|

Editor’s Note:?Bob’s analysis of the Economics of a Roth IRA Conversion is one of the definitive studies on the subject. ?This Blog will be well worth the time you devote to studying it. (Variations of Roth Conversions will be featured at the InsMark Symposium on March 27 - 28, 2015 in Las Vegas, NV.) |

The one serious impediment to the conversion of an IRA to a Roth IRA is the income tax cost. ?The purpose of this Blog is to demonstrate that the tax cost is typically not a cost at all; it is an investment.

Case Study

Simon and Ann Scott are ages 55 and 50. ?They are in a 40% income tax bracket. ?Their net worth is $6 million ($600,000 IRA, $1,000,000 in CDs, $1,000,000 in Munis, $2,500,000 in Equities plus $900,000 in home value and personal property).

Click here to review the Scotts’ Information Summary that includes yield and growth rate assumptions.

Click here for comments regarding yield, growth, and Monte Carlo simulations.

Simon and Ann plan to retire in 10 years. At retirement, they want $25,000 in monthly, after tax, retirement cash flow indexed at 3.00% as an inflation offset.

This analysis covers their next 45 years (ages 55/50 to ages 100/95).

This Case Study compares keeping the IRA with converting it to a Roth IRA over an eight-year period in order to reduce the likelihood of bumping the Scotts into a higher tax bracket by assuming a conversion all in year 1. ?The analysis then adds $2,000,000 of life insurance on Simon to the Roth IRA.

| Options to Consider |

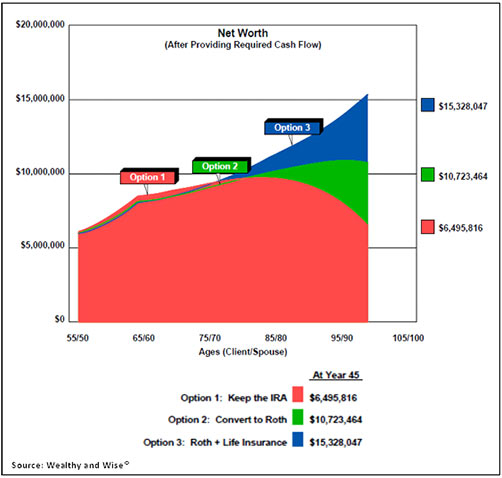

| Long-Range Total Net Worth |

| (All Assets) |

| Options | Long-Range Net Worth |

Increase Over Option 1 |

|---|---|---|

| Option 1: Keep the IRA | $ 6.5 million | n/a |

| Option 2: Convert to Roth | $10.7 million | 65.1% |

| Option 3: Roth + Life Insurance¹ | $15.3 million | 136.6% |

| ¹ Paid via asset transfer. |

Note: ?All Options include after tax retirement cash flow of $25,000/month indexed at 3.00% starting at ages 65/60.

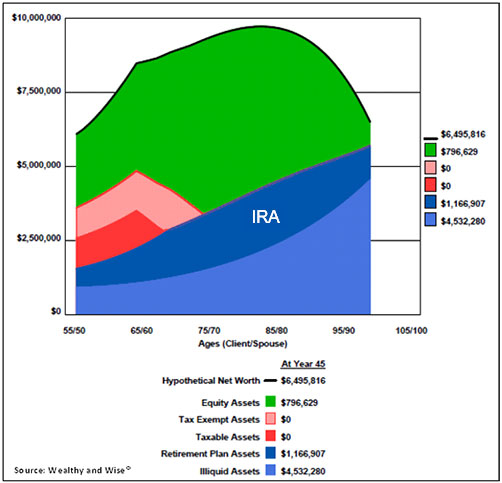

Option 1: Keep the IRA

Long-range net worth is almost $6.5 million.

