(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using Wealthy and Wise® (Advanced)

We should all follow this advice from Epictetus, the Greek philosopher:

“All external events are determined by fate, and are thus beyond our control, but we can accept whatever happens calmly and dispassionately. Individuals, however, are responsible for their own actions which they can examine and control through rigorous self-discipline.”

This presentation discusses planning techniques to employ now to reduce or eliminate the effect of the increases in income, capital, and death taxes expected from Joe Biden should he be elected with control of the House, Senate, and Presidency.

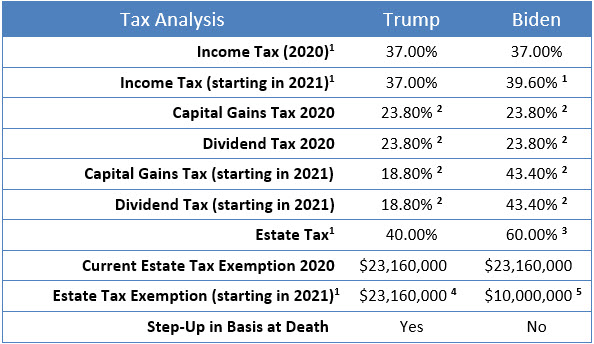

There is nothing moderate about Biden’s proposals to tax high-income investors. In 2021, the top individual tax rate for income above $400,000 would increase to 39.6% from 37%. Also, long-term capital gains and qualified dividends would rise to the ordinary income tax rate of 39.6% on incomes above $1 million. The investment income surtax of 3.8% would bring this total to 43.4%. The $23,160,000 estate tax exemption per couple would likely reduce to $10,000,000. Finally, capital gains taxes would be imposed at death or basis would not pass to heirs.

Click here to read the 2020 tax estimates of several qualified commentators.

Blog #205 compares Trump’s tax policy (including his desired decrease in capital gains taxes to 15% in 2021) to Biden’s announced tax increases for 2021. Better than just comparing numbers, Blog #205 features a Case Study to view them in the context of an overall wealth plan comparison of Trump vs. Biden.

Table 1

Case Study

Anthony and Anita Favaro, age 55 and 50, have retired after selling their commercial real estate company for $40 million. They want their annual, after-tax, personal cash flow to be at least $600,000 with a 3.00% cost of living (COLA). If we project that indexed cash flow for 40 years (slightly longer than their joint life expectancy), the after-tax cash flow totals $45,240,754 due to the initial $600,000 increasing to $1,900,216 in year 40.

This cash flow goal is the primary information needed to begin a Wealthy and Wise® analysis, and the System will always alert you if a shortfall occurs in any year. The majority of advisers ignore this issue as it relates to available liquid assets. A valid Wealthy and Wise® analysis makes sure the goal is met.

This indexed cash flow is a critical requirement typically overlooked in most financial analyses. Too often, a retirement evaluation begins and ends with asset allocation recommendations coupled with a Monte Carlo Analysis without regard to the anticipated, inflation-adjusted spending desires of the clients.

Wealthy and Wise® includes a solution based on our “Maximize Net Worth” algorithm (see the Illustration Details tab). With it, the program develops a life-long, asset-by-asset analysis that results in providing the desired cash flow coupled with maximizing long-range net worth. Click here for an 8-minute Case Study video on this important feature.

Below is a summary of the Favaro’s current net worth.

Table 2

Click here for comments regarding yields, sequence of returns, and Monte Carlo simulations.

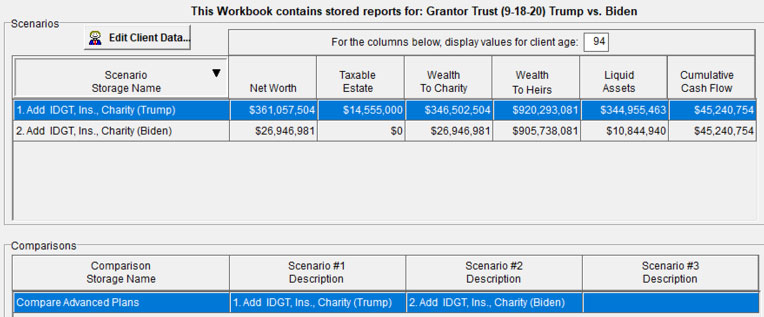

Below is what we developed for InsMark’s Advanced Version of Wealthy and Wise®.

