|

Editor’s Note: This Blog discusses planning options for an IRA; however, Bob’s remarks apply equally to a 401(k), 403(b), Keogh, etc. |

We have always recommended that you ask this question of all clients with whom you have an active relationship: “Do you have a favorite charitable cause?” Lots of them do, and most of the time, you don't know about it. It’s a wonderful piece of information to keep in your back pocket because charitable solutions will often occur to you as you think through planning strategies, and one of the best is Charitable IRA.

An IRA has six stages; two are terrific, one is not so hot, and three are terrible:

Terrific #1: Contributions are deductible.

Terrific #2: The account grows without taxation.

Not So Hot: Distributions are taxable as ordinary income.

Terrible #1: Any balance in the account at death is taxed as ordinary income (unless the so-called ?stretch? option is selected).

Terrible #2: Even if the ?stretch? option has been selected, an inherited IRA is subject to mandatory distributions taxable as ordinary income.

Terrible #3: With large estates, values in the IRA can be subject to estate and inheritance taxes.

With Charitable IRA, your clients can avoid the three Terribles by naming a favorite charity as the ultimate beneficiary of an IRA. Note that this transfer to the charity will not occur until the death of the account owner and a surviving spouse. ?Prior to this, values in the IRA are freely available to the account owner or a surviving spouse without requiring permission from the charity. ?This is because the charitable beneficiary is not an irrevocable designation and the charity is not involved as an owner of the account until the death of the account owner and a surviving spouse.

This also means a “change your mind” option is always available merely by designating family members -- or anyone else (a different charity, for example) -- as replacement beneficiaries. One of the hallmarks of good estate planning is the ability to “change your mind”.

With this strategy, an irrevocable Wealth Replacement Family Trust is typically established to own a life insurance policy that provides the heirs with a replacement asset that, unlike an inherited IRA, is free of both income taxes and possible death taxes.

If a client has a strong charitable motivation, this variation gets lots of happy feedback; however, the concept is so powerful that, charitably motivated or not, it often makes sense whenever an IRA of at least six figures is present, and the bigger the retirement account the better it works.

This type of charitable planning requires some pre-death paperwork involving a trust, but using this strategy is significantly better than leaving the retirement plan “as is” where the IRS can confiscate up to 50% in income tax at death or on distributions made by heirs if the stretch option has been elected. ?And if the estate is large enough, the IRA may also incur death taxes.

Case Study Featuring InsMark’s Wealthy and Wise®

Harold and Martha Fontaine, age 65 and 60, have a current net worth of a little over $5,500,000 which includes an IRA with a value of $1,000,000. ?Based on their taking required minimum distributions (RMDs) beginning in five years, their IRA is expected to grow to almost $1,650,000 by their mid-80s and gradually reduce thereafter due to the accelerating RMDs.

Harold and Martha are both active in the Red Cross, and the idea of leaving a legacy to that special organization is very appealing to them. ?They like the Charitable IRA approach with $1,000,000 of increasing death benefit second-to-die life insurance in a Wealth Replacement Trust funded by annual gifts of $14,000.

Check out the Table below comparing the IRA values for heirs in Strategy 1 vs. the death benefit of the life insurance policy for heirs in Strategy 2.

| Age | Strategy 1 Inherited Value 0f the IRA (Fully Taxable) |

Strategy 2 Inherited Value of the ILIT-Owned Life Insurance (Non-Taxable) |

| 65/60 | 1,064,250 | 1,005,778 |

| 70/65 | 1,365,269 | 1,069,571 |

| 75/70 | 1,526,471 | 1,176,624 |

| 80/75 | 1,635,032 | 1,312,540 |

| 85/70 | 1,649,225 | 1,475,619 |

| 90/85 | 1,524,327 | 1,640,380 |

| 93/88* | 1,371,916 | 1,704,815 |

| 95/90 | 1,239,041 | 1,703,006 |

*Joint Life Expectancy: Age 93/88

Below is a Summary of the overall results at age 95/90. ?Both Strategies include Harold and Martha with $150,000 of after tax retirement cash flow (indexed at 3.00%). The gifts to the trust for the life insurance premiums of $14,000 in Strategy 2 are paid for via asset allocation, not from their retirement cash flow.

