(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using Wealthy and Wise ®.)

|

In Blog #146 and Blog #147, we examined several “Compared to What?” term vs. permanent illustrations for Tom Robinson, age 35, involving $601,839 of Indexed Universal Life (IUL). The policy was illustrated at 7.00% with scheduled premiums of $20,000 a year through age 65 with significant cash developing thereafter. It was compared to $600,000 of 30-year level term costing $525 with the difference in premiums invested in either an indexed annuity or an equity account. |

|

If you missed reading these two Blogs, I strongly recommend you and/or your staff review each one if competition with term insurance is something you or your associates face with clients and/or their advisers.

This Blog takes a different tack in that I included the “term vs. perm” comparison within an overall retirement analysis using our Wealthy and Wise® System (although the logic should work with most comprehensive retirement plans).

Case Study

Tom Robinson and his wife, Jodie (also age 35), are both CPAs employed by the same large accounting firm. They have a good start toward their retirement with significant values in their 401(k)s earning 7.00%. They both plan to contribute the maximum amount of $18,000 (the 2017 maximum), and their employer matches 20%. They have agreed we should take inflation into account when calculating future contributions, and we did so assuming 3.00% inflation.

|

Note: While 3.00% is an artificial number for the future, whatever actual inflation occurs should be reflected in your annual reviews as their plan is brought up to date. |

Tom and Jodie also plan to include the IUL noted above with its $20,000 annual premium to age 65 in the overall analysis. In the alternative term analysis, this same $20,000 will be invested in an equity account with a growth assumption of 7.00% plus a 2.00% dividend. I assumed the annual $20,000 is new money contributed toward their retirement.

Tom and Jodie’s current combined after tax income is $250,000 and their goal is to provide this after tax amount at retirement plus the 3.00% inflation adjustment while maintaining a reasonable level of net worth.

It is important whether the inflation goal for retirement cash flow is calculated in today’s dollars or beginning with their retirement goal of $250,000. If today’s dollars is the benchmark for the 3.00% inflation, by the time they retire in 30 years, their first year’s after tax cash flow requirement will be $606,816 increasing yearly thereafter by 3.00%. While they may want to work toward this goal in future years, for this analysis, we based the beginning of the inflation assumption on the $250,000 starting at age 65. Otherwise, they would need a massive commitment of personal income to their retirement plan. They already have committed a significant amount: a deductible $36,000 a year to their two 401(k)s and $20,000 to either the IUL or the term plus equities package.

I also kept the asset base limited to their defined contribution 401(k)s and an equity account in order to make this evaluation a little less complex for you.

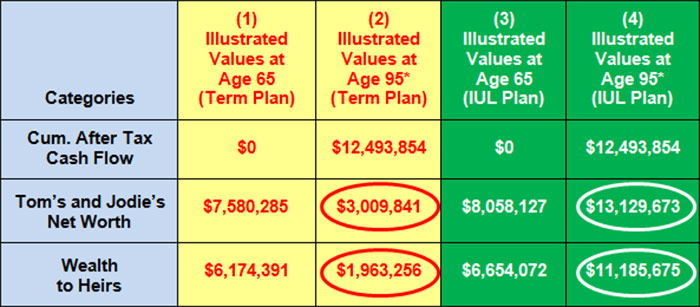

Below is a summary of the results of the comparative analysis:

Summary of the Retirement Analysis

Tom and Jodie Robinson (both currently age 35)

*Joint life expectancy plus five years.

(Joint life expectancy is the point at which at least one of the clients is alive.)

Click here for a discussion of joint life expectancy by Mike Kitces.

Click here for comments on Yield, Sequence of Returns, and Monte Carlo Simulations.

As do so many people their age, Tom and Jodie have no expectancy of ever collecting retirement benefits from Social Security, so we have ignored any entries for that category. We have also kept the data to a minimum to make this an easier analysis to evaluate.

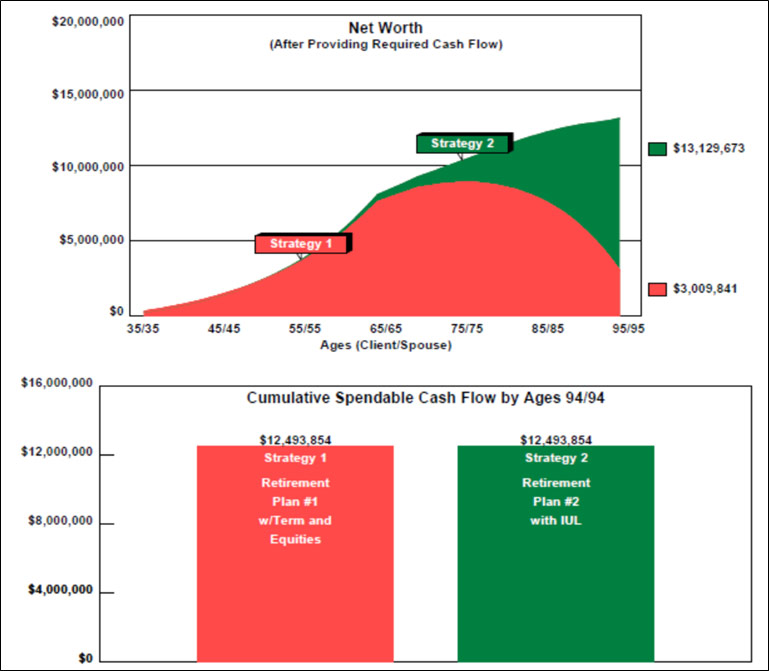

Below is graphical comparison of the Robinsons’ Net Worth:

| Retirement Planning |

| Strategy 1: Term Insurance and an Equity Account vs. Strategy 2: Indexed Universal Life |

| Image 1 (Net Worth and Cash Flow Comparison) |

Both Strategies produce the same desired spendable cash flow, but buying the term is a $10 million dollar (and growing) long-range mistake. The additional net worth produced by Strategy 2 means that Tom and Jodie could realize millions more in after tax retirement cash flow by utilizing IUL. Note that Strategy 1, the term/equity combination, is in a death spiral.