Scenario 1 (Trump) and Scenario 2 (Biden)

- The first step is where the Favaros start their wealth planning by donating the maximum tax-free gift of $23,160,0006 of their equity assets to an intentionally defective grantor trust (IDGT)7 in 2020. There are no other changes in 2020. From 2021 on, new tax numbers apply to both Scenarios (see Table 1 above). The Favaros are responsible for the IDGT’s ongoing income tax consequences, which enhances the growth of the IDGT considerably with no corresponding gifts or gift taxes.

- They also finance a sale8 of their $10,000,000 S Corporation (at a 35% discount) to the IDGT in 2020, subject to a $6,500,000 loan. The Favaros are also responsible for the IDGT’s ongoing income tax consequences of the S Corporation, which enhances the growth of the IDGT considerably with no corresponding gifts or gift taxes.

- They also acquire $25,000,000 of non-correlated cash value life insurance in 2020 owned by the IDGT, with fifteen scheduled premiums of $1,500,000 paid from IDGT assets.

- The taxable portion of the Favaro estate is directed to the Favaro Charitable Trust as a bequest at death, thereby completing a zero estate tax plan.

| 6 | The 2020 estate tax exemption for married couples. |

| 7 | Published by the law firm of Knox McLaughlin Gornall & Sennett, P.C. (This is a comprehensive, easily understandable explanation of Grantor Trusts.) |

| 8 | The financing is at a 35% discount (typical for such transactions). The loan of $6,500,000 is at 1.00%, the long-term Applicable Federal Rate for September 2020. |

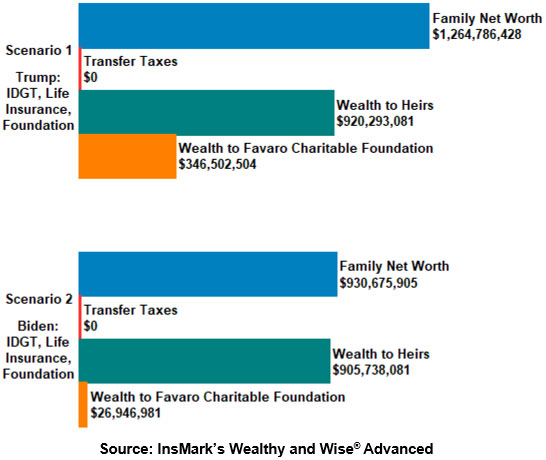

The Favaro Charitable Foundation

When the death of the Favaros occurs, the Charitable Foundation will be a beneficiary of a bequest of a projected $346 million under the Trump plan at age 95/90 and $27 million under the Biden plan. The Foundation’s Board of Directors will consist of certain children and grandchildren of the Favaros, several of whom will probably be operating officers of this “controlled” Foundation.

This charitable technique has allowed super-wealthy individuals (like Warren Buffet, Bill Gates, and Mark Zuckerberg) to promise to donate at least 50% of their assets to charity (the Giving Pledge). The Favaros have planned for a bequest at death of 100% of their residual net worth (a significant improvement over the Giving Pledge’s 50% commitment).

Comparison of Results (Trump vs. Biden)