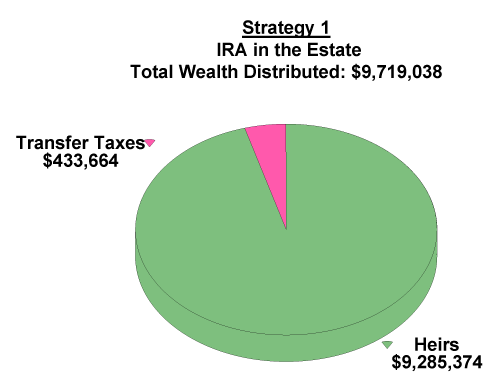

Strategy 1: ?Leave the IRA as is:

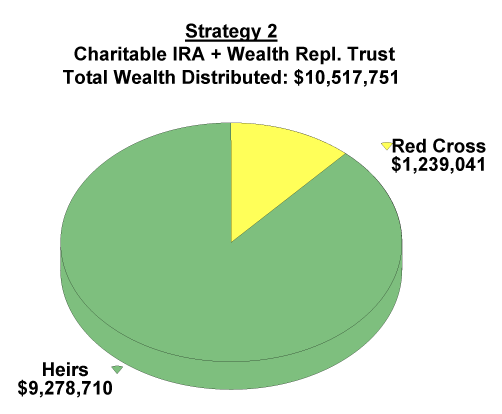

Strategy 2: ?Include the Charitable IRA option:

The transfer taxes in Strategy 1 are the amount of income tax due on the residual value of the IRA. This is, of course, avoided in Strategy 2 as the charitable beneficiary designation eliminates any tax liability on the IRA. Imagine trading $433,664 in income tax for a gift to charity of $1,239,041 while wealth to heirs remains virtually unchanged. You likely have clients who need to know about this!

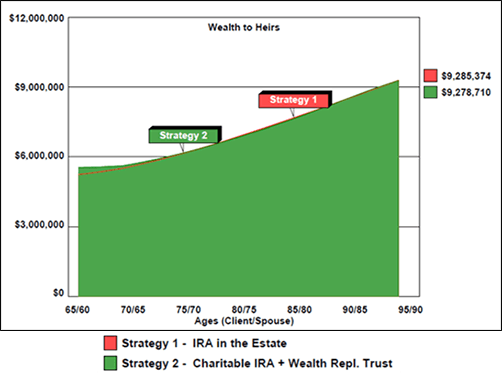

What is particularly revealing about this evaluation is that, thanks to the life insurance, wealth to heirs tracks almost identically in both Strategy 1 and Strategy 2 as shown in the graphic below:

Conclusion

The key takeaways for Strategy 2 are:

- The heirs are better off due to the favorable tax treatment of the life insurance in the trust compared to the IRA;

- The Red Cross ultimately benefits by more than $1.2 million;

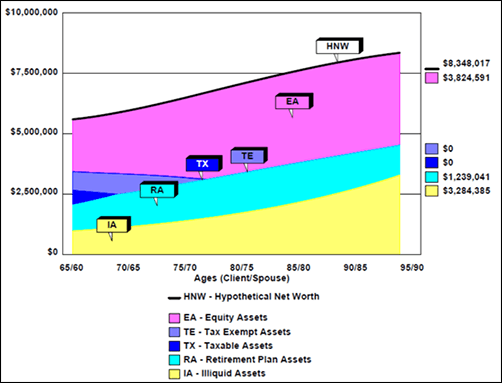

- This is all accomplished with the Fontaines having the retirement cash flow they desire while also maintaining an increasing level of net worth as shown in the graphic below.

Most people resist wealth planning decisions unless they are convinced that their retirement lifestyle won’t be affected both as to cash flow and retained net worth. ?This Wealthy and Wise analysis has accomplished this for the Fontaines.

Licensing

To license Wealthy and Wise, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). ?Institutional inquiries should be directed to David Grant, Senior Vice President ? Sales, at dag@insmark.com or 925-543-0513.

Case Data Files

If you are licensed -- or become licensed -- for Version 11.0 of Wealthy and Wise and would like to review the data input and the reports for the evaluation in this Blog, please email us at bob@www.robert-b-ritter-jr.com, and we will get the Case Data file (Workbook) right out to you. ?Be sure to ask for the Workbook associated with Blog #55 - Charitable IRA.

Testimonials:

"If you don’t get the client to distinguish cash flow from net worth, you won't make the case sale. ?In my experience, Wealthy and Wise is the only system that recognizes this important estate planning component."

Stephen Rothschild, CLU, ChFC, CRC, RFC, International Forum Member, Saint Louis, MO

"InsMark helps us help our clients understand their money and their choices. I am always learning something new that changes what we do and how we can do it more efficiently. That translates to a better bottom line for us and for our clients. It’s making more money for everyone ? just by pushing InsMark buttons on the computer. How great is that?!"

Kay Corbin, CLU, ChFC (InsMark Power Producer) Phoenix, AZ

"I am writing to give you a ringing endorsement for the Wealthy and Wise System. As you know, I am a LEAP practitioner. The Wealthy and Wise software has helped me supplement my LEAP skills in the over age 60 client base. I have been paid for many cases using Wealthy and Wise as support, the smallest of which was $27,000, the largest was $363,000. With those type of commissions, you would have to be nuts not to buy it."

Vincent M. D'Addona, CLU, ChFC, MSFS, AEP, InsMark Power Producer