(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark® Illustration System)

Gabriel is not chowing-down on Juniper; they are best buddies.

An Analogy

A dog you want costs $2,100. Your boss wants to help you buy it, so she gives you a $2,100 bonus.

Is it a free dog? No, because you have to pay the tax on the bonus. If you’re in a 30% tax bracket, the dog costs you $630 in taxes.

Let’s see if your boss will help you out. You ask her to increase the bonus to $3,000, so you’ll have the $2,100 to buy the dog.

Would this get you a free dog? Yes — but it doesn’t matter, because she won’t do it. All she’ll come up with is the $2,100.

You have to find a way to pay the $630 tax on the $2,100 bonus — and pay for the dog.

What if we could find a bank to take the dog as collateral for a $630 loan?

And the bank adds the interest to the loan?

And the loan includes free dog life insurance, so when the dog dies, the loan is paid off.

Now that would be a free dog, wouldn’t it? Absolutely!

Let’s see if we can make this logic work with a private retirement plan.

Private Retirement Plan

You met Tony Jamison in Blog #136: Taking Care of a Rainmaker. Tony is Executive Vice President and General Manager of Town and Country Auto Group, Inc., a multi-brand, multi-city, new car dealership based in Austin, TX, operating as an S Corporation. Tony, age 45, continues to be a significant rainmaker for Town and Country; however, the company is a family business, and Tony does not expect to be a shareholder. The company is vitally interested in providing him with irresistible executive benefits that will ensure his employment for several more years.

You met Tony Jamison in Blog #136: Taking Care of a Rainmaker. Tony is Executive Vice President and General Manager of Town and Country Auto Group, Inc., a multi-brand, multi-city, new car dealership based in Austin, TX, operating as an S Corporation. Tony, age 45, continues to be a significant rainmaker for Town and Country; however, the company is a family business, and Tony does not expect to be a shareholder. The company is vitally interested in providing him with irresistible executive benefits that will ensure his employment for several more years.

In Blog #136, Town and Country rewarded Tony with Executive Trifecta®, a benefit that provides him with $260,000 of after-tax retirement cash flow from age 65 to 100. Blog #203 provides an identical benefit for Tony, funded more simply.

The new version rewards him with a $100,000 annual bonus for a private retirement plan, which costs Town and Country $60,000 a year after taxes. The benefit to Tony is another $260,000 of after-tax retirement cash flow from age 65 to 100.

Is this new plan a free retirement plan for Tony? No, because he has to pay the tax on the bonus. In a 32% tax bracket, the private retirement plan costs him $32,000 a year.

Let’s see if the company will increase the bonus to $147,059, so Tony will have $100,000 left after paying $47,059 in income taxes.

Would this produce a free retirement plan for Tony? Yes, but it doesn’t matter, because the company won’t increase the bonus above $100,000.

Tony has to find a way to pay the $32,000 tax on the $100,000 annual bonus.

Let’s find a life insurance company willing to take the retirement plan as collateral for the $32,000 income tax payments, and it also agrees to add the interest to the loan?

Life insurance comes with the loan, so if Tony dies, the loan gets paid off, and his family receives from $2.3 million to $4.0 million of tax-free life insurance proceeds. And to top it off, Tony will receive $260,000 more in after-tax, retirement cash flow each year from age 65 to 100.

This benefit turns out to be a fabulous, tax-free retirement plan, only possible because of 21st-century cash value life insurance — in this case, indexed universal life.

You won’t get an insurance company to help you get a free dog, but you can find several life insurance companies willing to help Tony with his private retirement plan.

