|

Editor’s Note: We’re pleased to introduce you to Version 17.0 of the InsMark Illustration System, what we are calling the “Jazz” release. You can see examples of Jazz reports in Tom and Kristin’s illustrations available in this Blog. We will be releasing Jazz updates to other Systems throughout the year. Jazz is dedicated to Bob Ritter’s outstanding years as a cornet player with his top-notch Dixieland jazz band, the Spring Street Stompers. Click here if you would like to learn more about the Jazz software release. (You can also hear a couple of songs from the Spring Street Stompers in that link.) |

In last week’s Blog #46, we introduced you to Tom and Kristin Scott, age 40 and 35, and their two daughters, Daisy and Jody, age 10 and 8. We analyzed how much life insurance the Scotts should acquire to take care of both girls’ needs through their college years should something happen to their parents.

In last week’s Blog #46, we introduced you to Tom and Kristin Scott, age 40 and 35, and their two daughters, Daisy and Jody, age 10 and 8. We analyzed how much life insurance the Scotts should acquire to take care of both girls’ needs through their college years should something happen to their parents.

We ended up recommending $500,000 of 15-year term insurance coverage on each parent. ?Tom’s annual premium: $600; Kristin’s annual premium: $400.

This week, we are expanding the analysis further to include a retirement evaluation for Tom and Kristin through their age 100/95 using InsMark’s Wealthy and Wise® planning software. We’ll include the cost of the term insurance noted above in this assessment, and we’ll also include funding for the actual cash flow needed for the girls’ college plus other items described below. ?Then we’ll examine cash value life insurance alternatives instead of term insurance.

The plan assumes an income tax bracket of 35% and retirement ages of 65/60.

The goal is to withdraw all the following cash flow requirements from assets -- with none of it paid from their earned income.

Pre-Retirement After Tax Cash Flow Desired

Premiums of $600 in years 1 - 15 for Tom’s term insurance policy. Premiums of $400 in years 1 - 15 for Kristin’s term insurance policy.

$30,000 a year (with a 5.00% inflation adjustment) for four years of college and two years of graduate school starting in year 8 for their daughter Daisy, age 10.

$30,000 a year (with a 5.00% inflation adjustment) for four years of college and two years of graduate school starting in year 10 for their daughter Jody, age 8.

Gifts of $50,000 to Daisy and Jody as each reaches age 25 for personal use, e.g., down payment on a home, investment in a business, travel, etc.

Note: ?This cash flow was established in Blog #46. ?The face amount of the term insurance was established using the Survivor Needs Analysis module in the InsMark Illustration System.

Retirement After Tax Cash Flow Desired

Retirement cash flow of $150,000 starting at Tom and Kristin’s age 65/60 plus a 3.00% annual increase as an inflation offset.

Below are their assets/benefits:

Retirement Plan Assets:

Tom’s 401(k): $80,000 @ 7.50%

Kristen’s 401(k): $90,000 @ 7.50%

(Each of them plans to continue contributing at least $17,500 a year.)

Liquid Assets:

Taxable assets: $50,000 @ 3.00%

Tax exempt assets: $50,000 @ 2.00%

Equity assets: $185,000 @ 6.00% growth; 1.50% dividend

(They plan to add $20,000 a year to equities.)

Click here for comments regarding yields and Monte Carlo simulations.

Illiquid Assets:

Residence: $350,000 with a $190,000 mortgage @ 4.00%

(Their assumption is they will downsize at retirement.)

Personal property: $100,000 depreciating by 5.00%

Expected Post-Retirement Cash Flow:

Social Security: Starting at age 67.

Before proceeding, this is the time to ask Scott and Kristin a very important question: “Are there any items that should be increased, reduced, or eliminated?” Be certain to ask this question and adjust accordingly; otherwise, your analysis will be based on shaky assumptions. ?Let’s assume their answer is “No”.

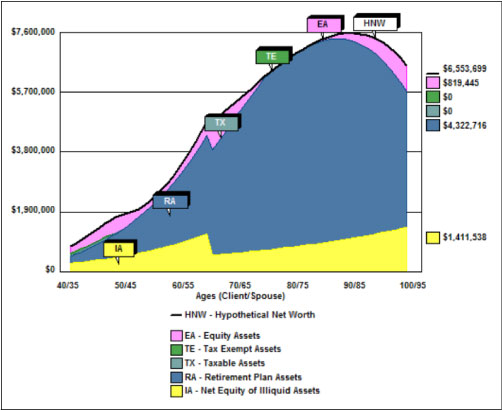

Below is a timeline of the interplay of the Scotts’ desired cash flow and the assets/benefits available to produce it.

