Roger Bacon, a widower, is age 75. He has a current net worth of $4.6 million including $500,000 in a money market fund earning under 1.00%. Roger is a risk-averse investor and, having given up waiting for better yields for this type of account, he is considering directing the $500,000 to a Charitable Gift Annuity (“CGA”). He likes the idea of leaving a scholarship legacy to a favored charitable organization.

Let’s see what happens to his net worth, wealth to heirs, and wealth to charity if he purchases a CGA.

The Arizona State University (ASU) Foundation used to have a simple CGA calculator on its website at, unfortunately, it is no longer available.

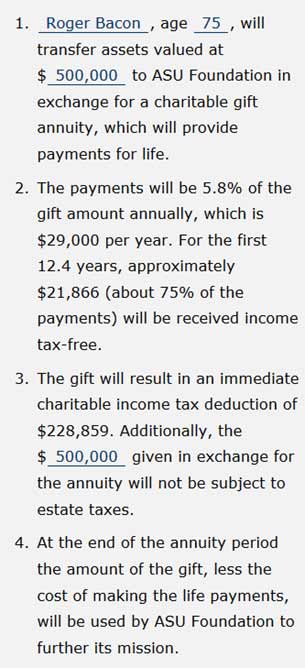

Below is a replication of the calculations by ASU Foundation for Roger’s CGA.

The assumed date of transfer for this example is May 27, 2014. The calculations used the May 2014 IRC Section 7520 discount rate of 2.4% to optimize the charitable deduction.

NOTE: ASU Foundation provides this calculation for educational purposes only. The type of assets transferred, the actual date of the gift, and other factors may have a material effect on the amount or use of the deduction. You are advised to seek the advice of your tax advisors before implementing a gift of this type.

Case Study

Roger’s current net worth consists of:

| $ 1,000,000 | IRA Assets @ 7.50% |

| 500,000 | Taxable Assets @ 0.50% |

| 1,000,000 | Tax Exempt Assets @ 3.00% |

| 1,300,000 | Equity Assets @ 6.00% growth; 1.50% dividend |

| 500,000 | Residence @ 5.00% growth |

| 300,000 | Personal Property @ -5.00% |

| $ 4,600,000 | Total Net Worth |

Click here for comments regarding yields and Monte Carlo simulations.

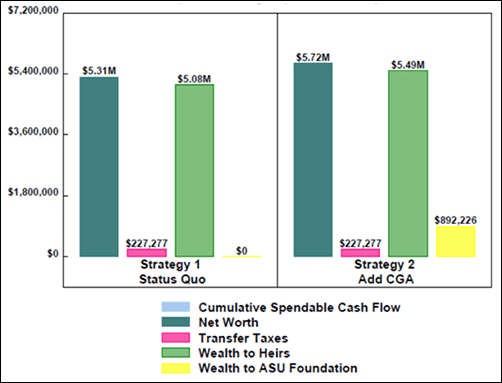

We used InsMark’s Wealthy and Wise® to compare the results of keeping the money in the money market fund (Strategy 1) or converting it to a CGA (Strategy 2). Both strategies provide for Roger’s desired level of annual after tax cash flow, $100,000 plus a 3.00% inflation offset.

To estimate the potential value of the gift to the ASU Foundation at Roger’s death, we assumed that the ASU Foundation will earn 7.50% on the funds in the CGA less the $29,000 in annual life payments to Roger (5.8% of the $500,000 gift amount, the maximum percentage payout recommended by the American Council on Gift Annuities for a single male, age 75).

Here are the results at the end of 20 years:

Long range, net worth and wealth to heirs is increased by over $400,000, and wealth to ASU Foundation is almost $900,000. The transfer taxes are the amount of income tax due on the residual value of Roger’s IRA (after required minimum distributions).

What has been accomplished by this evaluation?

- An impressive gift to ASU. You should make friends in the deferred giving division at any charitable organization when you explain the analytical process you used to help Roger with his CGA. They may have other donors they would like to introduce to you.

- You now have details of all Roger's assets. You also have Roger's confidence in your planning ability, and he will likely want to learn what other opportunities you might have for him. Some examples could be:

|

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Conclusion

There was an interesting Letter to the Editor of the Wall Street Journal on April 24, 2014, from Mike Smith of Sugar Land, Texas. Included were these remarks:

“The Fed is inexorably destroying retirement nest eggs which have taken decades of frugality to create. The risk-averse saver is being forced to choose between watching his stash evaporate due to inflation, accepting negative after-tax returns on savings or risk it chasing positive returns in equity dividends.”

With CDs and money market funds languishing with the Fed’s low interest rates, the CGA approach may well be a good addition to your portfolio of planning solutions -- particularly for those clients who have strong charitable inclinations.

Licensing

To license Wealthy and Wise, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President of Sales, at dag@insmark.com or 925-543-0513.

Case Data Files

If you are licensed -- or become licensed -- for Wealthy and Wise and would like to review the data input and the reports for the evaluation in this Blog, please email us at bob@www.robert-b-ritter-jr.com, and we will get the Case Data file (Workbook) right out to you. Be sure to ask for the Workbook associated with Blog #56 - An Easy Charitable Legacy.

Testimonials:

"Major cases we are developing have all moved along successfully because of the sublime simplicity and communication capability of Wealthy and Wise. I guarantee that the proper use of this tool will dramatically raise the professional and personal self-image of any associate who dares to take the time to understand it"

Phillip Barnhill, CLU, Minneapolis, MN

"It was invaluable to see how flexible Wealthy and Wise is as a planning tool! There are countless options, yet the illustrations provide clear choices for my clients.”

Dennis Dahl, InsMark Power Producer, Rigby, ID