|

Editor’s Note: This benefit plan will be examined at the 2015 InsMark Symposium scheduled for March 27 - 28, 2015, in Las Vegas, Nevada. See the sidebar below for details. |

Executive bonus plans using cash rich life insurance policies are among the best of the executive-owned benefit plans that are used to provide significant pre-retirement death benefits to the executive’s family plus substantial tax free retirement cash flow. When these arrangements are provided to key non-owner executives, there is a technique called the Controlled Executive Bonus that aids considerably in their retention. It can be used for executives employed by C Corporations, S Corporations, LLCs, Partnerships, and Tax Exempt Organizations.

Note: A Controlled Executive Bonus is typically not used to provide a benefit for an owner. Its use is primarily for non-owner executives.

Important non-owner executives are simple to identify if you pose the following question to the owner:

“Do you have any non-owner executives who are so valuable to your business that you will do whatever is economically reasonable to induce them to stay with you?”

Assuming an interested owner surfaces, consider introducing the Controlled Executive Bonus. This variation typically uses a single, gross-up, or graded bonus with provisions in the plan agreement that the bonus must be repaid to the employer if the executive terminates employment by a certain date (for example, within 5, 10, or 15 years or, perhaps, at retirement) for reasons other than death or disability. It outperforms loan regime split dollar and is reminiscent of classic equity split dollar, but with none of the disadvantages. (More on this below.)

Case Study

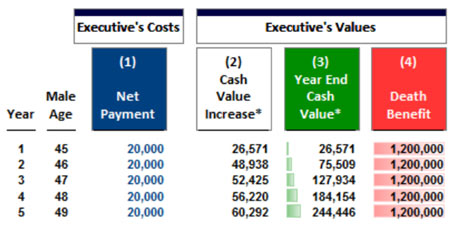

Billy Mayfield, age 45, is the General Manager of Eagle Lake Ford, LLC. Billy has been provided with a $1,200,000 life insurance policy with five scheduled premiums of $50,000 funded with a bonus equal to each policy premium. In Billy’s personal, marginal tax bracket of 40%, it will cost him $20,000 a year in taxes for five years, and all policy values are his property -- subject, of course, to the bonus repayment obligations.

The goal of the plan is to induce Billy to remain with Eagle Lake Ford for at least five years, and the firm will likely repeat the benefit at the end of five years as further inducement to Billy.

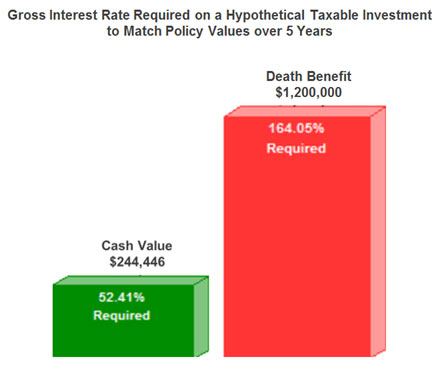

Below are Billy’s costs and benefits over the first five years of the plan. The rate of five-year return is extraordinary (pre-tax equivalent rate of return of 52.41% on cash value) largely because Billy has acquired the policy at a 60% discount from its annual premium cost of $50,000 paid by the employer by way of a bonus.

Below is an example are Billy’s repayment obligations using data from the Executive Security Plan module in the InsMark Illustration System. I added year 6 to illustrate when, in this case, repayment is no longer required.

Assuming the plan is constructed properly to provide a meaningful reason for Billy to remain employed, full vesting at the end of year 5 when the repayment obligation ends should seriously help accomplish this.

Below is a review of the overall costs and benefits of the plan using a single bonus with a repayment obligation of 100% of the bonus over five years.

| Click here to review the full illustration. |

| (Page 7 shows the bonus repayment obligations.) |

An alternative option for the employer might be to establish a sliding scale of repayment as shown in the example below.

Another alternative would be to use a gross-up bonus which, while increasing the employer’s costs, includes the income tax on the bonus resulting in $0 out-of-pocket cost to the executive -- provided employment is not terminated earlier.

Below is a review of the overall costs and benefits of the plan using a gross-up bonus with a repayment obligation of 100% of the bonus over five years.

| Click here to review the full illustration. |

| (Page 7 shows the bonus repayment obligations.) |

Conclusion

The Controlled Bonus Plan is easy to understand, has minimal plan administration, and is highly valued by sponsors and participants.

