On A Disk (DOD) in both the Business Owner Benefit Plans and the Key Employee Benefit Plans section of documents. These specimen documents don’t exist anywhere else, so if you use this concept, you will need them – particularly those relating to severance. If you are licensed for both the InsMark Leveraged Compensation System and DOD, you can access these documents from within the 401(k) Look-Alike module (part of the Leveraged Compensation System) by clicking on this section on the lower right of the Basic Data tab:

Alternatively, assuming you are appropriately licensed, you can access the documents directly by logging into My InsMark/DOD at this address: https://www.insmark.com/. Look in the upper right area of the website for My InsMark.

Licensing InsMark Systems

For licensing information regarding the Leveraged Compensation System (where the 401(k) Look-Alike illustration module is available) and Cloud-Based Documents On A Disk™, contact Julie Nayeri at Julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President — Sales, at dag@insmark.com or (925) 543-0513.

If you want to illustrate a compensation reduction concept without the pretend 401(k) comparison, use the Leveraged Deferred Compensation module also in the Leveraged Compensation System.

For a review of all InsMark Systems (including the InsMark Illustration System where we illustrated the comparisons to a Pretend 401(k) and Equity account in this Blog), go to our Product Center.

For those who would like a discounted suite of our entire product line, visit our Platinum Power Producer site.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Digital Workbook Files For This Blog

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Before downloading and reviewing any files, be certain you have installed the most current updates to your InsMark System(s). Do this using Live Update available under Help on the main menu bar of the System or this icon on the main menu bar:

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark Systems. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

If you obtain the digital workbook for Blog #191, click here for a guide to its content. It will be invaluable to you.

To license any of the InsMark software products, visit our Product Center online or contact Julie Nayeri at Julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President — Sales, at dag@insmark.com or (925) 543-0513.

For help on how to use InsMark software, go to The Quickest Way To Learn InsMark.

Testimonials

“Thanks to the genius of Bob Ritter and InsMark, I was able to complete two cases in the last few months using the 401(k) Look-Alike module in the InsMark Leveraged Compensation System. Annual premiums total was over $90,000. Before reaching out to Bob, I struggled with conceptualizing and communicating this new deferred compensation logic to the business owners and their key employees. With the InsMark software, the compelling case logic was immediately obvious to everyone. In addition, the software is easy to learn and use. InsMark continues to work magic for me and my business!”

Glenn A. Main III, InsMark Power Producer, The Main Point LP, Pittsburgh, PA

“InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP®, CAP®, RFC®, Past President International Forum, InsMark Platinum Power Producer®, Encino, CA

“InsMark is the Picasso of the financial services world — their marketing savvy never fails to amaze me.”

Doug Peete, Past President, Top of the Table, and InsMark Power Producer, Overland Park, KS

“The reason I use InsMark products is because they are so good at explaining financial concepts to all three parties: 1) the producer trying to explain the idea; 2) the computer technician trying to illustrate it; 3) the customer trying to understand it.”

Rich Linsday, CLU, AEP, ChFC, InsMark Platinum Power Producer®, Top of the Table, International Forum, Pasadena, CA

“InsMark has increased my production by 10 fold. It clearly communicates to the client the best financial scenario to take.”

Gary Sipos, M.B.A., A.I.F.® InsMark Platinum Power Producer®, Sipos Insurance Services, Freehold, NJ

“InsMark” is registered trademark of InsMark, Inc.

“Cloud-Based Documents On A Disk” is a trademark of InsMark, Inc.

Copyright © 2019 InsMark, Inc.

All Rights Reserved

Important Note #1: The hypothetical life insurance illustrations and alternative investments referred to in this report assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations of life insurance are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

Important Note #3: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner when policy loans are present and net cash values are so low that the income tax on the gain on surrender (calculated using gross cash values less basis) is more – often significantly more – than the net cash surrender value.

This lurking tax bomb can be present in all forms of whole life and universal life where policy loans of any type are utilized. It can be avoided, and you, the producer, are key to making sure your clients are aware of how to sidestep it.

A tax bomb can be avoided if the policy is neither surrendered nor allowed to lapse, since the policy death benefit wipes away the income tax liability. The foundation of this special treatment is IRC Section 101. This statute provides that the proceeds of life insurance maturing as a death claim are exempt from federal income tax. This applies to the full death benefit, including any cash value component whether loans exist or not.

Can your clients remember these facts years into the future? If they are incapacitated, will family members understand the issues? It is probably best to file a short note with the policy – something like this (although your compliance officer will likely have preferred language):

If/when you take policy loans on this policy, be sure to talk to your financial adviser before surrendering or lapsing the policy in order to anticipate unexpected tax consequences that may otherwise be avoided.

Some life insurance companies have concierge units that monitor loan status at the point of lapse or surrender, and you would be well-advised to select an insurance company with this capacity. To be effective regarding the tax bomb, such carriers need to be proactive in their client relationships, not merely reactive to client inquiries. I hope that ultimately the policyholder service division of all life insurance companies will bring this potential liability to the attention of those surrendering or lapsing policies, particularly those policies with 50% or more of the gross cash value subject to outstanding loans.

![]()

More Recent Blogs:

Blog #190: Crystal Clear — and Simple

Blog #189: Permanent vs. Term Comparison (Part 3) Wall Street Journal – You Are So Wrong!

Blog #188: Permanent vs. Term Comparison (Part 2) Wall Street Journal – You Are So Wrong!

Blog #187: Permanent vs. Term Comparison (Part 1) Wall Street Journal – You Are So Wrong!

Blog #186: Solo 401(k) vs. Indexed UL Knock Your Socks Off (Part 4)