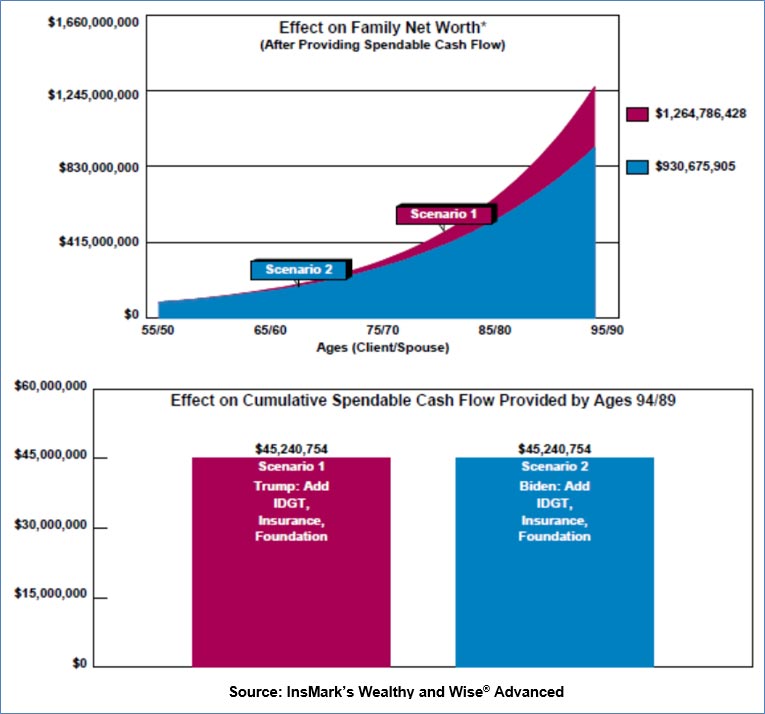

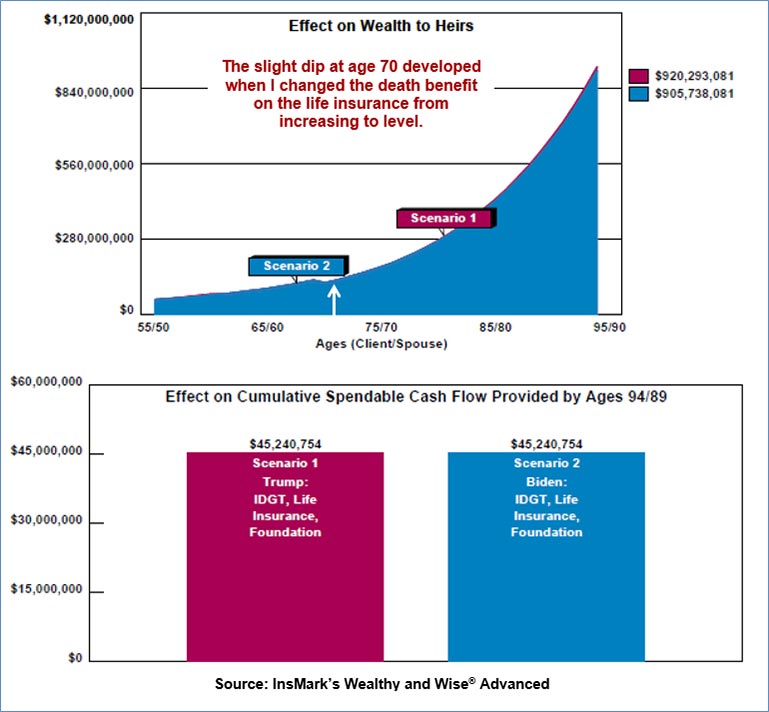

The graphic below compares the impact on net worth (including the desire for $600,000 of indexed retirement cash flow).

| Image 1 |

| Effect on Net Worth |

| Scenario 1 (Trump) vs. Scenario 2 (Biden) |

-vs.-Scenario-2-(Biden)-769x702.jpg)

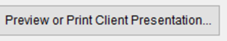

The net worth numbers also include the Favaros paying all the Grantor Trust taxes via asset allocation. If Biden is elected, $334,110,523 of the Favaro’s long-range net worth (92.5%) goes down the drain.

One of my primary goals in this evaluation is to provide the Favaros with an identical amount of spendable cash flow with either Scenario. As you can see with the cash flow comparison, Scenarios 1 and 2 each provide the desired $45,240,750.

Family Net Worth

I want to share with you InsMark’s distinction between Net Worth and Family Net Worth:

Net Worth is typically the wealth of the parents only.

Family Net Worth involves the combined net worth of more than one generation (i.e., a family group) and is not historically associated with wealth management and estate planning. It is an important concept when assessing the short-, mid-, and long-term potential of wealth accumulation and asset transfer. It has a particular application when a significant portion of the parents’ wealth has been transferred to children — or in trust for the children — during the parents’ lives.

Is Family Net Worth a legitimate distinction? The reduction in net worth of the parents caused by such transfers presents itself more clearly in the context of overall, multi-generational Family Net Worth. It is distinctly applicable for assets in an IDGT when parents have access to that wealth under certain circumstances using distributions such as spousal access and secured loans8. The addition of a family-managed Charitable Foundation also adds an element of indirect control9.

| 8 | The Favaro’s can borrow money from the IDGT utilizing accrued loan interest, which eliminates any out-of-pocket cost for loan interest payments. The entire accumulated loan and interest would then be a valuable deduction against estate assets at death. |

| 9 | “Control of wealth is the virtual equal of ownership of wealth.” |

| John Rutledge, Connecticut Merchant Banker |

Family Net Worth more clearly reflects the real picture of inter-generational net worth; otherwise, the Grantor Trust assets virtually disappear until the analysis of results at death. Family Net Worth is an incredibly valid assessment of family assets, particularly when the parents can access that wealth.

