|

Editor’s Note: Blog #42 is the second in a series of Blogs involving several issues that emanate from the decision to sell a closely-held business, most of which provide opportunities for you to develop some serious business. If your practice involves retirement and/or estate planning for owners of such firms (or you would like it to), it is impossible to do it effectively without knowing the value of the business. InsMark has formed a joint venture with a cloud-based business valuation firm named BizEquity to form the InsMark Business Valuator. Most business valuations cost upward of $8,000 - $10,000. The InsMark Business Valuator (powered by BizEquity) will do it for $350 ($150 if you purchase a package of 20 valuations.) It is critical that you understand how the InsMark Business Valuator works, and if this market interests you, we recommend you review two resources before proceeding further -- if you haven?t reviewed them already: Review Blog #41: If We Sell Our Business, Can We Afford to Retire? |

This current Blog features a solution regarding life insurance coverage on the owner of the business where the InsMark Business Valuator has detected a $1,000,000 loss to the firm should the owner die.

In Blog #41: If We Sell Our Business, Can We Afford to Retire? we determined that?George and Marie Grove, age 65 and 60, could maintain their current level of net worth (approximately $10 million) while ensuring after tax retirement cash flow of $440,000 a year indexed at 3.00% as an inflation hedge. To prove this, we used a combination of the InsMark Business Valuator to value the business and Wealthy and Wise® for the proof of the cash flow and net worth.

Key Executive Coverage

(Business-Owned or Personally-Owned?)

George and Marie believe the business will be hurt financially should George die prior to selling it in five years. The InsMark Business Valuator identifies this loss to the business at $1,000,000. Click here to view the entire report to see the comprehensiveness of the evaluation. Note the yellow highlighted sections on Pages 5 and 6 -- the value of the business is reduced from the $5,000,000 we originally used in Blog #41 to the $3,971,542 noted on Page 6, a $1,000,000+ reduction caused if George dies this year. If he lives, the valuation remains at $5,000,000 as authenticated by the InsMark Business Valuator and described in Blog #41.

The easy solution is to indemnify the business against the loss of George by having the business purchase $1,000,000 of life insurance on him. The evaluation should also take into account that George needs to replace his income for Marie?s benefit. One way to meet the cash needs of the business and the income needs of Marie is to have the firm own a life insurance policy on George large enough where $1,000,000 of the death benefit offsets the reduced value of the firm due to George?s death, and the balance is used to fund a salary continuation benefit for Marie.

Is there a way to coordinate those two goals with, let’s say, $2,000,000 of coverage? What kind? ?Term insurance for five years? ?Is there a place for a permanent policy?

The best way involves the personal purchase of permanent life insurance, and it works regardless of the structure of the business: C Corporation, S Corporation, Limited Liability Company (“LLC”), or Partnership. (George’s firm is an LLC.)

Alternate Key Executive Insurance Technique

Following are the steps for implementing this arrangement:

- George purchases the life insurance policy personally with Marie as beneficiary. ?The face amount of the policy is $2,000,000, $1,000,000 of which reflects the loss to the firm should he die prior to the sale of the business.

- If George dies prior to the sale of the business, Marie collects the life insurance proceeds, and although the LLC has lost $1,000,000 in valuation through the death of George (as documented by the InsMark Business Valuator), Marie has the $1,000,000 of the life insurance in a tax free life insurance death benefit to offset the loss.

Should the LLC need the $1,000,000 to continue business operations, Marie can loan it to the LLC at a fair market rate of interest giving her the cash flow of the loan interest. The loan would be repaid when the LLC is sold.

- George and Marie have personal access to the policy’s loan values for tax free cash flow during retirement years.

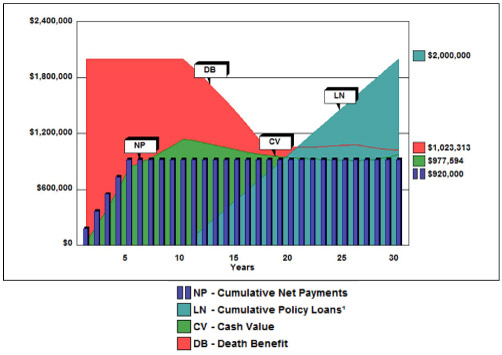

Below is a graphic of the $2,000,000 policy. It is a max-funded Indexed Universal Life policy with five premiums of $184,000. ?Click here to review the Illustration of Values of the policy from the InsMark Illustration System.

“Wow”, you may say, “this could be an impossible sale!”?And it may well be impossible if you expect George and Marie to cough up the $184,000 out of their personal income.

