(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark® Illustration System)

-769x513.jpg)

Both Dave Ramsey and Suze Orman say, “Buy term and invest the difference.”

|

Blog #194 continues a series of four Blogs featuring InsMark’s CheckMate® Logic as it relates to the purchase of a life insurance policy. Blog #193 (Part 1) dealt with procrastinating clients who seem to want the coverage but postpone purchasing it. Blog #194 (Part 2) dealt with clients who are concerned that cash value life insurance may be inappropriate for retirement planning. Blog #195 (Part 3) deals with clients who want to look at “buy term and invest the difference”. Blog #196 (Part 4) will deal with clients who want a comprehensive analysis to see the specific impact on their retirement plan of 1) acquiring the policy compared to 2) investing in an equity account compared to 3) buying term insurance and investing the difference. I will cover all four points in detail from the Main Platform at the 2020 InsMark Symposium in Las Vegas on February 28 – 29. I look forward to seeing you there. |

There are a few subjects bound for everlasting argument: Religion, Politics, Sex, and Term Insurance.

Why term insurance? It’s because “buy term and invest the difference” has been shouted from rooftops by faux commentators for over 100 years, but there is no valid economic theory that explains why a bad idea is acceptable simply because one hears it frequently.

It is one of those ideas that sounds reasonable but turns out to be dead wrong when you apply mathematics. It uses the Lamppost Theory1 the way a drunk uses a lamppost for support, not illumination.

| 1 | Alan Blinder, Princeton economist. |

So let’s illuminate . . .

Case Study

You met Harvey Pierce, MD, in Blog #193 and Blog #194. He is age 45 and is in a combined, federal and state, income tax bracket of 40%. He has been considering the following cash value life insurance policy:

Indexed Universal Life (IUL)2 illustrated at 6.85% as follows: $650,000 of increasing death benefit with 20 annual premiums of $30,000 and $120,000 of yearly participating policy loans from age 65 to 100.

| 2 | See the Whole Life Alternative section below for a different policy solution. |

Dr. Pierce wonders if term insurance coupled with an equity account with projected growth of 7.00% and a 2.00% dividend would work better for him as part of his retirement plan. Let’s check the math assuming the equity account is directed to match the same $120,000 in after-tax cash flow as the IUL.

This comparison can easily be calculated using the Permanent vs. Term module available on the Personal Insurance tab in the InsMark Illustration System. I searched the web for the lowest cost for $650,000 of 20-year, level, term life insurance and located a rate of $700, which I used in the analysis.

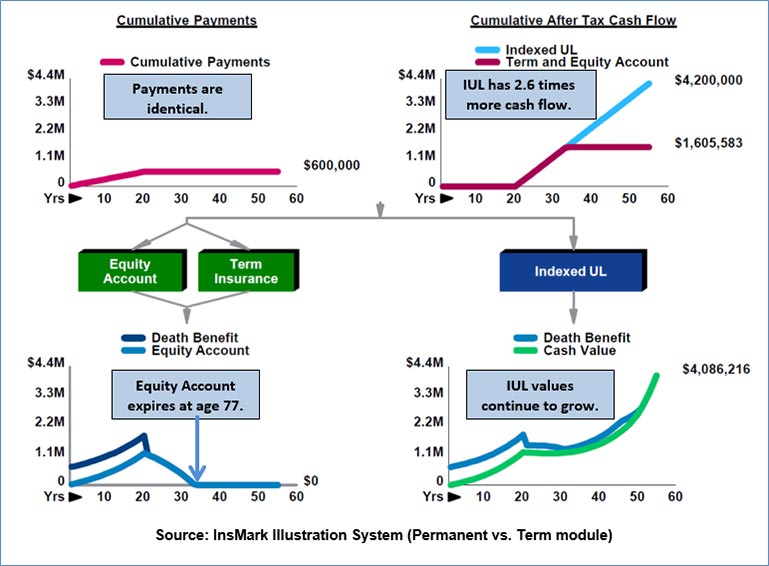

Below is a graphic of the results:

| Image 1 |

| Indexed Universal Life |

| vs. |

| Term Insurance and an Equity Account |

Click here to review the entire illustration.

Page 1 is a narrative Preface that includes the above graphic (minus the explanation inserts).

Pages 2 and 3 summarize the calculations.

Page 4 shows that the equity account would need growth of 10.81% plus the 2.00% dividend for a total yield of 12.81% to match the IUL. (For anyone doubting this result, if you have the InsMark Illustration System, you can prove it by entering 10.81% as the growth rate plus the 2.00% dividend.)

Pages 5 and 6 show details of the equity account calculations that you should review.

Pages 7 and 8 show 25% turnover calculations for the equity account – an unusually low level of internal turnover for equities.