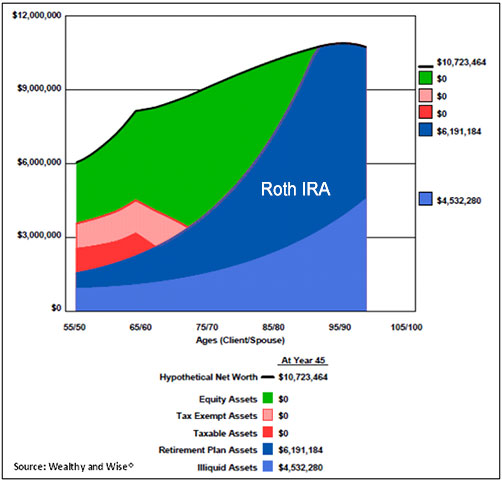

| Option 2: Convert to Roth |

| Source: Wealthy and Wise? |

The total income tax bite shown in Column (4) is not an out-of-pocket cost since the income tax will be paid by withdrawals from the Scotts’ weakest asset, their CDs. ?While it reduces the values of their CDs, you’ll see that the advantages of the Roth far outweigh that reduction.

Option 2 net worth is 165% greater than Option 1.

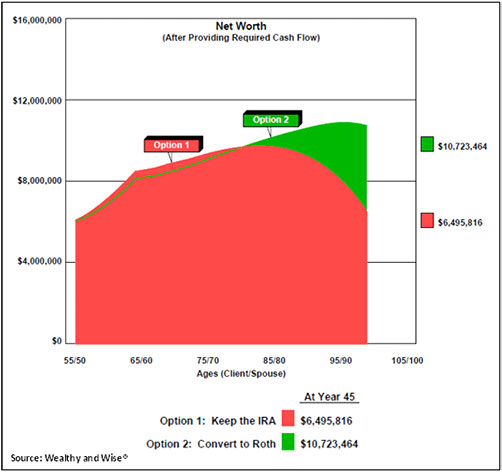

| Option 1 vs. Option 2 |

So, what do you think? ?It requires $294,605 in income tax over eight years to convert to the Roth. ?Should this income tax bite be avoided like the plague or welcomed as an investment resulting in $4,227,648 of increased net worth? ?A pessimist with tunnel vision might view the tax as something to be avoided at all costs. An optimist would surely say it is an investment the Scotts should welcome. ?The $4,227,648 gain in net worth is equivalent to a pre-tax equivalent rate of return of 10.93% on the $294,605 tax investment.

Good as this is, the results can be made even better by introducing an investment-grade life insurance policy.

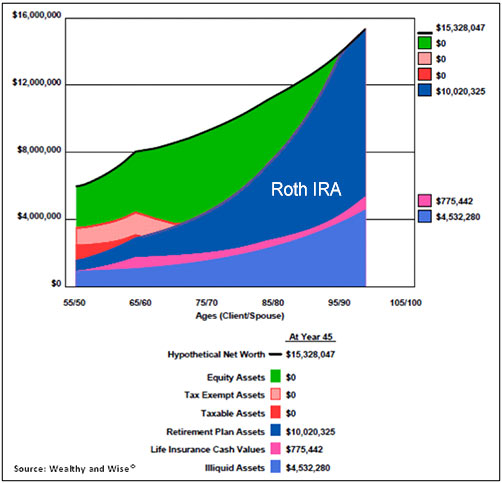

Option 3:?Roth + Life Insurance

Assume the Scotts purchase $2,000,000 of Indexed Universal Life (IUL) on Simon’s life. ?The premium is illustrated at $63,819 for 10 years. Like the tax cost of the Roth conversion, the source of the premiums for the IUL is the Scotts’ weakest asset, their CDs.

Policy loans on the IUL begin in Year 11 to help support the Scotts’ retirement cash flow needs of $25,000 monthly, thus significantly reducing the strain on their other assets.

Click here to review the IUL illustration.