Below is a graphic of the planning effect of Family Net Worth.

| Image 2 |

| Effect on Family Net Worth |

| Trump vs. Biden |

If Biden is elected, $334,110,523 of Favaro Family Net Worth disappears due to his promised tax increases.

Wealth to Heirs

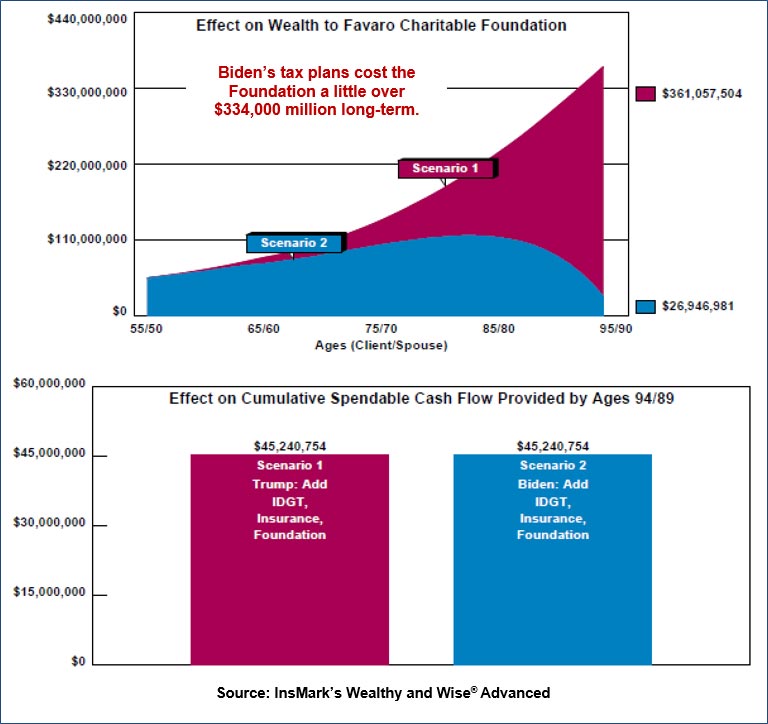

Another primary goal is to even out the wealth to heirs, so they are not significantly affected by tax considerations. You can see this stabilizing below.

| Image 3 |

| Effect on Wealth to Heirs |

| Trump vs. Biden |

To accomplish identical wealth to heirs, as shown above in Image 3, the Favaro Charitable Foundation gets severely short-changed, as shown below in Image 4.

| Image 4 |

| Effect on Wealth to Favaro Charitable Foundation |

| Trump vs. Biden |

Below is a final summary analysis of the alternatives.

| Image 5 |

| Review at Ages 95/90 |

| Trump vs. Biden |

Conclusion

As you have seen in this presentation, the impact of the Biden tax increases is overwhelming. It not only affects very wealthy clients like Anthony and Anita Favaro; it will have devastating consequences for any client with an upper seven-figure or higher estate.

No financial analysis is good or bad without a comparative evaluation, which is why I compared the results of the Trump vs. Biden planning strategies. “Compared to what” is an essential component of any financial recommendation, and it is among the best communication tools available. With it, clients can easily understand your advice.

A Wealthy and Wise® evaluation is not a one-and-done analysis. You must ensure that up-to-date data entries occur at least annually. If not, you will lose your client to competitors. Also, be sure to check all Scenarios with the Maximize Net Worth calculator, located on the Prioritize Use of Assets sub-tab on the Illustration Details tab to be sure you are using the most efficient use of assets.

Wealthy and Wise® (Advanced) Reports

Click here to view the 64-page Wealthy and Wise® (Advanced) evaluation of Trump vs. Biden, consisting of 10 comparison pages, 26 Trump pages, 26 Biden pages, and 2 Disclosure pages.

I don’t know how you can present the comparison professionally without revealing all its components. I recommend that you have all the reports for a given analysis with you when visiting with a client or client’s attorney or CPA. The System backs up every number shown, and you never know which report you’ll need to have handy to answer this inevitable question, “Where did this number come from?”