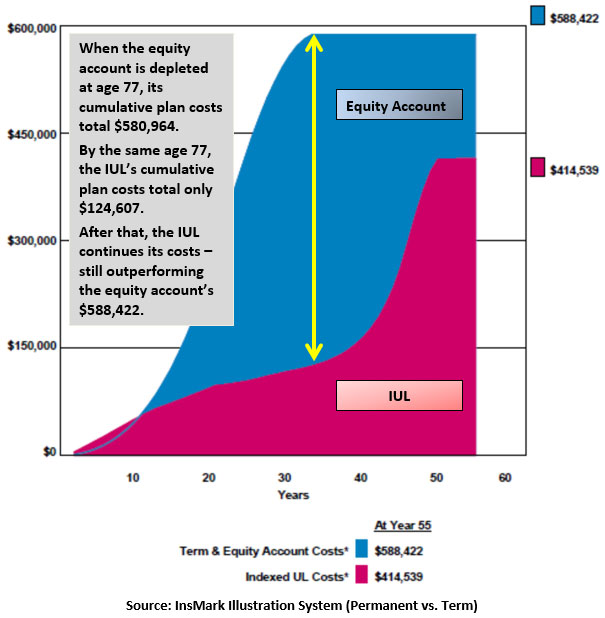

Page 9 is a graphic comparing the internal plan costs of each component, and Pages 10 and 11 show details of what makes up the graphic on Page 9.

Below is a replication of the Page 9 graphic:

| Image 2 |

| Comparison of Plan Costs |

Conclusion

It’s not even close – the IUL outperforms the term insurance and equity account combination by a considerable margin in after-tax cash flow, cash values, death benefits, and plan costs. Unlike the equity account, IUL also provides a zero percent floor to limit any losses that will inevitably occur in its companion stock index.

The evaluations in this Blog are valid regardless of a client’s age.

401(k) Alternative

Dr. Pierce is eligible for a Solo 401(k) which has a contribution limit in 2019 of $56,000. Dr. Pierce has not taken advantage of it; however, if he directs $48,833 to a Solo 401(k), in his 40% income tax bracket, it costs him $29,300 in after-tax dollars – plus the $700 term premium – for a total of $30,000, the same as the premium for the IUL.

Like the equity account, the Solo 401(k) does not outperform the IUL. There are two reasons for this: 1) income tax on the retirement cash flow from the Solo 401(k)3 and 2) its cumulative plan costs are more than three times greater than the IUL.

| 3 | In Dr. Pierce’s 40% tax bracket, for the Solo 401(k) to match the IUL’s annual after-tax policy loans of $120,000 in retirement years, he must withdraw $200,000 annually from the 401(k) in those same years. The income tax of $80,000 in each retirement year is what creates the increase in plan costs and is what causes the Solo 401(k) to collapse at age 77. |

Click here to review the illustration report for IUL vs. Solo 401(k) plus term insurance.

Whole Life Alternative

Although this Blog features IUL, those who prefer the guarantees of Whole Life can produce proportionate results using the same InsMark illustration module for more conservative clients. You can do this by reducing the equity account’s growth and dividend assumptions to align more closely with the internal rate of return of the policy and each client’s risk tolerance. If you include the Solo 401(k), you should also reduce its yield assumption accordingly.

Suitability

“Suitability” is core to the recommendation of any financial product. FINRA, for example, is quite specific regarding reasonable-basis suitability, customer-specific suitability, and quantitative suitability. One of the best FINRA-approved compliance questionnaires I have seen is from Backroom Technician by Advisys, Inc., which has granted InsMark permission to provide my readers with a copy.

Click here to contact Backroom Technician for more information on its overall product line.

What’s Wrong With It?

Near the end of an interview, after you have thoroughly covered all the issues, Dr. Pierce might ask, “You told me all the good things – now tell me what’s wrong with it?”

Many advisers are uncomfortable with this question, but in reality, it indicates your customer is close to buying – and you need a reasonable answer.

Never say, “There’s nothing wrong with it.”

If you are presenting life insurance, try this: “You’ll have to take a physical to prove to the insurance company you’re a good risk. When would be a good time to do that?” You’ll next be talking about the physical, and “What’s wrong with it?” is long gone.

I have never seen this not work!

Suze Orman, Dave Ramsey, and Jim Dahle, MD (White Coat Investor®)

Don’t let your clients get trapped believing the “buy term and invest the difference” misrepresentations from Suze Orman, Dave Ramsey, and Jim Dahle, MD (White Coat Investor®). Their advice is words and uninformed opinion only. Provided your clients have the available cash flow to consider permanent life insurance, let year-by-year comparative mathematics guide their decisions (something Suze, Dave, and Jim don’t include in their exaggerated narratives about permanent life insurance).

Your Comments

Add your comments to this Blog. Your email address will not be published.

Licensing InsMark Systems

To license the InsMark Illustration System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275) or visit us online. Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

If you would like highly qualified, illustration design assistance with no commission split required, contact LifePro Financial, InsMark’s Referral Resource, discussed below.

