Sometimes it seems there are only two kinds of prospects for long-term care insurance: Those who can’t afford it and more affluent candidates who can -- but resist spending the money thinking, "I’ll just self-insure it."

Next time you run across one of the latter, ask this question: "Would you like to know mathematically whether self-insuring is a valid option?" Most affluent people will want to hear what you have to say. For example:

Assumed Client Data

Clients: Age 65 and 60

Net Worth: $3.5 million

Desired After Tax Retirement Cash Flow: $100,000 indexed at 3.00%

Assumptions

- Assume a claim occurs in 8 years for one of the insureds that lasts for 6 years, after which death occurs.

- Assume the total benefits for the claim on a monthly basis will be $6,000 in today’s dollars -- and medical inflation averages 5% a year.

- Assume the annual premium for a Long-Term Care policy with an inflation rider covering both individuals is $12,000 -- reducing to $6,000 during the claim period.

- Assume the inflation rider increases total monthly benefits by 5% (compounded) a year.

- Assume retirement cash flow needs decline by 25% during and after the claim period.

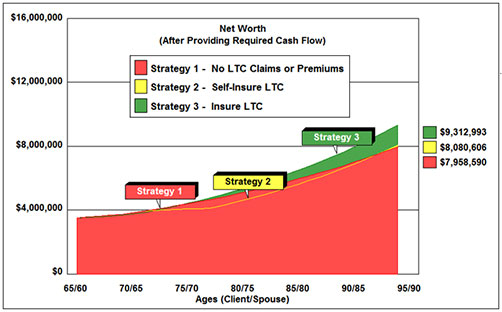

Let?s compare three scenarios:

- No coverage purchased and no claim costs assumed.

- No coverage purchased and claim costs paid via withdrawals from Net Worth.

- Coverage purchased and claim costs paid by the insurance company.

Hold on to your hats. Here are the results using InsMark’s Wealthy and Wise® software system.

Why is buying the LTC insurance the most efficient option?

Remember the assumption above where "retirement cash flow needs decline by 25% during and after the claim period". Each client?s situation will require different assumptions, but in this case, it’s simple mathematics -- the present value of the reduction in retirement cash flow more than offsets the present value of the cost of the premiums for the Long-Term Care policy.

This logic also makes self-insuring slightly more efficient than doing nothing -- but the insurance option is the winning strategy by a large margin.

Go forth and be productive . . . but if you aren’t using Wealthy and Wise, you don’t want to run into a competitor who is.

Click here to review the 20 summary reports for this Case Study.

Click here to review the 65 detailed reports for this Case Study.

If you are licensed for InsMark’s Wealthy and Wise and would like to review the menu prompts we used for this analysis, please email us at bob@www.robert-b-ritter-jr.com, and we will get both Case Data files (Workbooks) right out to you for the 20 summary reports and the 65 detailed reports, Be sure to ask for the two Workbooks for the Blog #6: "How to Prove which of Your Clients Should Purchase Long-Term Care".

Click here to learn more about InsMark’s Wealthy and Wise. You can also contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice?President ? Sales, at dag@insmark.com or (925) 543-0513.