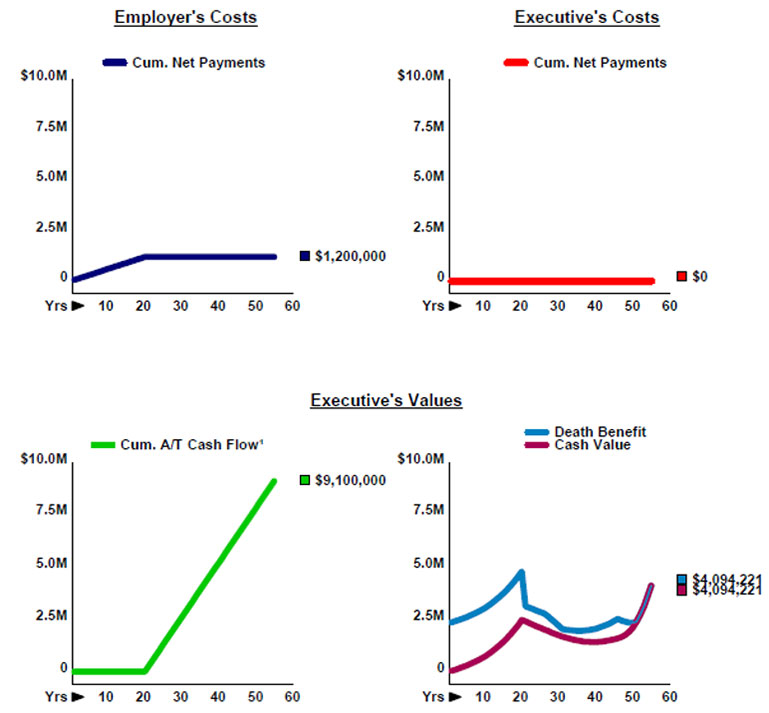

Below is a graphic of the results:

| Image 1 |

| Tony Jamison’s Private Retirement Plan |

1For retirement.

Source: InsMark Illustration System (Executive Security Plan module)

Click here to review the year-by-year reports for this private retirement plan illustrated using the Executive Security Plan module in the InsMark Illustration System.

Illustration Note: The life insurance company used for the policy data does not allow access to policy values during the first year. To produce $0.00 out-of-pocket cost for the executive in the first year, I reduced the first year premium from $100,000 to $68,000. This change, coupled with a gross-up bonus in the first year only, produces a bonus of $100,000 — equal to the single bonus of $100,000 in subsequent years.

Tax Authority

Bonuses funding a private retirement plan are taxable to the executive under IRC Sec. 61 and deductible to the employer under IRC Sec. 162, provided the executive’s overall compensation is reasonable.

Be sure to avoid any bonus arrangement that the IRS could construe as part of a deferred compensation plan under IRC Sec. 409A. A deferred compensation plan can occur when the employer makes a binding promise to pay a bonus in the future. The compensation in an executive bonus plan is a series of discretionary annual bonuses, each payable in the current year. Careful documentation avoids making the plan a deferred compensation plan under 409A. Your client’s legal and tax advisers must make sure they are completely satisfied in this regard. See the section below entitled Specimen Documents for access to documents with these provisions that you can provide to legal and tax advisers.

Principals of pass-through organizations like S corporations, LLCs, LLPs, and Partnerships are generally not addressed by financial advisers for bonus benefits. That is a blunder, as you will see by clicking here to view a plan for Tony Jamison as though he is a shareholder of an S corporation. Instead of bonuses, illustrate the allocation of profits. It is as useful a strategy as a bonus plan. Use either the Executive Bonus Plan or Executive Security Plan in the InsMark Illustration System to illustrate this variation.

Controlled Bonus

Some companies prefer to include a penalty if the insured executive voluntarily terminates employment during the early years of a Private Retirement Plan. There is a provision called a Controlled Bonus in our Executive Bonus and Executive Security Plan modules that deals with this.

Click here to see how a Controlled Bonus might be applied in Tony’s case. The percentage of bonus repayment illustrated in Column (3) on Page 1 can be any percentage or length desired by the employer and acceptable to the executive.

Conclusion

A Private Retirement Plan for non-owner executives is an uncomplicated benefit plan to illustrate, present, install, and administer. It is typically well-received by participants.

Once again, we see that the intelligent convergence of safe planning for life and death has been fully realized with the development of 21st-century life insurance.

Incidentally, Free Dog is just an analogy.

Gabriel is not available for gift or sale.

Neither is Juniper.

They are both dear members of Bob and Laurel Ritter’s household.

Your Comments

What are your thoughts and conclusions after reviewing this material? Please add your comments to this Blog. Your email address will not be published.

What’s Next?

Licensing InsMark Systems

To reproduce similar “Free Dog” illustrations, license the InsMark Illustration System or visit us online, or contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). There is a special 50% discount on both the initial and ongoing maintenance fees available through August 31. (The maintenance fee provides free upgrades and enhancements which occur often.)

Institutional inquiries — contact David Grant, Senior Vice President – Sales, at dag@insmark.com or (925) 543-0513.

Specimen Documents

InsMark’s Cloud-Based Documents On A Disk™ (“DOD”) has specimen implementation documents for Executive Bonus Plans in the Key Employee Benefit Plans section along with hundreds of other benefit, estate, and charitable planning techniques available for licensees to study or provide to attorneys and CPAs.