Digital Workbook Files For This Blog

New Zip File Downloaders

Watch the video.

Digital Workbook Files For This Blog

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward it to your PC where your InsMark System(s) are installed. |

If you obtain the digital workbook for Blog #195, click here for a user guide to its content.

For help on how to use InsMark software, go to The Quickest Way To Learn InsMark.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

![]()

Testimonials

“InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP®, CAP®, RFC®, Past President International Forum, InsMark Platinum Power Producer®, Encino, CA

“I really thought I knew all the sales techniques that affect my business, but I do now, thanks to InsMark.”

Sam Keck, MBA, CLU, CFP, LUTCF, InsMark Platinum Power Producer®, Financial Planner, Denver, CO

“InsMark is the Picasso of the financial services world — their marketing savvy never fails to amaze me.”

Doug Peete, Past President, Top of the Table, and InsMark Power Producer, Overland Park, KS

“The reason I use InsMark products is because they are so good at explaining financial concepts to all three parties: 1) the producer trying to explain the idea; 2) the computer technician trying to illustrate it; 3) the customer trying to understand it.”

Rich Linsday, CLU, AEP, ChFC, InsMark Platinum Power Producer®, Top of the Table, International Forum, Pasadena, CA

“InsMark has increased my production by 10 fold. It clearly communicates to the client the best financial scenario to take.”

Gary Sipos, M.B.A., A.I.F.® InsMark Platinum Power Producer®, Sipos Insurance Services, Freehold, NJ

“White Coat Investor” is a registered trademark of The White Coat Investor, LLC.

“InsMark” and “Checkmate” are registered trademarks of InsMark, Inc.

Copyright © 2019 InsMark, Inc.

All Rights Reserved

Important Note #1: The hypothetical values associated with this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Life insurance illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

Important Note #3: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner when policy loans are present and net cash values are so low that the income tax on the gain on surrender (calculated using gross cash values less basis) is more – often significantly more – than the net cash surrender value.

This lurking tax bomb can be present in all forms of whole life and universal life where policy loans of any type are utilized. It can be avoided, and you, the producer, are key to making sure your clients are aware of how to sidestep it.

A tax bomb can be avoided if the policy is neither surrendered nor allowed to lapse, since the policy death benefit wipes away the income tax liability. The foundation of this special treatment is IRC Section 101. This statute provides that the proceeds of life insurance maturing as a death claim are exempt from federal income tax. This applies to the full death benefit, including any cash value component whether loans exist or not.

Can your clients remember these facts years into the future? If they are incapacitated, will family members understand the issues? It is probably best to file a short note with the policy – something like this (although your compliance officer will likely have preferred language):

If/when you take policy loans on this policy, be sure to talk to your financial adviser before surrendering or lapsing the policy in order to anticipate unexpected tax consequences that may otherwise be avoided.

Some life insurance companies have concierge units that monitor loan status at the point of lapse or surrender, and you would be well-advised to select an insurance company with this capacity. To be effective regarding the tax bomb, such carriers need to be proactive in their client relationships, not merely reactive to client inquiries. I hope that ultimately the policyholder service division of all life insurance companies will bring this potential liability to the attention of those surrendering or lapsing policies, particularly those policies with 50% or more of the gross cash value subject to outstanding loans.

![]()

More Recent Blogs:

Blog #194: CheckMatereg; Logic (Part 2 of 4) Measuring the Value of Permanent Life Insurance

Blog #193 CheckMate® Logic(Part 1 of 4) When a Client Postpones Purchasing a Policy

Blog #192: 401(k) Look-Alike Meets the Calculation Dynamics of Wealthy and Wise® (Part 2 of 2)

Blog #191: 401(k) Look-Alike (Part 1 of 2)

Blog #190: Crystal Clear — and Simple

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive

PS: At one of the MDRT meetings I heard you say… “If something you knew to be true, turned out to be false, when would you want to know it? That could just be the best

the best power phrase (question) ever and it is part of many interviews I have had over those years since hearing you!

Richard Murphy

Since a 1993 radio ad I created soliciting and offering a cash reward for a documented BT&ID (“buy term and invest the difference.”) success story for an article I wanted to write and, searching over the past 26 years for subsequent academic research that supports this concept, to date I have received 0 (zero!) responses.

There is simply no recognized, creditable academic research anywhere to be found. The theory sounds great but in reality, as Bob Ritter points out in Blog #195 (over many years), that it is just noise from people who have never done any real study/research on this theory. It does, however, sell a lot of books and tapes in the fairy tale genre.

Best regards,

Richard Murphy, CLU, LUTCF, AEP

Thanks for your illuminating comment, Richard. I’m not at all surprised by the results of your research.

American humorist Josh Billings once said that “It ain’t ignorance causes so much trouble; it’s folks knowing so much that ain’t so.”

Warm regards,

Bob Ritter, President, InsMark