|

Editor’s Note: All the InsMark illustrations available in this Blog were prepared using the Jazz release (Version 17.0) of the InsMark Illustration System. We think you?ll like the new features. Click here if you would like to learn more about the new features of Jazz. |

Someone asked me recently if it’s possible to explain all you need to know about the powerful mathematics of cash value life insurance in a simple illustration. ?We have such an illustration called Life Plan located on the Personal Insurance tab of the InsMark Illustration System.

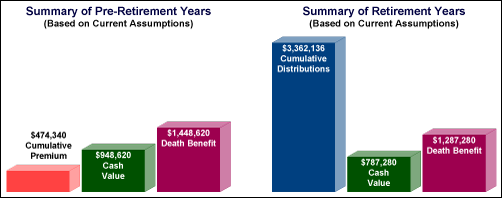

Below are the results with the Life Plan module using an Indexed Universal Life policy insuring Harvey Pierce, MD, age 45. It is a $500,000 policy (increasing death benefit) with premiums of $23,717 for 20 years. Participating policy loans are illustrated starting at age 65.

Click here to view the entire Life Plan illustration.

Note: ?Life Plan is also available in Spanish.

Life Plan produces a lot of information in just a few pages. While it produces a concise analysis, it ignores one of the most fundamental components of a good life insurance presentation -- it lacks a comparison. ?Almost everyone makes better decisions in a comparative environment, so let’s introduce some comparisons to go with it.

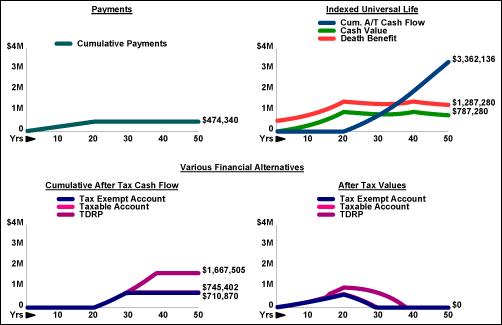

We’ll select one of our most popular modules, Various Financial Alternatives (“VFA”), and compare the Indexed Universal Life to a:

- Tax Exempt Account @ 3.00%

- Taxable Account @ 6.00%

- Tax Deductible Retirement Plan @ 7.50%

Below is a graphic of the results from age 45 to 95:

Click here to view the entire VFA illustration.

We are edging into what we call CheckMate Selling®, i.e., anticipating a prospect’s objections before they are raised. ?Various Financial Alternatives certainly helps in this regard.

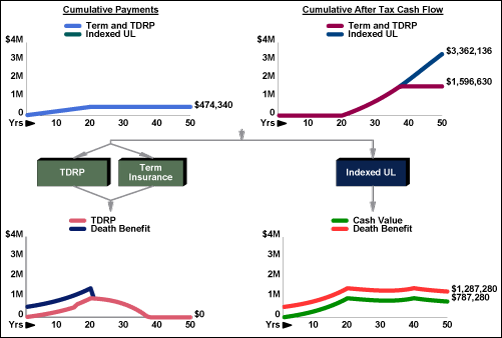

The only remaining issue is likely “what about term insurance?” ?So let’s add a comparison to term insurance and a side fund. We’ll take the best of the alternatives, Tax Deductible Retirement Plan @ 7.50%, and couple it with $500,000 of 20-year level term insurance with an annual premium of $600, the kind of solution that Suze Orman prefers. I can hear her now:

“Why would you pay almost $24,000 for something you could get for $600?”

This graphic tells you why:

Click here to view the entire term comparison illustration.

Conclusion

Indexed Universal Life is a remarkable financial instrument. ?The combination of Life Plan, Various Financial Alternatives, and a Term comparison make it irresistible for a prospect with the cash flow to acquire it.

Licensing

To license the InsMark Illustration System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). ?Institutional inquiries should be directed to David Grant, Senior Vice?President - Sales, at dag@insmark.com or 925-543-0513.

Case Data Files

If you are licensed -- or become licensed -- for Version 17.0 of the InsMark Illustration System and would like to review the data input for the illustrations in this Blog, please email us at bob@www.robert-b-ritter-jr.com, and we will get the Case Data file (Workbook) right out to you. ?Be sure to ask for the Workbook associated with Blog #49 - Revisiting CheckMate Selling.

Testimonials:

“I have been using InsMark since it was a C:> prompt back in the early 1980s. ?The new Jazz release is the most exciting upgrade to the system I’ve seen in 28 years! ?With unlimited options for customization, you can now be as creative as you want when producing illustrations. ?I downloaded it last night, and used it successfully with my first appointment this morning.”

Chris Jacob, CFP, InsMark Power Producer, SFI-Cadeau, St. Louis, MO.

"Life Plan demonstrates an illustration that simply depicts the benefits of the basic life insurance policy. ?It is an ideal program for the package sale. I still run into individuals with a basic need for life insurance and cash value accumulation vehicles who are under the level where more complex planning is needed and who are not yet in the mindset for retirement distribution planning.”

Mel Gross, CLU, ChFC, MSFS, Houston, TX

"InsMark’s Life Plan presentation provides a valuable tool for our agents in discussing retirement plans with their clients. ?Its concise and to-the-point design makes the concept very easy to understand. ?And, having it available in both Spanish and English has proven to be extremely useful."

Zerita Reynolds, CLU, ChFC, FLMI, LLIF, REBC, RHU Director, Advanced Markets, Aviva USA