Where else are the funds coming from to purchase the policy? ?We integrated the policy’s costs and benefits into the Wealthy and Wise analysis developed in Blog #41: If We Sell Our Business, Can We Afford to Retire? to determine if the premium cost can be absorbed by George and Marie’s assets with the after tax loans scheduled from the policy to apply on their retirement cash flow needs. ?The goal is not to invade their net worth too much to do this.

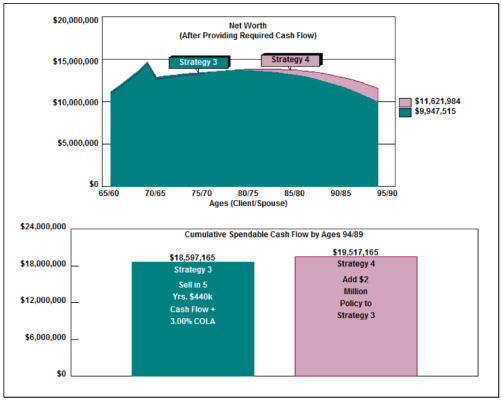

Good news! The procedure not only doesn’t degrade net worth; it improves it long-range by almost $1.7 million as you can see in the graphic below.

Note: ?Participating loans of $100,000 a year from the Indexed UL for retirement cash flow begin in year 11 and are reflected in the graphic.

Strategy 3 (from Blog #41): Sell the business in 5 years; retire on $440,000 after tax cash flow plus a 3.00% cost of living adjustment.

Strategy 4: Same as Strategy 3 plus acquire $2,000,000 of personally-owned indexed UL paid for from assets.

So who says life insurance is expensive? In this case, it costs almost $1.7 million if George and Marie don’t buy it.?On top of that, it provides substantial death benefits as well.

There is no other planning software that can accomplish the analysis in Blogs #41 and #42 other than the combination of the InsMark Business Valuator (powered by BizEquity) and Wealthy and Wise.

Click here if you would like to review the Wealthy and Wise reports comparing Strategy 3 with Strategy 4. ?If you are licensed -- or become licensed -- for Wealthy and Wise and would like to review the data input we used for this variation for George and Marie, please email us at bob@www.robert-b-ritter-jr.com, and we will get the Case Data file (Workbook) right out to you. ?Be sure to ask for the Workbook associated with Blog #42.

Please understand that Strategy 3 in this Workbook is replicated from Blog #41 with Strategy #4 added. ?With Strategy 4, the $184,000 premiums for the life insurance are entered on the Desired Cash Flow tab in years 1 - 5. ?The $100,000 expected policy loan proceeds are entered on the Expected Cash Flow tab in years 11 - 30, and the cash value and death benefit of the policy are entered in all years on the “Other Assets” tab. ?This scheduling directs Wealthy and Wise to find the money for the policy premium from George and Marie’s assets, and the powerful cash value and participating loan features of Indexed Universal Life more than offset the assets used to pay for the policy.

Next week in Blog #43, we will examine a dynamic new way that the business can induce Tom Hamilton, who is a key, non-shareholder, Executive Vice President and General Manager, to remain with the firm during these next critical years while the plans to sell the business are firming up.

For information about the InsMark Business Valuator (powered by BizEquity) or licensing information regarding Wealthy and Wise and the InsMark Illustration System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). ?Institutional inquiries should be directed to David Grant, Senior Vice?President - Sales, at dag@insmark.com or 925-543-0513.

Documentation for the Alternate Key Executive Insurance Technique is available in InsMark’s Documents On A Disk™ (Version 21.0 and higher) in the Key Employee Insurance Plans section of specimen documents. A variation with superb tax results is also provided in that same section in which an irrevocable trust is owner and beneficiary of the life insurance.

Documentation for the Alternate Key Executive Insurance Technique is available in InsMark’s Documents On A Disk™ (Version 21.0 and higher) in the Key Employee Insurance Plans section of specimen documents. A variation with superb tax results is also provided in that same section in which an irrevocable trust is owner and beneficiary of the life insurance.

Testimonials:

"InsMark is the Picasso of the financial services world ? their marketing savvy never fails to amaze me."

Doug Peete (Past President, Top of the Table) Overland Park, KS

"Wealthy and Wise has been instrumental in closing three difficult planning cases in the last two years. Total commissions exceeded $100,000. Without being able to demonstrate adequate retirement cash flow, these cases would not have closed."

Scott Mounger, CLU, ChFC, Mesa, AZ