Although net worth begins to tail off in the last decade illustrated, the Scotts are able to meet all their desired cash flow goals without committing more to savings/investments than currently scheduled.

Let’s next look at the 15-year term insurance ($500,000 each) that is included in the analysis. ?Would $500,000 of Indexed Universal Life (IUL) policies be better suited to their goals? Let’s see . . .

Click here for Tom’s IUL illustration. ?Click here for Kristin’s. ?(Both are from Version 17.0, the Jazz enhancement to the InsMark Illustration System.)

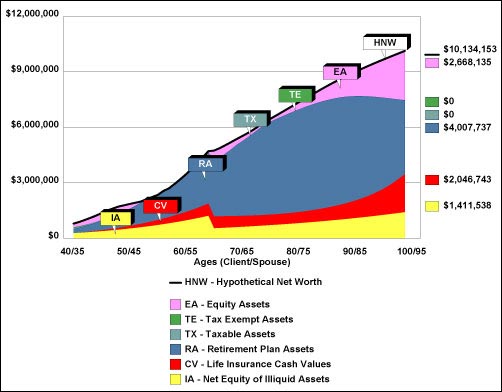

Below is the revised net worth graphic with the only change being the IUL premiums, participating loans, cash values, and death benefits instead of the term premiums and death benefits. ?This is a cash flow neutral analysis which means that the premiums for the IUL policies are being drawn from assets which are being replaced (and then some) by way of the policies’ values.

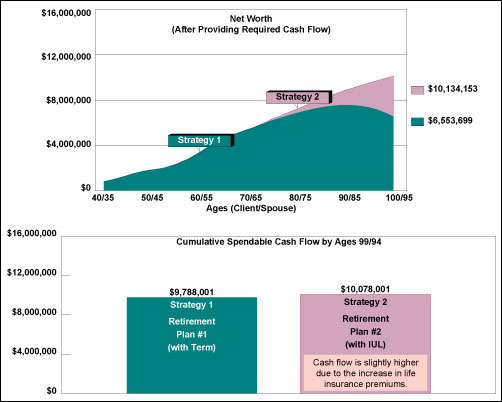

Below are the two net worth values superimposed on one another with the cumulative cash flow produced by the software included below the landscape graph:

It’s rewarding that after starting with a net worth of $715,000 at age 35/40, all of Tom and Kristin’s current financial goals are projected to be met with long-range net worth growing to $10.1 million. They experience a $3.58 million increase in net worth if they use IUL instead of term insurance, an increase of 54.6%. Daisy and Jody will be equally affected by way of their ultimate inheritance with Strategy 2.

The system generates a significant number of reports. ?Click here to review the key Wealthy and Wise illustrations spread over 20 pages, many of them graphics.

Click here to review the detailed backup reports (78 Pages).

I recommend you collate pages in a similar way so as not to overwhelm your clients with 98 pages of reports. ?(You may never need to get to Appendices). ?Why so many pages? ?It’s because we backup every number we produce, so you’re never left in the dark when a CPA or attorney asks you, “Where did this number come from?”

Good News; Bad News

There are two methods of showing clients how cash value life insurance can be a source of after tax retirement cash flow. ?First, many producers simply present the policy illustration where it bears no integrated relationship with the overall retirement plan. ?However, if you use a more inclusive method . . . where you show the policy’s accumulation and distribution features as part of a comprehensive overall plan . . . the impact is far more powerful.

The bad news for some is that you have to gather all of a client’s financial data for this type of analysis. ?Many of my readers are used to doing this. ?For those of you who are not so comfortable with it, how do feel about asking a prospective client to reveal details of financial data? ?Clearly, you have to earn a prospective client’s trust to do that. ?My suggestion for the best way to gain that confidence is to share examples of how this concept works for others -- this Blog, for example, or the Wealthy and Wise reports noted above.