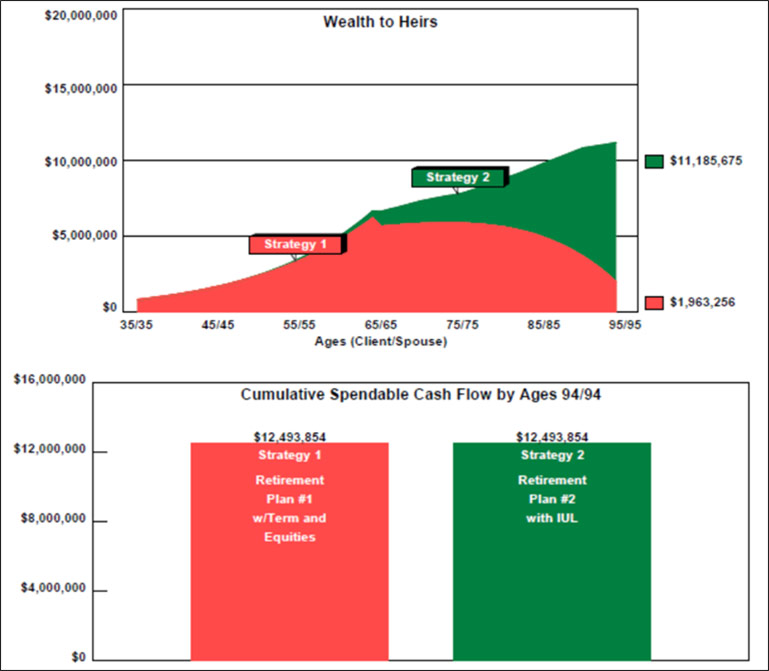

| Retirement Planning |

| Strategy 1: Term Insurance and an Equity Account vs. Strategy 2: Indexed Universal Life |

| Image 2 (Wealth to Heirs and Cash Flow Comparison) |

Heirs are better off long-range with Strategy 2 by over $9 million.

Click here to review a selection of reports from this Wealthy and Wise evaluation. There are 4 Comparison reports, 14 reports involving the term and an equity account, and another 14 dealing with the winning permanent solution. With any Wealthy and Wise presentation, I recommend that you have all the reports for a given analysis with you when you are visiting with a client or client’s attorney or CPA. The system backs up every number shown, and you never know which report you’ll need to have handy to answer the inevitable question, “Where did this number come from?” That’s why I provided all of them to you in this Blog.

Most Wealthy and Wise users select a few key illustrations for the main report and put the balance in supplemental sections or an Appendix. More elaborate report organization can be accomplished (Table of Contents and Section pages) through use of the following prompt -- which I used for this Blog -- located on the bottom right of the Main Workbook Window:

Conclusion

Buy term and invest the difference? Phooey! In view of the “perm vs. term” evaluations in Blog #146, Blog #147, and Blog #148, you should be well-armed to eliminate the “buy term and invest the difference” argument whenever it surfaces.

“I can only wonder if another asset with the same qualities would be implemented more frequently if it wasn’t called life insurance.”1

1From an article by Bill Boersma in the December 2014 issue of Trusts & Estates entitled “Life Insurance as an Asset Class”.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

If you obtain the digital workbook for Blog #148, click here for a guide to its content.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Licensing InsMark Systems

To license any of the InsMark software products, visit our Product Center online or contact Julie Nayeri at Julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or (925) 543-0513.

For help on how to use InsMark software, go to The Quickest Way To Learn InsMark.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Testimonials

“InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP®, CAP®, RFC®, Past President International Forum, InsMark Platinum Power Producer®, Encino, CA

“If you don’t get the client to distinguish cash flow from net worth, you won’t make the case sale. In my experience, Wealthy and Wise is the only system that recognizes this important estate planning component.”

Stephen Rothschild, CLU, ChFC, CRC, RFC, International Forum Member, Saint Louis, MO

“InsMark helps us help our clients understand their money and their choices. I always learn something new that changes what we do and how we can do it more efficiently. That translates to a better bottom line for us and for our clients. It’s making more money for everyone -- just by pushing InsMark buttons on the computer.”

Kay Corbin, CLU, ChFC, InsMark Platinum Power Producer®, Phoenix, AZ

“Major cases we are developing have all moved along successfully because of the sublime simplicity and communication capability of Wealthy and Wise. I guarantee that the proper use of this tool will dramatically raise the professional and personal self-image of any associate who dares to take the time to understand it . . .”

Phillip Barnhill, CLU, InsMark Gold Power Producer®, Minneapolis, MN

Important Note #1: The hypothetical life insurance illustration associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

“InsMark” and “Wealthy and Wise” are registered trademarks of InsMark, Inc.

![]()

More Recent Blogs:

Blog #147: New Logic for Permanent vs. Term (Part 2 of 3)

Blog #146: New Logic for Permanent vs. Term (Part 1 of 3)

Blog #145: The $23 Trillion Market

Blog #144: Don’t Burn the Nest Egg®

Blog #143: Premium Financing Opportunities In The Small Case Market

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive