A dog you want costs $500. Your boss wants to help you buy it, so she gives you a $500 bonus.

Is it a free dog? No -- because you have to pay the tax on the bonus. If you’re in a 40% tax bracket, the dog costs you $200.

So let’s see if your boss will help you out. You ask her to increase the bonus to $833. If so, you’ll pay $333 in income tax and have $500 left over to buy the dog.

Would this get you a free dog? Yes -- but it doesn’t matter because she won’t do it. All she’ll come up with is the $500.

We have to find a way to pay the $200 tax on the $500 bonus -- and pay for the dog.

What if we could find a bank to take the dog as collateral for a $200 loan? And the bank added the interest to the loan? And the loan included free dog life insurance so when the dog died, the loan was paid off?

What if we could find a bank to take the dog as collateral for a $200 loan? And the bank added the interest to the loan? And the loan included free dog life insurance so when the dog died, the loan was paid off?

Now that would be a free dog!

Let’s see if we can make this work with a life insurance policy.

Assumptions:

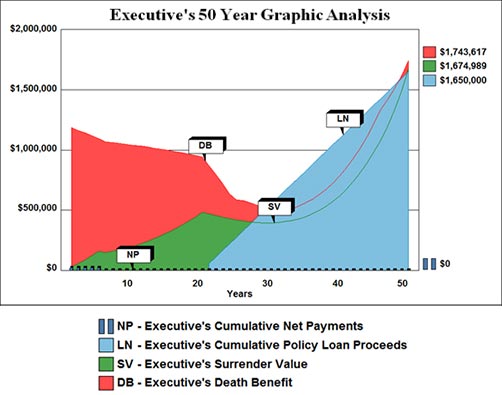

Executive: Age 45;

Initial face amount of policy: $1,184,217;

Premium: $50,000 a year for 5 years;

Bonus from employer: $50,000 a year for 5 years;

Income tax due by executive (40% tax bracket): $20,000 a year for 5 years;

Policy loans by the executive to cover the income tax: $20,000 in years 2 through 6*;

Policy loans by the executive for retirement cash flow from age 65 to 95: $55,000 a year.

You won’t get a bank to help you with the free dog, but you can certainly get a business and a life insurance company to join in a transaction that resembles it.

It’s called an Executive Bonus Plan, and it’s designed to reward a valuable executive with a benefit that, like the free dog, cannot be duplicated personally.

Below are the illustrated results for this plan from the InsMark Illustration System software.

Click here to see reports for this Executive Bonus Plan from the InsMark Illustration System software.

InsMark’s Documents On A Disk™ System (DOD) has specimen legal documents for installation of several variations of the Executive Bonus Plan. Click here for Highlights of the Plan of the one typically used for non-owner employees. Click here for Highlights of the Plan of the one typically used for owner-employees. Click here to review features of DOD.

InsMark’s Documents On A Disk™ System (DOD) has specimen legal documents for installation of several variations of the Executive Bonus Plan. Click here for Highlights of the Plan of the one typically used for non-owner employees. Click here for Highlights of the Plan of the one typically used for owner-employees. Click here to review features of DOD.

Click here to see reports for this Executive Bonus Plan from the InsMark Illustration System software.

If you are licensed for the InsMark Illustration System and would like to review the menu prompts we used for this analysis, please email us at bob@www.robert-b-ritter-jr.com, and we will get the Case Data file (Workbook) right out to you.

*Some life insurance companies allow policy loans in the first year. In this event, loans would be shown in years 1 through 5. From a cash flow perspective, loans in years 2 through 6 should generally be satisfactory due to the delay between when the bonus is paid and the income tax is due.