You may run across a prospective client with a “just give me the facts” mindset. If so, emphasize the comparison graphics. However, you will surely end up in front of this client’s attorney or CPA, so be prepared to present all the reports.

Most Wealthy and Wise users select a few critical comparison graphics for the main section and include supplemental reports in separate illustrations or an Appendix. More elaborate report organization can be accomplished (Table of Contents and Section pages) through use of the following prompt which I used for this Blog — located on the bottom right of the Workbook Main Window:

Once the presidential election results are certified, the Trump vs. Biden comparison will lose one of its components. Immediately following the designation of the winner, I will present you with a Blog featuring full details of the winner’s tax promises in a “Compare No Changes” with full adoption of the “IDGT, Life Insurance, and Charitable Foundation.”

No matter who wins, the results will remain compelling. Unpleasant as new taxes can be, there are legal ways to reduce their effectiveness.

Charging Fees for Your Plan Design and Management

If your compliance resource approves charging fees, I believe both design and monitoring fees are justified. I have seen design fees as high as $25,000 with monitoring fees of $10,000 annually (indexed) — some attorneys who use Wealthy and Wise® charge considerably more.

For a discussion of fees for plan design and management, see the following Blogs:

Blog #97: The Value of “You” to Your Clients (Part 1 of 2).

This Blog features a superb guest article on the logic of fees, written by Mark Pace, President and Founder of Objectiview, Inc.

Blog #98: The Value of “You” to Your Clients (Part 2 of 2)

Blog #98 introduces integrating specific fees within the data entry of a Wealthy and Wise evaluation. It will add considerably to your “renewal” income over time. The example shown creates long-range, cumulative fee revenue that could be as high as $1 million. The presence of the built-in fees will limit any competitors from gaining access to your clients and certainly add to your practice’s value.

When introducing the subject of fees to a client, consider something like this:

My fees ensure that we can monitor and adjust your wealth plan as needed.

Every year, we analyze all the moving parts and recalculate them.

Can you imagine a client like the Favaros turning down such fees after the results we achieved for them?

Current and Planned Features of Wealthy and Wise® (Advanced)

Click here for a copy of the current and planned features below for Wealthy and Wise® (Advanced).

|

|

Planned enhancements for Wealthy and Wise® (Advanced) are:

- Grantor Trust-Owned Split-Dollar Funded by Company Loans

- Grantor Trust-Owned Private Split-Dollar Funded by Personal Loans

- Grantor access to assets in the IDGTs using secured loans

- Self-Completing Installment Notes (SCINs)

- Grantor Retained Annuity Trusts (GRATs)

- Charitable Lead Trust (CLTs)

- Charitable Remainder Trusts (CRTs)

Note: Planned enhancements assume Congress does not eliminate any strategies.

Licensing Fees for Wealthy and Wise® (Advanced)

Any current licensee of Wealthy and Wise® (including Power Producers) can upgrade to the Advanced version for an initial fee of $600 with an increase in monthly maintenance of $40.

Any current licensee of Wealthy and Wise® (including Power Producers) can upgrade to the Advanced version for an initial fee of $600 with an increase in monthly maintenance of $40.

For those not currently licensed for Wealthy and Wise®, the fees for Wealthy and Wise® (Advanced) are $2,250 with monthly maintenance of $99.95 a month.

Click here for online purchase of licenses for Wealthy and Wise® (Advanced).

Click here for a list of fees for IMOs, BDOs, Agencies, Life Insurance Companies, Attorneys and CPAs.

Note: Maintenance fees provide specific enhancements and free technical support.

For more information or licensing questions about Wealthy and Wise Wealthy and Wise® (Advanced), contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275).

Institutional inquiries — contact David Grant, Senior Vice President – Sales, at dag@insmark.com or (925) 543-0513.

Your Comments

What are your thoughts, conclusions, or questions after reviewing this material? Please add your comments to this Blog. Your email address will not be published.

Creating Similar Presentations

Assuming you are licensed for Wealthy and Wise® (Advanced), if you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

If you would like highly qualified design assistance with no commission split required, contact LifePro Financial, InsMark’s Referral Resource discussed below.