Option 3 net worth is 236% greater than Option 1.

| Option 1 vs. Option 2 vs. Option 3 |

Option 3 net worth is 143% greater than Option 2 and 236% greater than Option 1.

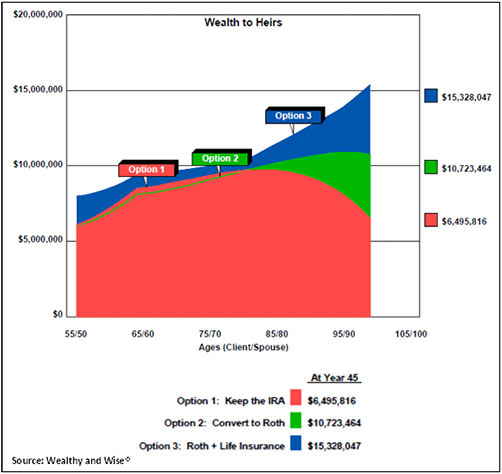

As you can see from the following graphic, Option 3 also increases wealth to heirs due to the death benefit of the life insurance.

| Option 1 vs. Option 2 vs. Option 3 |

| Details of the Wealthy and Wise Analysis |

| Click here to view all the reports from this analysis. ?This report is divided into four sections, and for the first time, you will be seeing reports from Version 12.0 of Wealthy and Wise: |

| Compare Options 1, 2, and 3 (Pages 1 - 7); |

| Option 1: Keep the IRA (Pages 8 - 40); |

| Option 2: Convert to Roth (Pages 41 - 78); |

| Option 3: Roth + Life Insurance (Pages 79 - 118). |

That is a huge number of reports, I know; however, I recommend that you have all the reports for a given case with you when you are visiting with a client or client’s attorney or CPA. ?Wealthy and Wise backs up every number shown, and you never know which report you’ll need to answer the inevitable question, “Where did this number come from?” ?That’s why I provided all of them to you in this Blog so you can familiarize yourself with them.

| Inherited IRAs vs. Inherited Roth IRAs |

| But we’re not done yet . . . brace yourself for what follows! ?It’s maybe the most significant of all as far as efficient wealth transfer is concerned. |

A conversion to a Roth IRA is clearly superior to retaining an IRA for Simon and Ann. ?How about Inherited IRAs vs. Inherited Roth IRAs for their heirs? ?We’ll continue to use Simon and Ann Scott’s example to evaluate this comparison.

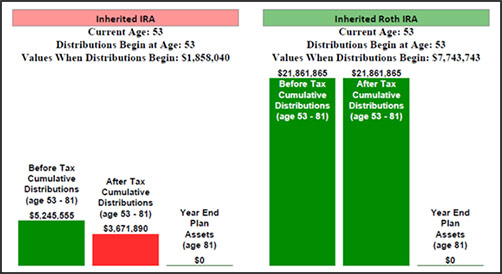

Their daughter, Marianne, is currently age 15. ?Let’s assume she inherits the retirement plan at her parents’ joint life expectancy of ages 92/87, which will be Marianne’s age 53.

Below is the comparison of Marianne’s Inherited IRA vs. her Inherited Roth IRA. ?Comparing spendable dollars for Marianne, the Inherited Roth outperforms the Inherited IRA by 603%.

| Marianne’s Alternatives Beginning at Her Age 53 |

| Source: InsMark Illustration System (InsCalc tab - Comparison of Inherited IRAs) |

The reason for the discrepancy between the two? ?During Simon and Ann’s lifetime, the required minimum distributions (RMDs) from Simon’s IRA have seriously depleted the initial value of the Inherited IRA to slightly under $1.9 million while the Inherited Roth with no RMDs has a starting balance for Marianne in excess of $7.7 million.