Some questions that may occur to you:

Q. ?How difficult is it to gather financial data from prospective clients?

A. ?There are typically only two reasons why you can’t get information about financial assets/benefits from what appear to be valid prospects: 1) they don’t trust you (yet) or 2) they don’t have very much in reserve and are embarrassed about it. ?Two couples, both of whom appear affluent, may be in quite different financial shape. ?You can’t easily spot those in the latter category who are often high livers and spenders but swamped in debt. ?Pressing for financial data can often uncover those who aren’t financially sound.

And if you can’t develop a trusting relationship with valid prospective clients, you’ll never get them to reveal very much of their financial data.

A Fact Finder is available in Wealthy and Wise to guide you in your data gathering (see Tools on the main menu bar). ?The Fact Finder is best filled out with the clients present and involved in the process.

At first glance the Fact Finder may look intimidating, but on most pages, you will be entering data in only a few of the listed categories. To acquaint yourself with it, try filling one out for your own situation. ?Then, if you have Wealthy and Wise, enter your data in your System -- you may be pleasantly surprised.

Q: ?Should college funding always be included in a retirement analysis?

A: ?Yes, assuming the parents are involved in paying all or some of the costs. ?It is a drain on retirement funds and must be accounted for.

Q. ?Do you always include social security cash flow?

A. ?Only if clients believe it will be available based upon their sense of the government’s financial ability to pay it. ?In the Scott’s case, they included it, but at a very conservative level (no inflation adjustments). Wealthy and Wise includes an after tax Social Security calculator.

Q. ?How can a plan like this be reliably projected so far into the future?

A. ?It can’t be reliably projected if you perceive retirement planning as a “one and done” analysis. To be a dependable adviser to your clients, you must meet with them at least once a year and bring all the data current. ?Each year represents a fresh look at the future, and this is what turns prospects into clients, not just policyholders. Otherwise, changes in finances will make your original evaluation obsolete, and you will lose clients to other advisers. ?If you follow this procedure, soon your clients won’t make a significant financial move without asking you to run it through Wealthy and Wise. ?This approach also gives you a good basis for charging an annual fee for the analysis. If you can develop fee revenue from clients who are glued to you for service, it has a significant impact on the value of your practice. ?These days, recurring revenue is hard to develop. ?Fees are an excellent way to do so.

If you prefer a “one and done” solution, comprehensive retirement planning is not for you. ?That is not to say there isn’t plenty of opportunity for you -- just not in this field.

Q: ?What if there are not sufficient assets and benefits to produce the desired cash flow?

A: ?This will occur, and when it does, your clients have several options, and Wealthy and Wise can deal with each one:

Commit more to savings and investments;

Commit more to savings and investments; Defer including inflation on desired cash flow;

Defer including inflation on desired cash flow; Reduce the amount of desired cash flow;

Reduce the amount of desired cash flow; Reduce the number of years of desired cash flow;

Reduce the number of years of desired cash flow; Defer the starting date for desired cash flow;

Defer the starting date for desired cash flow; Manage assets more aggressively.

Manage assets more aggressively.

Reducing cash flow goals doesn’t necessarily mean there will always be a shortage. ?Each year as you develop the annual review, add back some of what’s missing, typically by committing more to savings and investments. Get that commitment this year.

Case Data Files

If you are licensed -- or become licensed -- for Wealthy and Wise and would like to review the data input for Scott and Kristin’s retirement analysis, please email us at bob@www.robert-b-ritter-jr.com, and we will get the Case Data files (Workbooks) right out to you. Be sure to ask for the two Workbooks associated with Blog #47: Tom and Kristin’s Retirement Planning.

If you are licensed -- or become licensed -- for Version 17.0 of the InsMark Illustration System and would like to review the data input for Scott and Kristin’s life insurance illustrations, please email us at bob@www.robert-b-ritter-jr.com, and we will get the Case Data file (Workbook) right out to you. Be sure to ask for the Workbook associated with Blog #47: Jazz Illustrations.

Licensing

To license Wealthy and Wise, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President - Sales, at dag@insmark.com or 925-543-0513.

Testimonials:

“As I’ve said to anyone that will listen, Wealthy and Wise is the best piece of software in the industry.”

Simon Singer, CFP, CAP, RFC, International Forum Member, InsMark Power Producer, Encino, CA

“If you don’t get the client to distinguish cash flow from net worth, you won’t make the case sale. In my experience, Wealthy and Wise is the only system that recognizes this important estate planning component.”

Stephen Rothschild, CLU, ChFC, CRC, RFC, International Forum Member, Saint Louis, MO