InsMark’s Cloud-Based Documents On A Disk™ (“DOD”) has specimen implementation documents for Executive Bonus Plans in the Key Employee Benefit Plans section along with hundreds of other benefit, estate, and charitable planning techniques available for licensees to study or provide to attorneys and CPAs.

If you are currently licensed for DOD, click here for access. (Once you login, click on the DOD icon.)

If you are not licensed for DOD, but would like to learn more about it, click here or contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275).

Creating Similar Presentations

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files. Also be sure to download the “Guide to Digital Workbook File for Blog #203.pdf” also available below.

If you would like highly qualified, illustration design assistance with no commission split required, contact LifePro Financial, InsMark’s Referral Resource, discussed below.

Digital Workbook files

For those licensed for the InsMark Illustration System, click the link below:

|

Before downloading and reviewing any files, be certain you have installed the most current updates to your InsMark System(s). Do this using Live Update available under Help on the main menu bar of the System or this icon on the main menu bar:

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark Systems. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

If you download the Digital Workbook File for Blog #203, click here for a Guide to its content. It will be invaluable to you as you design similar illustrations.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Testimonials

“The reason I use InsMark products is because they are so good at explaining financial concepts to all three parties: 1) the producer trying to explain the idea; 2) the computer technician trying to illustrate it; 3) the customer trying to understand it.”

Rich Linsday, CLU, AEP, ChFC, InsMark Power Producer®, Top of the Table, International Forum, Pasadena, CA

“InsMark is the Picasso of the financial services world — their marketing savvy never fails to amaze me.”

Doug Peete, Past President, Top of the Table, and InsMark Power Producer, Overland Park, KS

“Bob Ritter is a master of illustrating complex issues in a simple easy-to-use manner that definitely helps you better serve your clients.”

Gary Curry, President and CEO, ORBA Insurance Services, Inc., InsMark Platinum Power Producer®, Rancho Cordova, CA

“I really thought I knew all the sales techniques that affect my business, but I do now, thanks to InsMark.”

Sam Keck, MBA, CLU, CFP, LUTCF, InsMark Platinum Power Producer®, Financial Planner, Denver, CO

“InsMark” and “Executive Trifecta” are registered trademarks of InsMark, Inc.

“Documents On A Disk” is a trademark of InsMark, Inc.

Copyright © 2020 InsMark, Inc.

All Rights Reserved

Important Note #1: The hypothetical values associated with this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Life insurance illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

Important Note #3: There is a potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. This unfortunate development occurs when policy loans are present, and net cash values are so low that the income tax on the gain on surrender can be significantly more than the net cash surrender value.

This lurking tax bomb can be present in all forms of cash value life insurance containing policy loans of any type. Be sure your clients are aware of how to sidestep it.

The tax bomb can be avoided if the policy is neither surrendered nor allowed to lapse since the policy death benefit wipes away the income tax liability. The foundation of this particular tax treatment involves IRC Section 101. This statute provides that the proceeds of life insurance maturing as a death claim are exempt from federal income tax. This exemption applies to the full death benefit, including any cash value component, whether or not loans exist.

Note: It is best to design the policy with no premiums scheduled after retirement if loans may occur in retirement years. This design may require higher premiums during pre-retirement years, but a policy with no premiums scheduled is much more tolerable at advanced ages than one with continuous premiums.

Can your clients remember these facts years into the future? If they are incapacitated, will family members understand the issues? It is probably best to file a short note with the policy – something like this (although your compliance officer will likely have preferred language):

If/when you take policy loans on this policy, be sure to talk to your financial adviser before surrendering or lapsing the policy in order to anticipate unexpected tax consequences that may otherwise be avoided.

Does this note make it harder or easier to deliver the policy? It’s harder if you haven’t discussed it with your client, and that’s the point – you should discuss it.

Some life insurance companies have concierge units that monitor loan status at the point of lapse or surrender. You would be well-advised to select an insurance company with this capacity as carriers need to be proactive in their client relationships, not merely reactive to client inquiries. I hope that the policyholder service division of all life insurance companies will ultimately bring this potential liability to those surrendering or lapsing policies, particularly those with 50% or more of the gross cash value subject to outstanding loans.

![]()

More Recent Blogs:

Blog #201: Awesome LLC Buy-Sell Strategy for Owners of C and S Corporations (Part 1)

Blog #200: InsMark’s Prudent Care™ Analysis (Part 2)

Blog #199: InsMark’s Prudent Care™ Analysis (Part 1)

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive