Brace yourself; this is a good one!

Last week in Blog #37, we reviewed the case of Elizabeth Rand, MD, age 40, who was analyzing the purchase of $3.6 million of indexed universal life (IUL). ?We compared the IUL to $3.6 million of 30-year level term insurance coupled with a side fund. ?We also illustrated $120,000 in policy loans on the IUL beginning at Dr. Rand’s age 60. ?As you may recall, the IUL turned out to be the smart way to go -- by a wide margin. ?Click here if you would like to review her comparison of IUL to term insurance using the InsMark Illustration System.

Wealthy and Wise®, InsMark’s wealth planning system, can also perform effective term comparisons, and it goes a step beyond by evaluating and comparing the overall impact on Dr. Rand’s cash flow, net worth, and wealth to heirs.

To gauge the impact of Wealthy and Wise, let’s first review Dr. Rand’s current financial picture:

| $ ?350,000 | Taxable Assets @ 5.00% |

| 350,000 | Tax Exempt Assets @ 4.00% |

| 1,500,000 | Equity Assets @ 7.50% growth; 1.00% dividend |

| 300,000 | Defined Contribution Plan Assets @ 7.50% |

| 500,000 | Residence @ 5.00% growth |

| (400,000) | Mortgage @ 4.40% |

| 100,000 | Art Collection @ 7.50% |

| 400,000 | Personal Property @ -5.00% |

| $ 3,100,000 | Total Net Worth |

Click here for comments about yields and Monte Carlo simulations.

The IUL policy has five scheduled premiums of $100,000 each, and Dr. Rand does not plan to pay those premiums from her income. ?Rather, she will pay them by way of withdrawal from her assets as part of the Maximize Net Worth solve available in Wealthy and Wise. ?This will deplete her current assets by $500,000 over the next five years and replace them with the values of the IUL policy.

At her retirement age 60, Dr. Rand wants $200,000 a year in today’s dollars for after tax retirement cash flow indexed at 3.00% as an inflation offset. ?In this case, $200,000 in today’s dollars will need to be $361,222 in tomorrow’s dollars by her age 60, and this amount will also need to rise by 3.00% in retirement years to meet her expectations. ?These amounts will also be withdrawn from assets and are included in the Maximize Net Worth solve noted above.

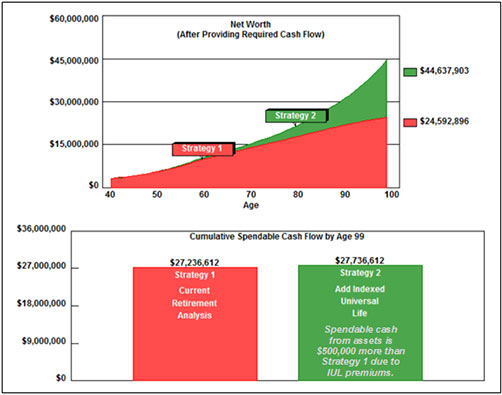

Will her current asset base support this? It will, and below is the comparison where Strategy 1 is her current plan without the new life insurance, and Strategy 2 includes the IUL as described above. Due to the addition of the IUL (and its participating loans), the long-range gain in net worth of Strategy 2 vs. Strategy 1 is over $20 million, an astonishing increase. ?21st century investment-grade life insurance is truly amazing, and it is the key component in helping Dr. Rand avoid a $20 million dollar mistake by acquiring the term insurance.

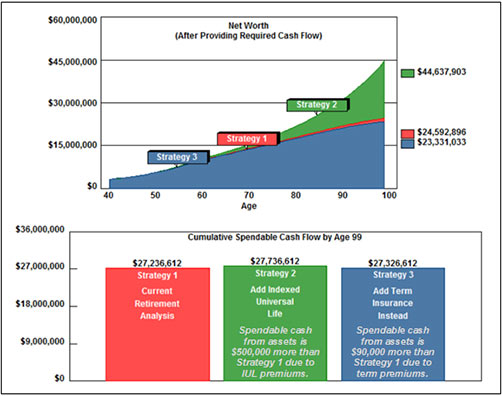

$3.6 million of 30-year, level term insurance costs $3,600. ?Let’s substitute that for the IUL policy and see what happens. ?As you can see below, Strategy 3 with term insurance is not suitable from the standpoint of long-range net worth and wealth to heirs.

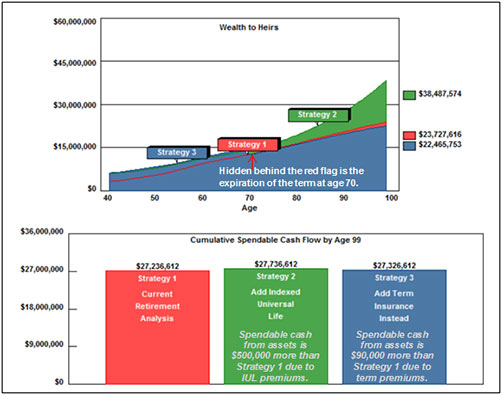

The difference in wealth to heirs is over $16 million in favor of the IUL vs. term insurance.

Critical point: ?The gain in net worth and wealth to heirs is accomplished with no additional out-of-pocket costs to Dr. Rand as premiums are funded by withdrawal from her assets; however, it is only the IUL that produces serious increases in wealth due to its participating loans, cash value, and death benefit.

The Suze Ormans of the world tell Dr. Rand to buy the term insurance. ?They are wrong!

For licensing information regarding Wealthy and Wise, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). ?Institutional inquiries should be directed to David Grant, Senior Vice President - Sales, at dag@insmark.com?or 925-543-0513.

If you are licensed -- or become licensed -- for Wealthy and Wise and would like to review the data input and completed menu prompts we used for Dr. Rand’s analysis, please email us at bob@www.robert-b-ritter-jr.com, and we will get the Case Data file (Workbook) right out to you. ?Be sure to ask for the Workbook for Blog #38: Avoiding a $20 Million Mistake.

Note: ?Wealthy and Wise produces a significant number of reports since we never want you to have a client, attorney, or CPA ask, “Where did this number come from?”?There is backup for every number, and in this Blog for example, there are four full evaluations: 1) Comparison of Alternatives; 2) Current Retirement Analysis; 3) Add Indexed Universal Life; and 4) Add Term Insurance Instead. ?Each one in the series produces different mathematics thus the large number of reports. You will likely want to pick and choose various combinations of reports to share with your clients, but you will always want to have access to all of those pertinent to your overall analysis.

Click here if you would like to review the 100+ page report for Dr. Rand generated by the System.

Testimonials:

"As I’ve said to anyone who will listen, Wealthy and Wise is the best piece of software in the industry."

Simon Singer, International Forum Member, InsMark Power Producer®, Encino, CA

“Major cases we are developing have all moved along successfully because of the sublime simplicity and communication capability of Wealthy and Wise.?I guarantee that the proper use of this tool will dramatically raise the professional and personal self-image of any associate who dares to take the time to understand it.”

Phillip Barnhill, CLU, InsMark Power Producer®,

Minneapolis, MN