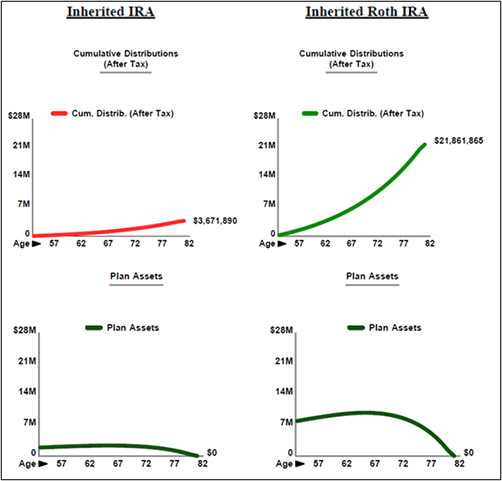

Below is a look at the trend lines.

| Source: InsMark Illustration System (InsCalc tab - Comparison of Inherited IRAs) |

Click here to view the entire comparison illustration of Inherited IRAs. (This was prepared using calculators available in the InsCalc section of the InsMark Illustration System. For details, see the Question and Answer section below.)

Conclusion

The key takeaways for this comparison of an IRA to a Roth IRA are:

- After taking into account the income tax associated with the conversion, the Roth IRA is a significantly superior asset to an IRA both in terms of net worth and wealth to heirs.

- An Inherited Roth IRA is vastly superior to an Inherited IRA.

- An investment-grade life insurance policy is a valuable partner in the overall wealth analysis.

The billions of dollars locked up in IRAs and 401(k)s await you. ?Go forth and prosper . . .

Questions and Answers

Click here for some Questions and Answers regarding Inherited IRAs and Inherited Roth IRAs.

Important Note: ?Many of you are rightly concerned about the potential tax bomb associated with life insurance policies with loan activity that can accidentally be triggered by a careless policyowner. ?Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Note: The file is for the newly released Version 12.0, so be sure you have this version before trying to load the file. You can find the version number in the upper left corner of your Workbook Main Window.)

If you are licensed -- or become licensed -- for Version 17.0 (or higher) of the InsMark Illustration System and would like to review the data input for the Inherited IRA comparisons in this Blog, please email us at bob@www.robert-b-ritter-jr.com, and we will get that System Workbook file right out to you. ?Be sure to ask for the InsMark Illustration System Workbook file associated with Blog #81. ?When you get the file, double click on the file name, and it will load in your InsMark Illustration System.

Licensing

To license Wealthy and Wise or the InsMark Illustration System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). ?Institutional inquiries should be directed to David Grant, Senior Vice President ? Sales, at dag@insmark.com or 925-543-0513.

Testimonials:

“InsMark has created without question the best suite of software for our industry that has ever existed. ?I personally have been using their software for almost 30 years, and it changed my career. ?This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP?, CAP?, RFC?, International Forum Member, InsMark Platinum Power Producer?, Encino, CA

“InsMark helps us help our clients understand their money and their choices. ?I always learn something new that changes what we do and how we can do it more efficiently. ?That translates to a better bottom line for us and for our clients. ?It’s making more money for everyone -- just by pushing InsMark buttons on the computer.”

Kay Corbin, CLU, ChFC, InsMark Platinum Power Producer?, Phoenix, AZ

“I am writing to give you a ringing endorsement for the Wealthy and Wise System. As you know, I am a LEAP practitioner. The Wealthy and Wise software has helped me supplement my LEAP skills in the over age 60 client base. I have been paid for many cases using Wealthy and Wise as support, the smallest of which was $27,000, the largest was $363,000. With those type of commissions, you would have to be nuts not to buy it.”

Vincent M. D'Addona, CLU, ChFC, MSFS, AEP, InsMark Platinum Power Producer?, New York City, New York

| Important Note |

The information in this presentation is for educational purposes only. ?In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

| IRS Circular 230 Disclosure |

Any tax advice contained in this presentation (including any attachments or referred material) was not intended, or written to be used, and cannot be used by you or any other person or entity for the purpose of avoiding penalties under the Internal Revenue Code.