Workbook file for Blog #205 Wealthy and Wise (Advanced)

For those licensed for Wealthy and Wise® (Advanced), click the link below:

|

Before downloading and reviewing any files, be certain you have installed the most current updates to your InsMark System(s). Do this using Live Update available under Help on the main menu bar of the System or this icon on the main menu bar:

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark Systems. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

If you are licensed for Wealthy and Wise (Advanced) and download the Digital Workbook File for Blog #205, click here for a Guide to its content. It will be invaluable to you as you design similar illustrations.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Testimonials

“I am writing to give you a ringing endorsement for the Wealthy and Wise System. As you know, I am a LEAP practitioner, and the Wealthy and Wise software has helped me supplement my LEAP skills and increase my commissions. I have been paid for many cases using Wealthy and Wise as support, the smallest of which was $27,000, the largest was $363,000. With those type of commissions, you would have to be nuts not to buy it.”

Vincent M. D’Addona, CLU, ChFC, MSFS, AEP, InsMark Power Producer®, New York, NY

“InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP®, CAP®, RFC®, Past President International Forum, InsMark Platinum Power Producer®, Encino, CA

“Wealthy and Wise allows us to reflect practically ANY planning scenario we have encountered with clients. The ability to flow data easily into the program (without being so granular as to be unwieldy) is, in my opinion, one of the core strengths of Wealthy and Wise. Modeling alternate planning scenarios and being able to present the results in both graphical and numerical formats is certainly welcome, and I can’t imagine doing cash flow and estate growth projections without Wealthy and Wise.”

Mark A. Trewitt, CLU, ChFC, CAP, CFP, AEP, InsMark Platinum Power Producer®, Plano, TX

“Major cases we are developing have all moved along successfully because of the sublime simplicity and communication capability of Wealthy and Wise. I guarantee that the proper use of this tool will dramatically raise the professional and personal self-image of any associate who dares to take the time to understand it . . .”

Phillip Barnhill, CLU, InsMark Gold Power Producer®, Minneapolis, MN

“InsMark helps us help our clients understand their money and their choices. I always learn something new that changes what we do and how we can do it more efficiently. That translates to a better bottom line for us and for our clients. It’s making more money for everyone – just by pushing InsMark buttons on the computer.”

Kay Corbin, CLU, ChFC, InsMark Platinum Power Producer®, Phoenix, AZ

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer®, Grafton, WI

“The net worth and cash flow modeling that Wealthy and Wise provides is one of the best financial planning tools in the market place. In and of itself, it delivers tremendous value to the client. Moreover, when advisers update it annually, they deliver that tremendous value year after year. However, until advisers have sold themselves on the value proposition of charging fees, they will avoid them — either to their financial detriment or in reduced service to clients. That is why advisers must be encouraged to believe the value they will create is worth far more than the fees they can charge.”

Mark Pace, CLU, RHU, ChFC, Creator of the Life Insurance Performance Management System, InsMark Gold Power Producer®, President, ObjectiView, Inc., Ridgeland, MS

“InsMark’s referral resource, Brian Manderscheid from LifePro, has been a gem to work with! He helps us use InsMark with every one of our cases. The genius factor is InsMark’s commitment to “Compared to What.”

Glenn Main, InsMark Platinum Power Producer®, McMurray, PA

“The reason I use InsMark products is because they are so good at explaining financial concepts to all three parties: 1) the producer trying to explain the idea; 2) the computer technician trying to illustrate it; 3) the customer trying to understand it.”

Rich Linsday, CLU, AEP, ChFC, InsMark Power Producer®, Top of the Table, International Forum, Pasadena, CA

“InsMark”, the InsMark Logo and “Wealthy and Wise” are registered trademarks of InsMark, Inc.

“Documents On A Disk” is a trademark of InsMark, Inc.

Copyright © 2020 InsMark, Inc.

All Rights Reserved

Important Note #1: The hypothetical values associated with this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Life insurance illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

Important Note #3: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. This is mainly a problem when policy loans are present and net cash values are so low that the income tax on the gain on surrender (calculated using gross cash values less basis) is significantly more than the net cash surrender value.

This lurking tax bomb can be present in all forms of whole life and universal life where policy loans of any type have been utilized. It is avoidable, and you, the producer, are crucial to making sure your clients know how to sidestep it.

