The way indexed deferred annuities are priced (short-term money vs. long-term money for indexed life insurance) leaves very little budget for the issuing company to use for hedging. Consequently, the caps can be much, much lower for annuities (in many cases, 3.00% vs. 10.00%+ for indexed life policies). Also, with the life policy, the issuing company can afford to take a thinner margin because of the mortality profit from the cost-of-insurance charges.

The higher caps introduce the opportunity to illustrate higher future values for the life insurance and, of course, all this couples with the superior tax advantages of life insurance (income tax free loans from cash values and tax free death benefit) vs. taxable cash flow and death benefits from annuities.

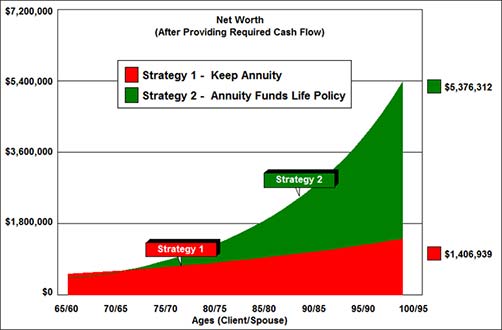

To prove the point, examine the following graphic from InsMark’s Wealthy and Wise®.

Alex and Susie Snow are 65 and 60. They own an indexed annuity with a current value of $500,000 but are stuck with a 3.00% maximum crediting rate. Their cost basis is $430,000. The graphic illustrates the impact of replacing the annuity with an indexed survivor life policy and providing the cash flow for the life policy’s five scheduled premiums of $98,605 by way of after tax withdrawals from the annuity ? a procedure calculated by Wealthy and Wise which depletes the annuity. (In this case, five years of premium payments are sufficient to avoid classifying the life policy as a modified endowment contract thereby preserving tax free access to its cash values.)

Wealthy and Wise provides a very quick and simple way to make this evaluation with minimal data input. It also provides you with a platform to discuss other planning opportunities with what is likely to be a very impressed client.

If you are licensed for InsMark’s Wealthy and Wise and would like to review the menu prompts we used for this analysis, please send us an email email us at bob@www.robert-b-ritter-jr.com, and we will get the Case Data file (Workbook) right out to you, Be sure to ask for the Workbook for the Blog #10: "Annuity Rescue Made Easy".

If you are not licensed for Wealthy and Wise, contact Julie Nayeri at 888-InsMark (467-6275) or julien@insmark.com for licensing information. Institutional inquiries should go to David Grant, Senior V.P. Sales, at dag@insmark.com or (925) 543-0513.