It is maybe the best executive benefit plan ever.

Documentation

Special documents are needed to support a Controlled Executive Bonus. It requires a special Resolution and Employment Agreement (or, perhaps, an amendment to a current employment agreement) outlining the employer’s bonus commitment and the executive’s repayment requirements.

Also needed is an Endorsement of Policy Ownership Rights Agreement. Its purpose is to restrict access to policy values prior to retirement without the express written permission of the employer. The Endorsement takes the form of an agreement between the business and the executive in which the executive agrees to this restriction.

The Endorsement is registered with the issuing insurance company and, as a result, the executive is unable to take any action on the policy other than that allowed by the Endorsement. One of life’s frustrating experiences involves an executive who starts a competing business using funds from an employer’s benefit plan that were designed to provide retirement benefits. The Endorsement eliminates this occurrence.

In the event of an executive’s death prior to retirement, the Endorsement allows the immediate payment of the death proceeds to the executive’s family.

Comprehensive specimen documents for all aspects of the Controlled Executive Bonus are available in Version 21.0 (and higher) of InsMark’s Documents On A Disk™ in the Key Employee Benefit Plans section.

Comprehensive specimen documents for all aspects of the Controlled Executive Bonus are available in Version 21.0 (and higher) of InsMark’s Documents On A Disk™ in the Key Employee Benefit Plans section.

Controlled Executive Bonus vs. Loan Regime Split Dollar

The Controlled Executive Bonus variation is superior to Loan Regime Split Dollar in almost all respects.

- Unlike loan-regime split dollar, the employer’s funding costs are deductible.

- Unlike loan-regime split dollar, there is no applicable federal rate (AFR), nor offset issues, nor original issue discounts involved. This is of immense value in what is expected to be an increasing interest rate environment.

- Unlike loan-regime split dollar, once the repayment period expires in the bonus plan, there is no requirement for the executive to repay the employer or, alternatively, have substantial taxable income when split dollar values are traditionally rolled out.

- Unlike loan-regime split dollar, the bonus plan is more easily and efficiently portable.

- Unlike loan-regime split dollar, senior officers of publicly-owned corporations can use the bonus plan (with or without the controlled bonus feature) whereas they are unable to use loan-regime split dollar due to the prohibition against loans to senior executives contained in Sarbanes-Oxley legislation.

- Unlike loan-regime split dollar, executive-owned bonus plans should not require ERISA compliance.

- Note: In all cases, a client’s tax advisers should carefully review the circumstances to determine if ERISA is applicable.

Click here for a further discussion of the Controlled Executive Bonus vs. Loan Regime Split Dollar.

Management Tool

The Controlled Executive Bonus with a gross-up bonus provides additional management information when offered to an important, non-owner executive like Billy Mayfield. Assume the plan has very significant mid- to long-range benefits but contains a 100% liability for bonus repayment if employment terminates within five years. If the executive accepts the plan with its five-year contingent liability, the owner may be fairly certain that this executive intends to remain with the company for at least the next five years.

Alternatively, suppose this executive elects not to participate in the plan. The employer has just discovered that this executive may be ready to consider alternative employment and is not interested in a benefit plan with a short-term contingent liability. Clearly, a decision not to participate has turned up valuable information that would otherwise be difficult to determine.

|

InsMark’s Digital Workbook Files If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files. Digital Workbook Files For This Blog Download all workbook files for all blogs

Licensing To license the InsMark Illustration System or cloud-based Documents on a Disk, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President - Sales, at dag@insmark.com or (925) 543-0513. |

Testimonials:

| “Thanks to InsMark, we recently set business goals in our firm that I basically thought were ridiculously unachievable - until now.” |

| Brian Langford, InsMark Platinum Power Producer®, Plano, TX |

|

|

| “InsMark is the best value for me in the industry.” |

| Mike Breedlove, InsMark Platinum Power Producer®, Tyler, TX |

|

|

| “InsMark is an absolutely mind blowing experience.” |

| Larry Gustafson, InsMark Platinum Power Producer®, Denver, CO |

Important Note

The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.