A tax bomb is avoidable if the policy is neither surrendered nor allowed to lapse, since the policy death benefit wipes away the income tax liability. The basis of this particular treatment is IRC Section 101. This statute provides that the proceeds of life insurance maturing as a death claim are exempt from federal income tax. This treatment applies to the full death benefit, including any cash value component, whether loans exist or not.

Note: It is best to design the policy with no premiums scheduled after retirement if you anticipate loans in retirement years. This suggestion may require higher premiums during pre-retirement years, but a policy with no premiums scheduled is much more tolerable at advanced ages than one with continuous premiums.

Can your clients remember these facts years into the future? If they are incapacitated, will family members understand the issues? It is probably best to file a short note with the policy – something like this (although your compliance officer will likely have preferred language):

If/when you take policy loans, be sure to talk to your financial adviser before surrendering or lapsing the policy to anticipate unexpected tax consequences that may otherwise be avoided.

Does this note make it harder or easier to deliver the policy? It’s more challenging if you haven’t discussed it with your client, easier if you have. And that’s the point – you should discuss it.

Some life insurance companies have concierge units that monitor loan status at the point of lapse or surrender. You would be well-advised to select an insurance company with this capacity. To be effective regarding the tax bomb, such carriers need to be proactive in their client relationships, not merely reactive to client inquiries. I hope that ultimately the policyholder service division of all life insurance companies will bring this potential liability to the attention of those surrendering or lapsing policies, particularly those policies with 50% or more of the gross cash value subject to outstanding loans.

Bob, You might remember meeting me at the Insmark Symposium in Vegas. I’m 26 years old and have been spending a lot of time learning Insmark. On Blog 205, I copied the workbook file and spent about 5 hours creating a hypothetical case using premium financing for a couple that was 20 years older than the Favaro’s. Modeling the consequences on their estate plan contingent on who won the election. I first imported the case into premium financing, exported to wealth and wise, and then added in their assets and desired cash flow. The 15 page report definitely caught their attention. I also have a nice relationship working with Julie Nayeri, who has taught me quite a bit so far. I’m wondering if we can accomplish something similar using intergenerational split-dollar.

All the best,

Robert Duncan

Yes, you can illustration intergeneration split-dollar using our Loan-Based Private Split-Dollar (Trust-owned) module (part of the Loan-Based Split-Dollar System). Once you complete it, consider using the Use the Export command: located on the right-side panel in Edit mode to send that data to Case Storage. Then, in Wealthy and Wise, you can import that data using one of the selections available on the Outside the Estate sub-tab located on the Other Assets tab. If this does not make sense, Julie Nayeri can help you with the details.

Bob Ritter

President

InsMark, Inc.

Bob, This is a fantastic blog! I especially appreciate how you outlined the IDGT strategy, the Sale of the Business to the IDGT, and the Zero-Estate Tax Bequest. My question is that I have a family that is similar to the Favaro’s, yet there is one key difference. Senior is uninsurable, and divorced. His ex-spouse passed 3 years ago. So far, they have just completed the IDGT transaction to “freeze the growth of his estate”. We are looking at doing an Intergenerational Split Dollar using Loan Regime. There have been some examples of Tax Court precedence, Morrissette (successful) and Cahill cases (unsuccessful). We are planning to have a G1 control which will buy financed policies on G2 for the benefit of G3. Senior is age 61 and has 4 children, 31, 29, 26 and 22 Can an intergenerational split dollar transaction using loan regime be modeled using Wealthy and Wise? There are two things I’m trying to illustrate vs. doing nothing: 1. The valuation discount of the note receivable from G2 to G1 2. The cash values available to pay the estate taxes at Senior’s life expectancy (Age 85) Thanks for your time

Yes. Do the intergeneration split-dollar using our Loan-Based Private Split-Dollar (Trust-owned) module (part of the Loan-Based Split-Dollar System). Use the Export command located on the right-side panel in Edit mode to send that data to Case Storage. Then, in Wealthy and Wise, you can import that data using one of the selections available on the Outside the Estate sub-tab located on the Other Assets tab. If this does not make sense, Julie Nayeri can help you with the details.

Bob Ritter

President

InsMark, Inc.

Bob, this is amazing work. You never cease to amaze me and I hope you remain healthy and alive for many years into the future. Thank you very much!

Best,

Wayne Weaver

TFP Funding Partners,LLC

Thank you so much, Wayne. It’s always great to hear from you.

Bob Ritter

InsMark President